- The bias is bullish as long as it stays above the median line (ml).

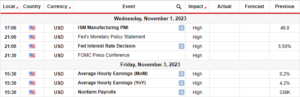

- The US data should bring more action later today.

- The upper median line (uml) represents the first target.

The gold price pared FOMC-led losses in the last New York session. The metal is at $1,966 at the time of writing.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The US dollar remains under strong downside pressure. Hence a deeper drop should force the yellow metal to jump higher in the short term.

Fundamentally, the XAU/USD turned to the upside after the ECB. As expected, the Main Refinancing Rate was increased to 4.00% from 3.75%.

Furthermore, the US data came in mixed. Capacity Utilization Rate, Industrial Production, Unemployment Claims, Import Prices, and Philly Fed Manufacturing Index indicators reported poor data.

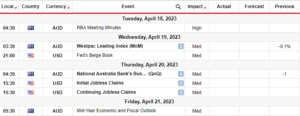

Today, the Bank of Japan left the monetary policy unchanged. The BOJ Policy Rate remained at -0.10%, as expected. Furthermore, the Eurozone Final CPI and Final Core CPI came in line with expectations.

Later, the US Prelim UoM Consumer Sentiment represents a high-impact event and is expected to reach 60.1 points in June versus 59.2 points in the previous reporting period.

The Prelim UoM Inflation Expectations indicator will be released as well. Better-than-expected US data could save the USD from the downside and could drag the XAU/USD lower again. On the other hand, poor US data should boost the price of gold.

Gold price technical analysis: Bullish bias

Technically, the XAU/USD stabilized above the weekly pivot point of $1,957. Now it has jumped above the upper median line (UML) of the descending pitchfork, representing a major dynamic resistance.

–Are you interested to learn more about automated trading? Check our detailed guide-

Validating the breakout may announce further growth. The first upside target is represented by the ascending pitchfork’s upper median line (uml).

Testing the UML and the weekly pivot point may announce a new bullish momentum. A valid breakout could activate a meaningful uptrend through the upper median line (uml) and above the weekly R1 (1,976).

In the short term, the bias remains bullish as long as it stays above the ascending pitchfork’s median line (ml).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/gold-price-breaks-1960-amid-dollars-weakness/

- :has

- :is

- 1

- 167

- 30

- 60

- a

- About

- above

- Accounts

- Action

- After

- again

- Amid

- analysis

- and

- Announce

- AS

- At

- Bank

- bank of japan

- BE

- bias

- boj

- boost

- breakout

- breaks

- bring

- Bullish

- by

- came

- CAN

- Capacity

- CFDs

- Chart

- check

- claims

- Consider

- consumer

- consumer sentiment

- Container

- Core

- could

- CPI

- data

- deeper

- detailed

- Dollar

- downside

- Drop

- dynamic

- ECB

- Eurozone

- Event

- expectations

- expected

- Fed

- final

- First

- Force

- forex

- from

- further

- Furthermore

- Gold

- gold price

- Growth

- hand

- hence

- High

- higher

- HTTPS

- import

- in

- increased

- index

- Indicator

- Indicators

- industrial

- Industrial Production

- inflation

- Inflation expectations

- interested

- Invest

- investor

- IT

- Japan

- jump

- june

- Last

- later

- LEARN

- left

- Line

- Long

- lose

- losing

- losses

- lower

- Main

- major

- manufacturing

- max-width

- May..

- meaningful

- metal

- mixed

- ML

- Momentum

- Monetary

- Monetary Policy

- money

- more

- New

- New York

- now

- of

- on

- Other

- our

- period

- Philly Fed Manufacturing Index

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- Point

- points

- policy

- poor

- pressure

- previous

- price

- Prices

- Production

- provider

- Rate

- reach

- released

- remained

- remains

- Reported

- Reporting

- represented

- representing

- represents

- Resistance

- retail

- Risk

- ROW

- s

- Save

- sentiment

- session

- Short

- should

- strong

- SVG

- Take

- Target

- Technical

- Technical Analysis

- term

- The

- The Weekly

- this

- Through

- time

- to

- today

- trade

- Trading

- Turned

- under

- unemployment

- UoM Consumer Sentiment

- UoM Inflation Expectations

- Upside

- uptrend

- us

- US Dollar

- USD

- Versus

- was

- weakness

- weekly

- WELL

- when

- whether

- will

- with

- writing

- XAU/USD

- yellow

- york

- you

- Your

- zephyrnet