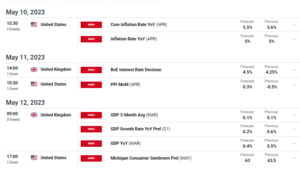

- The UK released GDP data that was much lower than expected.

- The US CPI and PPI figures beat forecasts.

- The Bank of England is set to raise its main rate by 25 basis points next week.

The GBP/USD weekly forecast is bearish as upbeat data from the US could mean higher rates for longer and possible rate hikes.

Ups and downs of GBP/USD

The pound closed the week lower as the dollar strengthened on upbeat data from the US. Meanwhile, the UK released GDP data that was much lower than expected. This showed the economy was doing poorly amid high interest rates.

-If you are interested in social trading apps, check our detailed guide-

On the other hand, the US released upbeat inflation and retail sales data. The US CPI and PPI figures beat forecasts, raising bets of higher rates for longer in the US. Moreover, retail sales data was hot, signaling a robust economy. This propelled the dollar, weakening the pound.

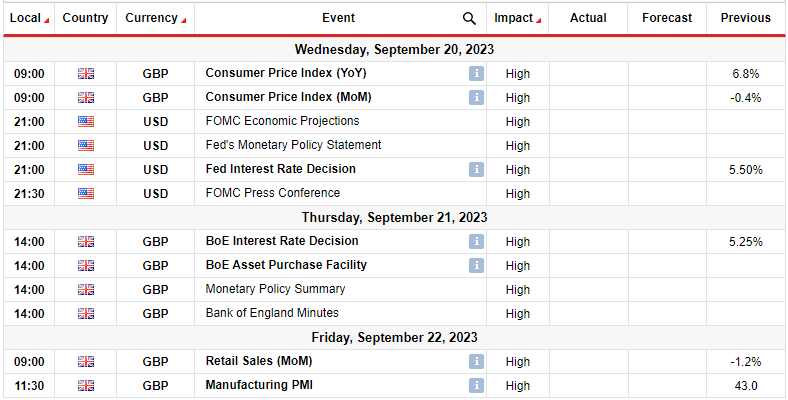

Next week’s key events for GBP/USD

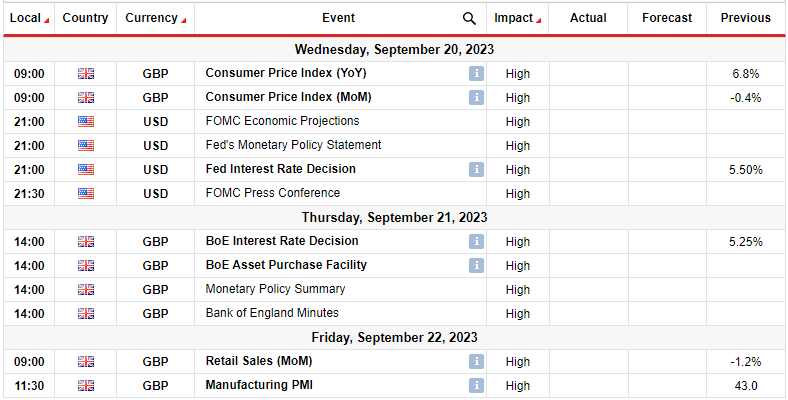

The UK will release data on inflation, retail sales, and manufacturing PMI. However, the focus will be on the monetary policy meetings in both countries.

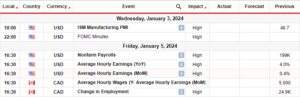

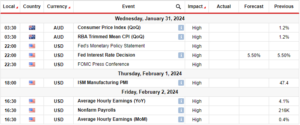

This week’s economic indicators solidified the expectation that the Federal Reserve will keep its key interest rate steady at next week’s monetary policy meeting. Moreover, there is optimism that the central bank’s tightening cycle might end.

Financial markets have already factored in a 97% probability that the Fed will maintain the Fed funds target rate at 5.25%-5.00%. Meanwhile, the Bank of England (BoE) is set to lift its main rate by 25 basis points on September 21.

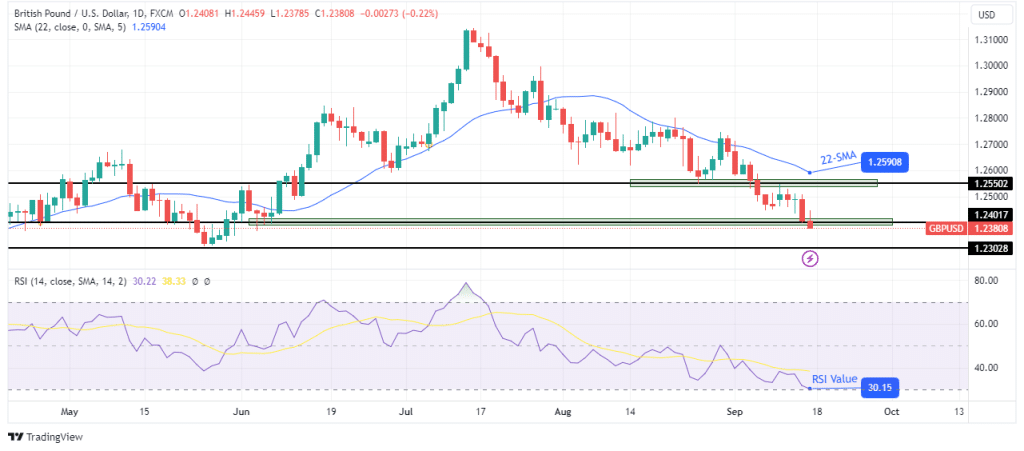

GBP/USD weekly technical forecast: 1.2401 support breach signals ongoing decline.

On the daily chart, the GBP/USD price closed below the 1.2401 key support level after a steep decline. After retesting the 22-SMA resistance, the price bounced lower and took out the 1.2550 support level. Consequently, the price reached a lower low. At the same time, the RSI respected the 50-level as resistance and fell deeper into bearish territory.

-If you are interested in brokers with Nasdaq, check our detailed guide-

All these occurrences support a bearish bias and show that the price is in a downtrend that could continue in the coming week. Since bears managed to close below the 1.2401 support, there is a high chance the collapse will continue next week, taking out the next support at 1.2302.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-weekly-forecast-sellers-overwhelm-ahead-of-boe-fed/

- :is

- 1

- 25

- 400

- a

- Accounts

- After

- ahead

- already

- Amid

- and

- ARE

- AS

- At

- Bank

- Bank of England

- Bank of England (BOE)

- basis

- BE

- bearish

- Bears

- below

- Bets

- bias

- BoE

- both

- breach

- by

- CAN

- central

- CFDs

- Chance

- Chart

- check

- Close

- closed

- Collapse

- coming

- Consequently

- Consider

- continue

- could

- countries

- CPI

- cycle

- daily

- data

- Decline

- deeper

- detailed

- doing

- Dollar

- downs

- Economic

- economic indicators

- economy

- end

- England

- events

- expectation

- expected

- factored

- Fed

- Federal

- federal reserve

- Figures

- Focus

- For

- Forecast

- forecasts

- forex

- from

- funds

- GBP/USD

- GDP

- hand

- Have

- High

- higher

- Hikes

- HOT

- However

- HTTPS

- in

- Indicators

- inflation

- interest

- INTEREST RATE

- Interest Rates

- interested

- into

- Invest

- investor

- ITS

- Keep

- Key

- Level

- longer

- lose

- losing

- Low

- lower

- Main

- maintain

- managed

- manufacturing

- Markets

- max-width

- mean

- Meanwhile

- meeting

- meetings

- might

- Monetary

- Monetary Policy

- money

- Moreover

- much

- next

- next week

- now

- of

- on

- ongoing

- Optimism

- Other

- our

- out

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- policy

- possible

- pound

- ppi

- price

- probability

- propelled

- provider

- raise

- raising

- Rate

- rate hikes

- Rates

- reached

- release

- released

- Reserve

- Resistance

- respected

- retail

- Retail Sales

- Risk

- robust

- rsi

- sales

- same

- Sellers

- September

- set

- should

- show

- showed

- signals

- since

- steady

- support

- support level

- Take

- taking

- Target

- Technical

- territory

- than

- that

- The

- the Fed

- the UK

- There.

- These

- this

- tightening

- time

- to

- took

- trade

- Trading

- Uk

- us

- US CPI

- was

- week

- weekly

- when

- whether

- will

- with

- Yahoo

- you

- Your

- zephyrnet