Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 14/09/2022

Close to apply: 22/09/2022

Balloting: 27/09/2022

Listing date: 06/10/2022

Close to apply: 22/09/2022

Balloting: 27/09/2022

Listing date: 06/10/2022

Share Capital

Market cap: RM89.775 mil

Total Shares: 256.501mil shares

Industry CARG

Industry CARG is not enough information for analysis.

Competitor Comparison (PAT %)

Cosmos: 11.8%

Cergas Proses S/B: 3.2%

Delta Ferdana S/B: -4.2%

Mimtech Technology S/B: 4.0%

Premier water services S/B: 9.5%

SVS Engineering S/B: 9.7%

S.Kian Seng S/B: 31.0%

Market cap: RM89.775 mil

Total Shares: 256.501mil shares

Industry CARG

Industry CARG is not enough information for analysis.

Competitor Comparison (PAT %)

Cosmos: 11.8%

Cergas Proses S/B: 3.2%

Delta Ferdana S/B: -4.2%

Mimtech Technology S/B: 4.0%

Premier water services S/B: 9.5%

SVS Engineering S/B: 9.7%

S.Kian Seng S/B: 31.0%

Business (FYE 2022)

Distribution and instrumentation services of fluid control products and manufacturing of fabricated metal products for industrial applications used in the water, wastewater and oil and/or gas industries.

Distribution and instrumentation services of fluid control products and manufacturing of fabricated metal products for industrial applications used in the water, wastewater and oil and/or gas industries.

Fundamental

1.Market: Ace Market

2.Price: RM0.35

3.P/E: 15,51 @ RM0.0226

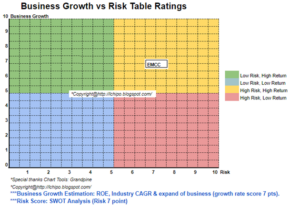

4.ROE(Pro Forma III): 12.14%

5.ROE: 21.80%(FYE2022), 26.91%(FYE2021), 8.03%(FYE2020), 45.97%(FYE2019)

6.NA after IPO: RM0.16

7.Total debt to current asset after IPO: 0.3895 (Debt:17.809mil, Non-Current Asset: 19.755mil, Current asset: 45.718mil)

8.Dividend policy: no formal dividend policy.

9. Shariah starus: –

1.Market: Ace Market

2.Price: RM0.35

3.P/E: 15,51 @ RM0.0226

4.ROE(Pro Forma III): 12.14%

5.ROE: 21.80%(FYE2022), 26.91%(FYE2021), 8.03%(FYE2020), 45.97%(FYE2019)

6.NA after IPO: RM0.16

7.Total debt to current asset after IPO: 0.3895 (Debt:17.809mil, Non-Current Asset: 19.755mil, Current asset: 45.718mil)

8.Dividend policy: no formal dividend policy.

9. Shariah starus: –

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2022 (FYE 30Apr): RM49.120 mil (Eps: 0.0226),PAT: 11.78%

2021 (FYE 30Apr): RM33.723 mil (Eps: 0.0218),PAT: 16.57%

2020 (FYE 30Apr): RM25.189 mil (Eps: 0.0047),PAT: 4.84%

2019 (FYE 30Apr): RM44.078 mil (Eps: 0.0206),PAT: 11.98%

Major customer (2022)

1. NOV (Malaysia) Sdn Bhd: 18.01%

2. National Oilwell Varco Inc: 15.63%

3. NOV Process & Flow Technologies Malaysia Sdn Bhd: 15.50%

4. Air Selangor: 9.84%

5. M8 Machinery Sdn Bhd: 7.90%

***total 66.88%

2022 (FYE 30Apr): RM49.120 mil (Eps: 0.0226),PAT: 11.78%

2021 (FYE 30Apr): RM33.723 mil (Eps: 0.0218),PAT: 16.57%

2020 (FYE 30Apr): RM25.189 mil (Eps: 0.0047),PAT: 4.84%

2019 (FYE 30Apr): RM44.078 mil (Eps: 0.0206),PAT: 11.98%

Major customer (2022)

1. NOV (Malaysia) Sdn Bhd: 18.01%

2. National Oilwell Varco Inc: 15.63%

3. NOV Process & Flow Technologies Malaysia Sdn Bhd: 15.50%

4. Air Selangor: 9.84%

5. M8 Machinery Sdn Bhd: 7.90%

***total 66.88%

Major Sharesholders

Dato’Chong: 40.5% (direct)

MSM” 27% (direct)

Dato’Chong: 40.5% (direct)

MSM” 27% (direct)

Directors & Key Management Remuneration for FYE2023 (from Revenue & other income 2022)

Total director remuneration: RM1.0095mil

key management remuneration: RM0.300 mil – 0.60mil

total (max): RM1.6095 mil or 11.79%

Total director remuneration: RM1.0095mil

key management remuneration: RM0.300 mil – 0.60mil

total (max): RM1.6095 mil or 11.79%

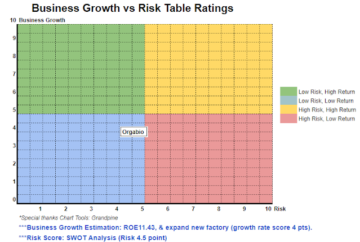

Use of funds

1. Acquisition of new building: 44.56%

2. Purchase of new machineries: 15.59%

3. Repayment of bank borrowing: 6.68%

4. Working capital: 19.80%

3. Listing Expenses: 13.37%

1. Acquisition of new building: 44.56%

2. Purchase of new machineries: 15.59%

3. Repayment of bank borrowing: 6.68%

4. Working capital: 19.80%

3. Listing Expenses: 13.37%

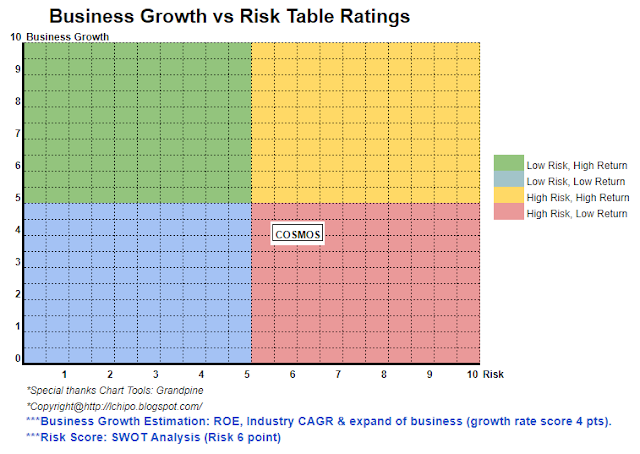

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

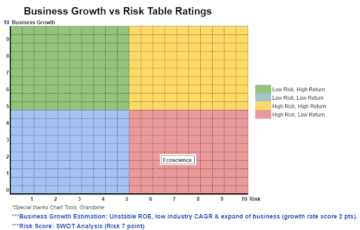

Overall, a bit risky investment business. The demand of the business product is very specific segment. The company business also not easy to grow faster like other business.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://lchipo.blogspot.com/2022/09/cosmos-technology-international-berhad.html

- 1

- 11

- 2022

- 7

- 9

- a

- acquisition

- After

- AIR

- All

- analysis

- and

- applications

- Apply

- asset

- Bank

- Bit

- Borrowing

- Building

- business

- cap

- capital

- Center

- change

- clear

- color

- company

- comparison

- control

- Cosmos

- Current

- customer

- Date

- Debt

- decision

- Demand

- direct

- Director

- dividend

- Earning

- Engineering

- enough

- Ether (ETH)

- expenses

- faster

- financial

- financial performance

- flow

- follow

- Forecast

- formal

- from

- fundamental

- GAS

- Grow

- homework

- HTTPS

- in

- Income

- industrial

- industries

- information

- International

- investment

- IPO

- Key

- listing

- machinery

- Malaysia

- management

- manufacturing

- Market

- max

- metal

- National

- New

- Oil

- Opinion

- Other

- own

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Pro

- process

- Product

- Products

- purchase

- Quarter

- Reader

- Recommendation

- Red

- release

- remuneration

- repayment

- result

- revenue

- Risk

- Risky

- segment

- Services

- Shares

- Shariah

- should

- specific

- Take

- Technologies

- Technology

- The

- their

- to

- Total

- us

- value

- View

- Water

- will

- working

- zephyrnet