Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 27/12/2022

Close to apply: 04/01/2023

Balloting: 06/01/2023

Listing date: 16/01/2023

Close to apply: 04/01/2023

Balloting: 06/01/2023

Listing date: 16/01/2023

Share Capital

Market cap: RM163.789 mil

Total Shares: 712.125mil shares

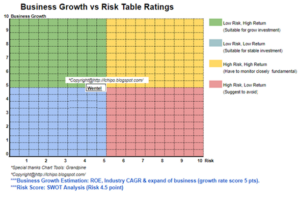

Industry CARG (2017-2021)

Revenue of wholesale of food (Thai) CAGR: 8.1%

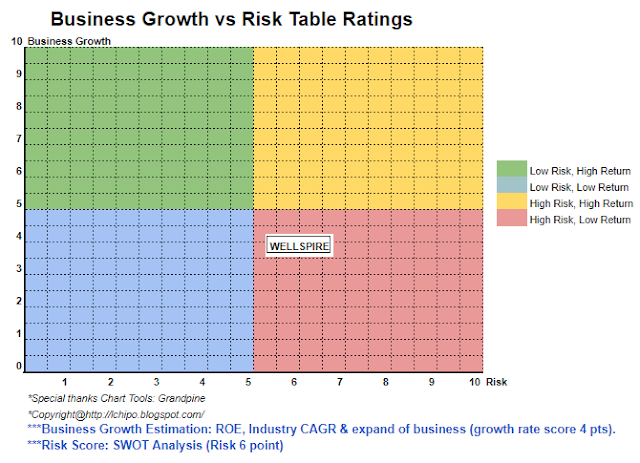

Industry competitors comparison (net profit margin%)

Wellspire Group: 11.3%

Sino-Pacific Trading (Thailand): 4.6%

Kor Chaisaeng: 0.8%

Heritage Marketing Co., Ltd: 0.5%

Sun Foods Trading Co., Ltd: 0.4%

Modern Food Trading Co., Ltd: 0.1%

Chailai Intertrade Co., Ltd: 9.2%

Capmax Trading Co., Ltd: 2.1%

Business (FYE 2021)

Distribution of consumer packaged foods focusing on snack foods in Thailand.

- Sunflower seeds: 92.07%

- Other Snack food, other seed and nuts, others: 7.93%

Distribution of consumer packaged foods focusing on snack foods in Thailand.

- Sunflower seeds: 92.07%

- Other Snack food, other seed and nuts, others: 7.93%

Fundamental

1.Market: Ace Market

2.Price: RM0.23

3.P/E: 22.98 @ RM0.01 (FPE2022)

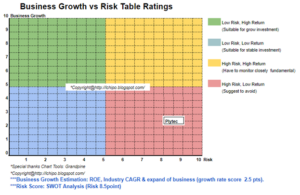

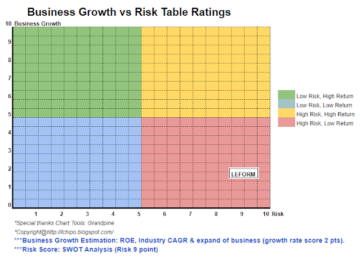

4.ROE(Pro Forma III): 8.11%

5.ROE: 106%(FYE2021), 80.41%(FYE2020), 98.2%(FYE2019)

6.Net asset: RM0.067

7.Total debt to current asset after IPO: 0.19 (Debt: 11.491mil, Non-Current Asset: 2.624mil, Current asset: 61.607mil)

8.Dividend policy: Propose 30% dividend policy.

9. Shariah starus: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2022 (FPE 30Jun, 6mth): RM60.509 mil (Eps: 0.0015), PAT:3.54%

2021 (FYE 31Dec): RM136.707 mil (Eps: 0.0156),PAT: 11.27%

2020 (FYE 31Dec): RM119.706 mil (Eps: 0.0166),PAT: 13.16%

2019 (FYE 31Dec): RM58.799 mil (Eps: 0.0044),PAT: 7.06%

Operating cashflow vs PBT

2022: 75.56%

2021: 77.71%

2020: 23.36%

2019: -ve

Major customer (2022)

1. CP All: 44.55%

2. Valueplus: 25.61%

3. Siam Makro: 14.18%

4. Big C: 5.72%

5. Ek-Chai Distribution: 5.03%

***total 95.09%

Major Sharesholders

1. Mo Guopiao: 28.16%

2. Silver Line Capital: 17.03%

3. He Haibin: 11.85%

4. Capital Pairing: 7.15%

Directors & Key Management Remuneration for FYE2023 (from Revenue & other income 2022)

Total director remuneration: RM2.214mil

key management remuneration: RM0.550mil - RM0.700mil

total (max): RM2.914mil or 7.63%

Use of funds

1. Acquire/construct a warehouse and operational facility in Thailand: 55.83%

2. Working capital: 20.79%

3. Listing Expenses: 23.38%

1. Acquire/construct a warehouse and operational facility in Thailand: 55.83%

2. Working capital: 20.79%

3. Listing Expenses: 23.38%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is a business that too focus on single product brand, which also is their higher risk contribution. They company need to increase the revenue contribution from other product.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://lchipo.blogspot.com/2022/12/wellspire-holdings-berhad.html

- 1

- 11

- 2021

- 2022

- 28

- 7

- 77

- 9

- 98

- a

- After

- All

- and

- Apply

- asset

- Big

- brand

- business

- cap

- capital

- Center

- change

- clear

- color

- company

- comparison

- competitors

- consumer

- contribution

- Current

- customer

- Date

- Debt

- decision

- Director

- distribution

- Earning

- Ether (ETH)

- expenses

- Facility

- financial

- financial performance

- Focus

- focusing

- follow

- food

- foods

- Forecast

- from

- fundamental

- Group

- higher

- Holdings

- HTTPS

- in

- Income

- Increase

- investment

- IPO

- Key

- Line

- listing

- Ltd

- management

- Market

- Marketing

- max

- Need

- net

- New

- operational

- Opinion

- Other

- Others

- own

- pairing

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Pro

- Product

- Profit

- propose

- Quarter

- Reader

- Recommendation

- Red

- release

- remuneration

- result

- revenue

- Risk

- seed

- seeds

- Shares

- Shariah

- should

- siam

- Silver

- single

- Take

- thai

- Thailand

- The

- their

- to

- too

- Total

- Trading

- us

- value

- View

- which

- wholesale

- will

- working

- zephyrnet