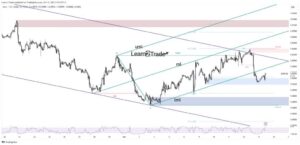

- XAU/USD could jump higher if it stays above the lower median line (LML).

- Taking out the range’s resistance activates an upward movement.

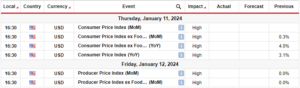

- The US inflation figures should be decisive on Wednesday.

The gold price is in a tight range in the short term. It is trading at $1,926 at press time. The US dollar bounced back and pushed the yellow metal down from $1,930, which was the day’s high.

-Are you looking for automated trading? Check our detailed guide-

If the US dollar weakens again, the gold buyers could drive the price higher. On the other hand, some economic data could affect the price of gold. On Saturday, China reported lower-than-expected consumer inflation and unchanged producer deflation.

Tomorrow, we will see how the UK economy performed and how confident the Eurozone and Germany are about their economic outlook. But the week’s most important event is the US inflation data release.

The market expects higher inflation in August than in July, both monthly and yearly. Higher inflation could boost the demand for gold as a hedge against currency devaluation.

Moreover, the European Central Bank and the US retail sales data could also impact the gold price on Thursday. So, there are a lot of factors that could shake the market this week. Stay tuned for more updates and analysis on gold.

Gold price technical analysis: Rangebound

The gold price is stuck in a narrow range between $1,929 and $1,915. It needs to break out of this range to show a clear direction. The rising trend line on the chart is a support level that could keep the price up.

-If you are interested in forex day trading then have a read of our guide to getting started-

If the price stays close to the $1,929 resistance, it could signal a breakout soon. A breakout above this level could lead to a bigger rally. On the other hand, if the price falls below this resistance and makes a new low below the trend line, it could indicate a larger drop. But this scenario is less likely as the buyers are still strong.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/gold-price-extending-consolidation-eying-us-cpi/

- :is

- $UP

- a

- About

- above

- Accounts

- affect

- again

- against

- also

- an

- analysis

- and

- ARE

- AS

- At

- AUGUST

- Automated

- back

- Bank

- BE

- below

- between

- bigger

- boost

- both

- Break

- break out

- breakout

- but

- buyers

- CAN

- central

- Central Bank

- CFDs

- Chart

- check

- China

- clear

- Close

- confident

- Consider

- consolidation

- consumer

- could

- CPI

- Currency

- data

- day

- decisive

- deflation

- Demand

- detailed

- Devaluation

- direction

- Dollar

- down

- drive

- Drop

- Economic

- economy

- European

- European Central Bank

- Eurozone

- Event

- expects

- extending

- factors

- Falls

- Figures

- For

- forex

- from

- Germany

- getting

- Gold

- gold price

- guide

- hand

- Have

- hedge

- High

- higher

- How

- HTTPS

- if

- Impact

- important

- in

- indicate

- inflation

- inflation figures

- interested

- Invest

- investor

- IT

- July

- jump

- Keep

- larger

- lead

- less

- Level

- likely

- Line

- looking

- lose

- losing

- Lot

- Low

- lower

- MAKES

- Market

- max-width

- metal

- money

- monthly

- more

- most

- movement

- needs

- New

- now

- of

- on

- Other

- our

- out

- Outlook

- performed

- plato

- Plato Data Intelligence

- PlatoData

- press

- price

- price up

- producer

- provider

- pushed

- rally

- range

- Read

- release

- Reported

- Resistance

- retail

- Retail Sales

- rising

- Risk

- sales

- saturday

- scenario

- see

- Short

- should

- show

- Signal

- So

- some

- Soon

- stay

- Still

- strong

- support

- support level

- Take

- Technical

- Technical Analysis

- term

- than

- that

- The

- the UK

- their

- then

- There.

- this

- this week

- thursday

- time

- to

- trade

- Trading

- Trend

- Uk

- Updates

- upward

- us

- US CPI

- US Dollar

- us inflation

- US Retail Sales

- was

- we

- Wednesday

- week

- when

- whether

- which

- will

- with

- Yahoo

- yearly

- yellow

- you

- Your

- zephyrnet