Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Open to apply: 29/09/2020

Close to apply: 05/10/2020

Listing date: 15/10/2020

Share Capital

Market Cap: RM100.8 mil

Total Shares: 210mil shares (Public apply: 10.5mil, Company Insider/Miti/Private Placement/other: 50.655mil)

Market Cap: RM100.8 mil

Total Shares: 210mil shares (Public apply: 10.5mil, Company Insider/Miti/Private Placement/other: 50.655mil)

Industry

Renewable Energy (Solar & Biogas)

-Renewable Energy demand rising globally

-Solar panel cost getting cheaper & getting more commons (costing effectiveness)

Competitor (net Profit Margin%)

Scatec Solar: 36.6%

Solarvest: 9.9% (PE39.18)

Samaiden: 9.5%

Panasonic Life Solutions: 2.1%

El Power: 6.4%

Business

Existing: Enginneering, procurement, construction & commisonning services for Solar PV system.

Futures: Own operate Biogas Plant (Bachok, Kelantan) & PV Power Plant (Sungai Petani, Kedah).

Market: Malaysia (Mainly), Vietnam (futures expend)

Existing: Enginneering, procurement, construction & commisonning services for Solar PV system.

Futures: Own operate Biogas Plant (Bachok, Kelantan) & PV Power Plant (Sungai Petani, Kedah).

Market: Malaysia (Mainly), Vietnam (futures expend)

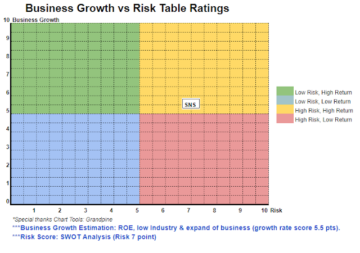

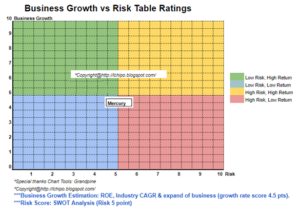

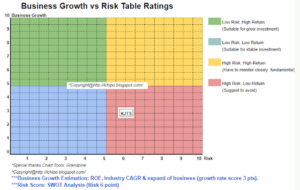

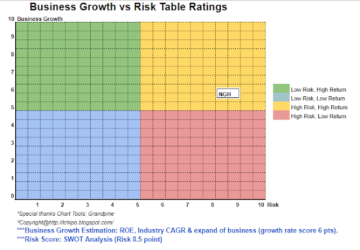

Fundamental

Market: Ace Market

Price: RM0.48 (EPS:0.0345)

P/E: PE13.91

ROE (Pro Forma III): 17.01

ROE: 49.23 (2020), 101.01 (2019), 65.93 (2018), 90.27 (2017)

Cash & fixed deposit after IPO: RM0.165 per shares

NA after IPO: RM0.20

Total debt to current asset after IPO: 0.299 (Debt: 17.355mil, Non-Current Asset: 1.539mil, Current asset: 58.116mil)

Dividend policy: No fix dividend policy.

Market: Ace Market

Price: RM0.48 (EPS:0.0345)

P/E: PE13.91

ROE (Pro Forma III): 17.01

ROE: 49.23 (2020), 101.01 (2019), 65.93 (2018), 90.27 (2017)

Cash & fixed deposit after IPO: RM0.165 per shares

NA after IPO: RM0.20

Total debt to current asset after IPO: 0.299 (Debt: 17.355mil, Non-Current Asset: 1.539mil, Current asset: 58.116mil)

Dividend policy: No fix dividend policy.

Past Financial Performance (Revenue, EPS)

2020: RM76.170 mil (EPS: 0.0345)

2019: RM68.301 mil (EPS: 0.0356)

2018: RM31.322 mil (EPS: 0.0153)

2017: RM6.530 mil (EPS: 0.0065)

2020: RM76.170 mil (EPS: 0.0345)

2019: RM68.301 mil (EPS: 0.0356)

2018: RM31.322 mil (EPS: 0.0153)

2017: RM6.530 mil (EPS: 0.0065)

Net Profit Margin

2020: 9.49%

2019: 10.95%

2018: 10.26%

2017: 20.89%

2020: 9.49%

2019: 10.95%

2018: 10.26%

2017: 20.89%

After IPO Sharesholding

Dato' Dr.Nadzri Bin Yahaya: 0.41%

Ir.Chow Pui Hee: 35.57%

Fong Yeng Foon: 35.31%

Lim Poh Seong: 0.14%

Olivia Lim: 0.14%

Dato' Dr.Nadzri Bin Yahaya: 0.41%

Ir.Chow Pui Hee: 35.57%

Fong Yeng Foon: 35.31%

Lim Poh Seong: 0.14%

Olivia Lim: 0.14%

Directors Remuneration for FYE2021 (from gross profit 2020)

Dato' Dr.Nadzri Bin Yahaya: RM62k

Ir.Chow Pui Hee: RM574k

Fong Yeng Foon: RM492k

Lim Poh Seong: RM50k

Olivia Lim: RM38k

Total director remuneration from PBT: RM1.216mil or 10.43%

Fong Yeng Foon: RM492k

Lim Poh Seong: RM50k

Olivia Lim: RM38k

Total director remuneration from PBT: RM1.216mil or 10.43%

Key Management Remuneration for FYE2021 (from gross profit 2020)

Susie Chung Kim Lan: RM150k-200k

Mohd Makhzumi bin Ghazali: RM100k-150k

Ir.Kang Ching Yew: RM100k-150k

key management remuneration from PBT: RM350k-500k or 0.3%

Susie Chung Kim Lan: RM150k-200k

Mohd Makhzumi bin Ghazali: RM100k-150k

Ir.Kang Ching Yew: RM100k-150k

key management remuneration from PBT: RM350k-500k or 0.3%

Use of fund

Purchase of Corporate Office: 23.85%

Business expansion and marketing activities: 8.65%

Capital expenditure: 3.98%

Working capital: 52.62%

Listing Expenses: 10.90%

Purchase of Corporate Office: 23.85%

Business expansion and marketing activities: 8.65%

Capital expenditure: 3.98%

Working capital: 52.62%

Listing Expenses: 10.90%

Good thing is:

1. Renewable Energy is in sunrise industry & demand is rising globally.

2. Cost of solar panel is getting cheaper compare past few years (lower cost of purchase)

3. PE13 is at acceptable fair value.

4. Revenue growing for past 4 years.

5. IPO use for expand business. (futures will have recurring income on own operate plant in Kedah & Kelantan).

1. Renewable Energy is in sunrise industry & demand is rising globally.

2. Cost of solar panel is getting cheaper compare past few years (lower cost of purchase)

3. PE13 is at acceptable fair value.

4. Revenue growing for past 4 years.

5. IPO use for expand business. (futures will have recurring income on own operate plant in Kedah & Kelantan).

The bad things:

1. High competitor environment as entry of business is not high.

2. No fixed dividend policy.

3. Director remuration is 10.43% from 2020 gross profit.

4. Listing is in Ace Market.

5. Net profit is around 10%

1. High competitor environment as entry of business is not high.

2. No fixed dividend policy.

3. Director remuration is 10.43% from 2020 gross profit.

4. Listing is in Ace Market.

5. Net profit is around 10%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion)

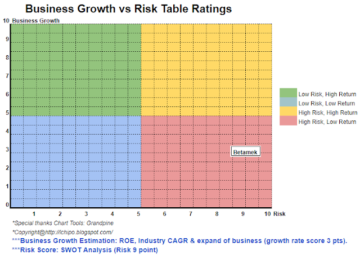

Riding on the right trend of business grow is benefited the company. We will see growth of the business.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

Source: http://lchipo.blogspot.com/2020/09/samaiden-group-berhad.htmlRiding on the right trend of business grow is benefited the company. We will see growth of the business.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- activities

- around

- asset

- BP

- business

- Business Grow

- capital

- change

- company

- construction

- Current

- Debt

- Demand

- Director

- dividend

- energy

- Environment

- Expand

- expansion

- expenses

- fair

- financial

- Fix

- follow

- Futures

- Group

- Grow

- Growing

- Growth

- High

- homework

- HTTPS

- Income

- industry

- IPO

- listing

- Malaysia

- management

- Market

- Marketing

- net

- Opinion

- performance

- policy

- power

- Pro

- Profit

- public

- purchase

- Reader

- renewable energy

- revenue

- Risk

- Services

- Shares

- solar

- Solutions

- system

- us

- value

- Vietnam

- View

- years