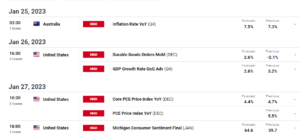

- Robust US retail sales data reduced bets on a Fed interest rate cut in March.

- The likelihood of a rate cut in March has reduced to 61% from 65.1% on Tuesday.

- Investors have steadily reduced bets on a hawkish Bank of Japan.

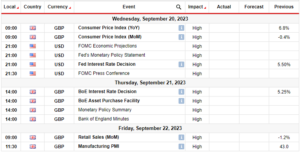

Thursday’s USD/JPY forecast maintains its optimistic stance, staying bullish despite a minor retreat. The dollar, lingering near a one-month high against major peers, draws strength from robust US retail sales data, which reduced expectations for a March Fed cut.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Moreover, the likelihood of a rate cut in March has reduced to 61% from 65.1% on Tuesday, according to CME’s FedWatch Tool. Notably, the dollar reached 148.525 yen overnight, a level not seen since the end of November. Investors steadily reduced bets on a hawkish Bank of Japan, partly influenced by the recent New Year’s Day quake in central Japan. The BOJ will have its policy meeting next week on Monday and Tuesday.

Meanwhile, Shoki Omori, Chief Japan Desk Strategist at Mizuho Securities, said that the dollar yen could fluctuate between 145 and 150 in the near term. This range was last seen in mid-November. Furthermore, if the BOJ maintains its dovish stance next week and Fed Chair Jerome Powell is hawkish at the US central bank’s policy meeting this month, Omori suggested the dollar might rise above 150 yen by the start of February.

Additionally, he said that Japanese officials could start to come in and verbally intervene at any time now” to stop the yen’s decline.

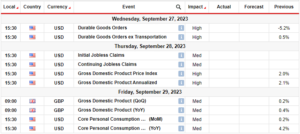

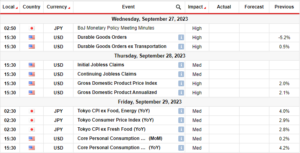

USD/JPY key events today

- US Initial Jobless Claims

USD/JPY technical forecast: Price hits resistance wall at 148.25

On the charts, the USD/JPY price has hit a ceiling at the 148.25 key resistance level and is retreating. However, the bullish bias is strong as the indicators on the chart point to a robust bullish trend. Notably, the price has respected the 30-SMA as support, bouncing higher every time to make a new high. Moreover, the RSI, which has stayed above 50 since the bulls took over, is currently overbought.

–Are you interested to learn about forex robots? Check our detailed guide-

The price has made a series of swing highs and swing lows. The most recent swing high has paused at 148.25. Therefore, the next move will likely be a swing low to retest the 30-SMA support. From there, bulls might target the 150.02 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/18/usd-jpy-forecast-robust-us-sales-push-dollar-to-1-month-top/

- :has

- :is

- :not

- 1

- 150

- 25

- 50

- 65

- a

- About

- above

- According

- Accounts

- against

- and

- any

- AS

- At

- Bank

- bank of japan

- BE

- Bets

- between

- bias

- boj

- Bullish

- Bulls

- by

- CAN

- ceiling

- central

- CFDs

- Chair

- Chart

- Charts

- check

- chief

- come

- Consider

- could

- Currently

- Cut

- data

- day

- Decline

- desk

- Despite

- detailed

- Dollar

- Dovish

- draws

- end

- events

- Every

- expectations

- February

- Fed

- Fed Chair

- Fed Chair Jerome Powell

- fluctuate

- For

- Forecast

- forex

- from

- Furthermore

- Have

- Hawkish

- he

- High

- higher

- Highs

- Hit

- Hits

- However

- HTTPS

- if

- in

- Indicators

- influenced

- initial

- interest

- INTEREST RATE

- interested

- intervene

- Invest

- investor

- Investors

- ITS

- Japan

- Japanese

- jerome

- jerome powell

- Key

- key resistance

- Last

- LEARN

- Level

- likelihood

- likely

- lose

- losing

- Low

- Lows

- made

- maintains

- major

- make

- March

- max-width

- meeting

- might

- minor

- Mizuho

- Monday

- money

- Month

- more

- Moreover

- most

- move

- Near

- New

- next

- next week

- notably

- November

- now

- of

- officials

- on

- one-month

- Optimistic

- Options

- our

- over

- overnight

- paused

- peers

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- Powell

- price

- provider

- Push

- quake

- range

- Rate

- reached

- recent

- Reduced

- Resistance

- respected

- retail

- Retail Sales

- Retreat

- Rise

- Risk

- robust

- rsi

- Said

- sales

- Securities

- seen

- Series

- should

- since

- stance

- start

- stayed

- staying

- steadily

- Stop

- Strategist

- strength

- strong

- support

- Swing

- Take

- Target

- Technical

- term

- that

- The

- There.

- therefore

- this

- time

- to

- took

- tool

- top

- trade

- Trading

- Trend

- Tuesday

- us

- US Retail Sales

- USD/JPY

- Wall

- was

- week

- when

- whether

- which

- will

- with

- Yen

- you

- Your

- zephyrnet