Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

Open to apply: 30 June 2023

Close to apply: 10 Jul 2023

Balloting: 13 July 2023

Listing date: 25 July 2023

Close to apply: 10 Jul 2023

Balloting: 13 July 2023

Listing date: 25 July 2023

Share Capital

Market cap: RM81.060 mil

Total Shares: 386,000,000 shares

Market cap: RM81.060 mil

Total Shares: 386,000,000 shares

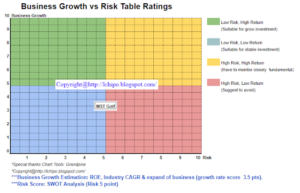

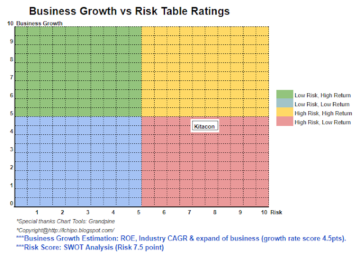

Industry CARG

Historical Market Size (In Terms of Export Value) and Growth Forecast for the EBN Industry in Malaysia, 2022-2027f: 34%

Industry competitors comparison (net profit%)

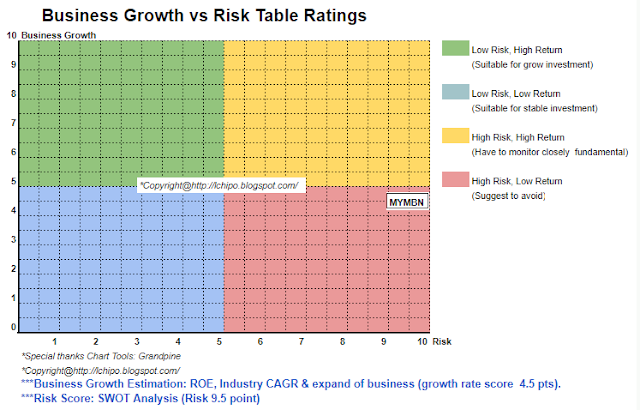

1. MYMBN: 6.28%

2. Dama Dingji: 0.9%

3. Ming Feng: 9.9%

4. Rickson: 1.9%

Business (FYE 2022)

Processing and sale of EBN (Edible bird’s nests), RUCEBN (Raw unclean edible bird’s nest)

Revenue by Geo

China: 98.55%

Malaysia: 1.45%

Fundamental

1.Market: Ace Market

2.Price: RM0.21

3.Forecast P/E: PE18.75 (FYE2022 EPS0.0112)

4.ROE(Pro Forma III): 13.22%

5.ROE: 28.61%(FPE2022), 62.41%(FYE2021), 79.01%(FYE2020), 22%(FYE2019)

6.Net asset: RM0.0847

7.Total debt to current asset: 0.194 (Debt: 6.115mil, Non-Current Asset: 7.235mil, Current asset: 31.569mil)

8.Dividend policy: no formal dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2022 (FYE 31Dec): RM68.871 mil (Eps: 0.0112), PAT: 6.28%

2021 (FYE 31Dec): RM91.556 mil (Eps: 0.0174),PAT: 7.35%

2020 (FYE 31Dec): RM44.408 mil (Eps: 0.0083),PAT: 7.22%

2019 (FYE 31Dec): RM11.897 mil (Eps: 0.00048),PAT: 1.57%

*EPS calculate using 386,000,000 shares

Operating cashflow vs PBT

2022: 37.99%

2021: 108%

2020: -ve

2019: -ve

Trade Receivable vs Revenue

2022: 4.33%

2021: 0.067%

2020: 16.69%

2019: 6.5%

Major customer (FYE2022)

1.Southeast Edible Bird Nest Capital (Xiamen) Industrial Development Co., Ltd: 64.37%

2.Southeast Edible Bird Nest Capital Biotechnology Co., Ltd: 14.01%

3.Jipintang Health Industry Co., Ltd.: 10.97%

4.Yue Xiang (Zhejiang) Food Co., Ltd: 5.87%

5.China-Malaysia Jinguyan (Guangxi)Biotechnology Co., Ltd.: 2.07%

***total 97.29%

Major Sharesholders

1.Lavernt Chen: 33.58% (direct)

2.Lee Wei Kong: 11.19% (direct)

3.Liw Chong Liong: 11.19% (direct)

4.MLCL Construction: 11.19% (direct)

5.Gentle Rainbow: 7.46% (direct)

Directors & Key Management Remuneration for FYE2023

(from Revenue & other income FYE2023 revenue forecast)

Total director remuneration: RM0.718 mil

key management remuneration: RM50k – RM0.25 mil

total (max): RM0.968 mil or 9.72%

Use of funds

1.Purchase of the New Facility to expand processing capacity: 13.63%

2.Renovation and fit out works of the New Facility: 15.55%

3.Setting-up of three (3) bird’s nests collection centres in East Malaysia: 8.16%

4.Expansion into the processing and sale of RCEBN: 6.07%

5.Purchase of raw bird’s nests for RUCEBN: 32.07%

6.Working capital: 9.94%

7.Estimated listing expenses: 14.58%

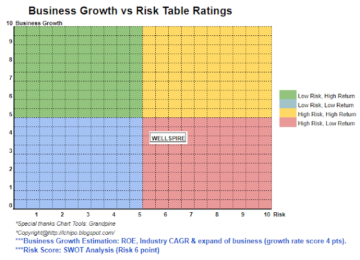

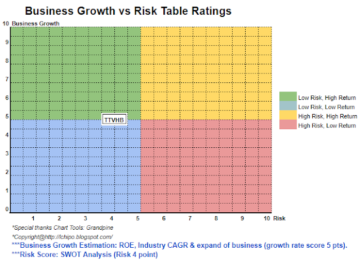

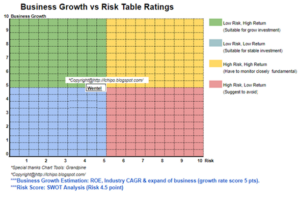

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is a unique business / industry. The business might have grow opportunities, but the industry it self might contain a lot of regulation risk & unstable income.

Overall is a unique business / industry. The business might have grow opportunities, but the industry it self might contain a lot of regulation risk & unstable income.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: http://lchipo.blogspot.com/2023/07/mymbn-berhad.html

- :is

- :not

- $UP

- 000

- 1

- 10

- 11

- 13

- 14

- 15%

- 16

- 2022

- 25

- 28

- 30

- 31

- 32

- 7

- 75

- 8

- 9

- 98

- a

- All

- and

- any

- Apply

- asset

- biotechnology

- bird

- both

- business

- but

- by

- calculate

- cap

- Capacity

- capital

- Center

- centres

- change

- chen

- chong

- clear

- CO

- collection

- color

- company

- comparison

- competitors

- construction

- Current

- customer

- Date

- Debt

- decision

- Development

- direct

- Director

- dividend

- do

- Earning

- East

- edible

- estimated

- Ether (ETH)

- Every

- Expand

- expansion

- expenses

- export

- Facility

- financial

- financial performance

- fit

- follow

- food

- For

- Forecast

- formal

- from

- fundamental

- gentle

- Grow

- Growth

- Have

- Health

- homework

- HTTPS

- if

- iii

- in

- Income

- industrial

- industry

- into

- investment

- IT

- July

- june

- Key

- Kong

- Lee

- left

- listing

- Lot

- Ltd

- Malaysia

- management

- Market

- max

- might

- Nest

- net

- New

- no

- normal

- of

- on

- only

- Opinion

- opportunities

- or

- Other

- out

- own

- per

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- pre

- price

- Pro

- processing

- purchase

- Quarter

- Raw

- Reader

- Recommendation

- Red

- Regulation

- release

- remuneration

- result

- revenue

- Risk

- sale

- SELF

- Shares

- Shariah

- should

- Size

- Status

- Take

- terms

- The

- their

- three

- to

- Total

- unique

- us

- using

- value

- View

- vs

- will

- working

- works

- zephyrnet