Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

opinion and reader should take their own risk in investment decision.

Open to apply: 28/12/2022

Close to apply: 09/01/2023

Balloting: 11/01/2023

Listing date: 17/01/2023

Close to apply: 09/01/2023

Balloting: 11/01/2023

Listing date: 17/01/2023

Share Capital

Market cap: RM340mil

Total Shares: 500mil shares

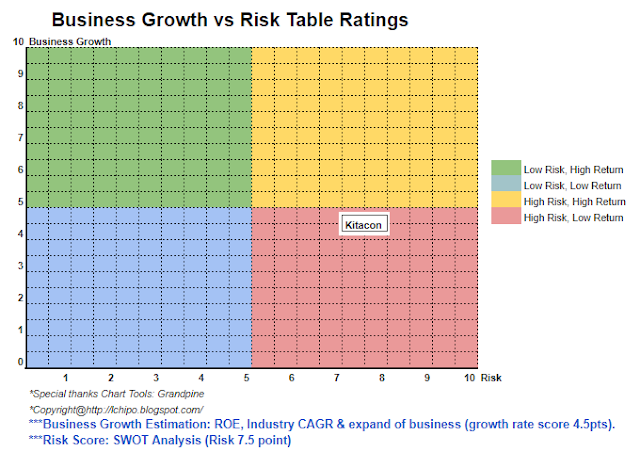

Industry CARG (2017-2021)

Market cap: RM340mil

Total Shares: 500mil shares

Industry CARG (2017-2021)

Value of building construction work completed by sectors

1. Malaysia (residential) CAGR: -9.1%

2. Malaysia (non-residential) CAGR: -6.8%

3. Selangor (residential) CAGR: -7.5%

4. Selangor (non-residential) CAGR: -7.9%

Industry competitors comparison (net profit%)

Kitacon: 9.2% (PE8.1)

Kerjaya: 9.9% (PE13.04)

MGB Bhd: 4.5% (PE14.31)

Nestcon: 3.4% (PE30.56)

Inta Bina: 3.5% (PE11.81)

Vizione: -28.9% (PE-1.37)

TCS: 1.2% (PE-10.45)

Gagasan: 3.7% (PE-29.04)

Haily: 5.0% (PE8.74)

Kitacon: 9.2% (PE8.1)

Kerjaya: 9.9% (PE13.04)

MGB Bhd: 4.5% (PE14.31)

Nestcon: 3.4% (PE30.56)

Inta Bina: 3.5% (PE11.81)

Vizione: -28.9% (PE-1.37)

TCS: 1.2% (PE-10.45)

Gagasan: 3.7% (PE-29.04)

Haily: 5.0% (PE8.74)

Business (FYE 2021)

Provision of construction services

Residential: 84%

Non-residentail: 16%

Principal Market

Selangor: 96.8%

Negeri Sembilan: 1.6%

Johor: 1.6%

Residential: 84%

Non-residentail: 16%

Principal Market

Selangor: 96.8%

Negeri Sembilan: 1.6%

Johor: 1.6%

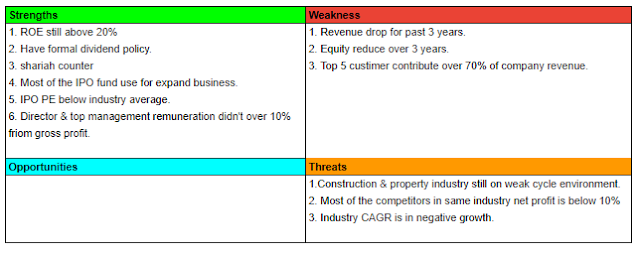

Fundamental

1.Market: Main Market

2.Price: RM0.68

3.P/E: 8.1 @ RM0.084

4.ROE(Pro Forma III): 21.09%

5.ROE: 22.69%(FYE2021), 14.96%(FYE2020), 22.42%(FYE2019)

6.Net asset: RM0.496

7.Total debt to current asset after IPO: 0.48 (Debt: 190.583mil, Non-Current Asset: 42.890mil, Current asset: 395.501mil)

8.Dividend policy: Propose 25% PAT dividend policy.

9. Shariah starus: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2022 (FPE 30Jun): RM234.733 mil (Eps: 0.052),PAT: 11.1%

2021 (FYE 31Dec): RM455.502 mil (Eps: 0.084),PAT: 8.40%

2020 (FYE 31Dec): RM489.645 mil (Eps: 0.078),PAT: 7.80%

2019 (FYE 31Dec): RM581.523 mil (Eps: 0.110),PAT: 9.40%

Order book

FYE2022: RM104.961 mil

FYE2023: RM617.578 mil

FYE2024: RM131.070 mil

FYE2022: RM104.961 mil

FYE2023: RM617.578 mil

FYE2024: RM131.070 mil

Operating cashflow vs PBT

2022: 87.83%

2021: 154.0%

2020: 84.9%

2019: 44.6%

Major customer (2022)

1. Sime Darby: 25.3%

2. Tropicana Aman Sdn Bhd: 14.8%

3. QLB: 11.4%

4. SP Setia Group: 10.2%

5. Symphony Hills Sdb bhd: 8.8%

***total 70.5%

Major Sharesholders

Tan Ah Kee: 8.4% (direct)

Teow Choo Hing: 28.9% (direct)

Suan Neo Capital: 35% (direct)

Directors & Key Management Remuneration for FYE2023 (from Revenue & other income 2022)

Total director remuneration: RM5.095mil

key management remuneration: RM2.10 mil - RM2.50 mil

total (max): RM7.595mil or 9.39%

Use of funds

1. Purchase of Aluminium formwork systems: 34.8%

2. Purchase of Scaffoldings and cabins: 11.6%

3. Purchase of land and construction of a storage and refurbishment facility: 38.7%

4. Working capital: 6.3%

5. Listing Expenses: 8.6%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion

and reader should take their own risk in investment decision)

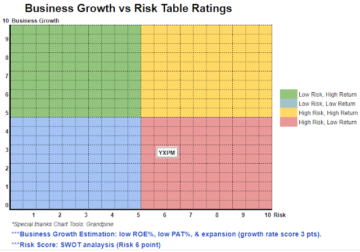

Overall is a high risk IPO due to overall weak performance & challenge of the industry

environment cause the difficulty for the company to growth. The order 2022 like unable to break revenue in 2021, but order book in 2023 likely will have better result compare 2022.

and reader should take their own risk in investment decision)

Overall is a high risk IPO due to overall weak performance & challenge of the industry

environment cause the difficulty for the company to growth. The order 2022 like unable to break revenue in 2021, but order book in 2023 likely will have better result compare 2022.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter

result release. Reader take their own risk & should do own homework to follow up every quarter

result to adjust forecast of fundamental value of the company

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://lchipo.blogspot.com/2022/12/kumpulan-kitacon-berhad.html

- 1

- 10

- 11

- 2%

- 2021

- 2022

- 28

- 35%

- 7

- 70

- 84

- 9

- a

- After

- All

- and

- Apply

- asset

- Better

- book

- Break

- Building

- cap

- capital

- Cause

- Center

- challenge

- change

- Choo

- clear

- color

- company

- compare

- comparison

- competitors

- Completed

- construction

- Current

- customer

- Date

- Debt

- decision

- Difficulty

- direct

- Director

- Earning

- Ether (ETH)

- expenses

- Facility

- financial

- financial performance

- follow

- Forecast

- from

- fundamental

- Group

- Growth

- High

- Hills

- HTTPS

- in

- Income

- investment

- IPO

- Key

- Land

- likely

- listing

- Main

- Malaysia

- management

- Market

- max

- NEO

- net

- New

- Opinion

- order

- Other

- overall

- own

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Pro

- propose

- purchase

- Reader

- Recommendation

- Red

- release

- remuneration

- result

- revenue

- Risk

- Shares

- Shariah

- should

- storage

- Systems

- Take

- The

- their

- to

- Total

- us

- value

- View

- will

- Work

- working

- zephyrnet