- The dollar got a boost after the FOMC meeting.

- Data on initial jobless claims showed a drop, supporting the view of a still-tight US labor market.

- The UK registered a surprise drop in inflation, pushing the pound lower.

The GBP/USD weekly forecast is bearish. The dollar is rising amid a hawkish Fed, while the BOE has pulled back amid lower inflation.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Ups and downs of GBP/USD

GBP/USD had a bearish week amid economic data and events favoring the dollar and weighing on the pound. The dollar got a boost after the FOMC meeting. The Fed decided to keep its rates unchanged but flagged one more hike before the end of 2023.

Moreover, data on initial jobless claims showed a drop, supporting the view of a still-tight US labor market, giving the dollar more support.

On the other hand, the UK registered a surprise drop in inflation, pushing the pound lower. Furthermore, the BOE paused rate hikes on Thursday, which saw the pound plummet to its lowest point since late March.

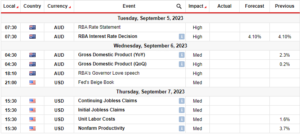

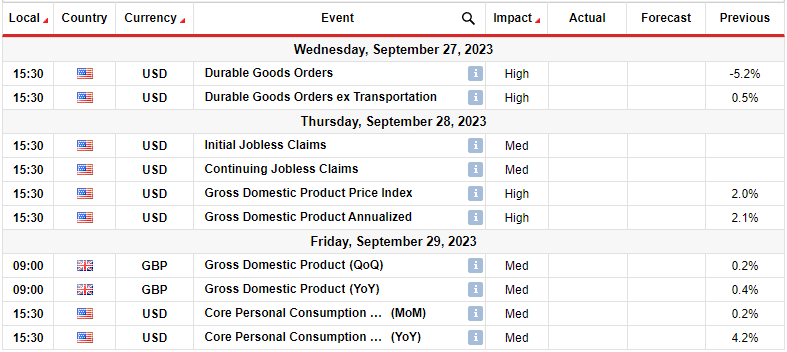

Next week’s key events for GBP/USD

The UK will release GDP data next week, while the US will release GDP, inflation, employment, and durable goods data. The GDP reports for both countries will show economic growth, influencing the BOE’s and Fed’s monetary policies.

Another critical report is the US core PCE index, the Fed’s favorite measure for inflation. A higher-than-expected figure for the core PCE could boost the dollar and further weaken the pound.

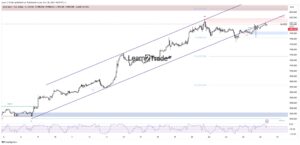

GBP/USD weekly technical forecast: Bears dominate by breaching 1.2302 support.

The GBP/USD bears have made a significant achievement by crossing below the 1.2302 key support level. The pound has been on a solid downtrend since the price broke below the 22-SMA. Since then, the price has kept making new lows.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Moreover, when the price crossed below the SMA, the RSI fell below 50 and has traded in bearish territory since then. The challenge for bears will be keeping the price below the 1.2302 level. The RSI currently trades below 30 in the oversold region. Therefore, there is a chance that bulls might resurface for a retracement, pushing the price back above 1.2302.

However, the downtrend will continue if the price stays below the 22-SMA and the RSI below 50. Therefore, eventually, the price will trade below the 1.2302 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-weekly-outlook-boes-retreat-flipping-the-pound/

- :has

- :is

- 1

- 2023

- 30

- 50

- a

- About

- above

- Accounts

- achievement

- After

- Amid

- and

- At

- back

- BE

- bearish

- Bears

- been

- before

- below

- BoE

- boost

- both

- Broke

- Bulls

- but

- by

- CAN

- CFDs

- challenge

- Chance

- check

- claims

- Consider

- continue

- Core

- could

- countries

- critical

- Crossed

- Currently

- daily

- data

- decided

- detailed

- Dollar

- dominate

- downs

- Drop

- Economic

- Economic growth

- employment

- end

- events

- eventually

- Favorite

- Fed

- Figure

- flagged

- FOMC

- For

- Forecast

- forex

- further

- Furthermore

- GBP/USD

- GDP

- Giving

- goods

- got

- Growth

- had

- hand

- Have

- Hawkish

- High

- Hike

- Hikes

- HTTPS

- if

- in

- index

- inflation

- influencing

- initial

- interested

- Invest

- investor

- ITS

- jobless claims

- Keep

- keeping

- kept

- Key

- labor

- labor market

- Late

- learning

- Level

- lose

- losing

- lower

- lowest

- Lows

- made

- Making

- March

- Market

- max-width

- measure

- meeting

- might

- Monetary

- money

- more

- New

- next

- next week

- now

- of

- on

- ONE

- Other

- our

- pce

- plato

- Plato Data Intelligence

- PlatoData

- Plummet

- Point

- policies

- pound

- price

- provider

- Pushing

- Rate

- rate hikes

- Rates

- region

- registered

- release

- report

- Reports

- retail

- retracement

- Retreat

- rising

- Risk

- rsi

- s

- saw

- should

- show

- showed

- significant

- since

- SMA

- solid

- support

- support level

- Supporting

- surprise

- Take

- Technical

- territory

- that

- The

- the Fed

- the UK

- then

- There.

- therefore

- this

- thursday

- to

- trade

- traded

- trades

- Trading

- Uk

- us

- US Core PCE

- US Core PCE Index

- View

- week

- weekly

- weighing

- when

- whether

- which

- while

- will

- with

- Yahoo

- you

- Your

- zephyrnet