- The downside pressure remains high after failing to make a new higher high.

- A new lower low activates more declines.

- Positive US data should lift the greenback.

The EUR/USD price lost its shine again on Friday. The pair is at 1.0913 at the time of writing. Fundamentally, the US dollar received a helping hand from upbeat US data in the last session.

If you are interested in automated forex trading, check our detailed guide-

The ADP Non-Farm Employment Change, Unemployment Claims, and Final Services PMI came in better than expected.

Today, the Eurozone CPI Flash Estimate reported a 2.9% growth less versus the 3.0% growth expected. Core CPI Flash Estimate came in line with expectations, PPI reported a 0.3% drop, more than the 0.1% fall estimated, while German Retail Sales dropped by 2.5% compared to the 0.5% drop forecasted.

Later, the US economic figures should drive the price. The Non-Farm Payrolls is expected at 168K versus 199K in the previous reporting period. Average Hourly Earnings may announce a 0.3% growth in December versus a 0.4% growth in November, while the Unemployment Rate could jump from 3.7% to 3.8%.

Furthermore, the US will release the ISM Services PMI and the Factory Orders, while Canada publishes the Employment Change and Unemployment Rate. Positive US data should lift the greenback.

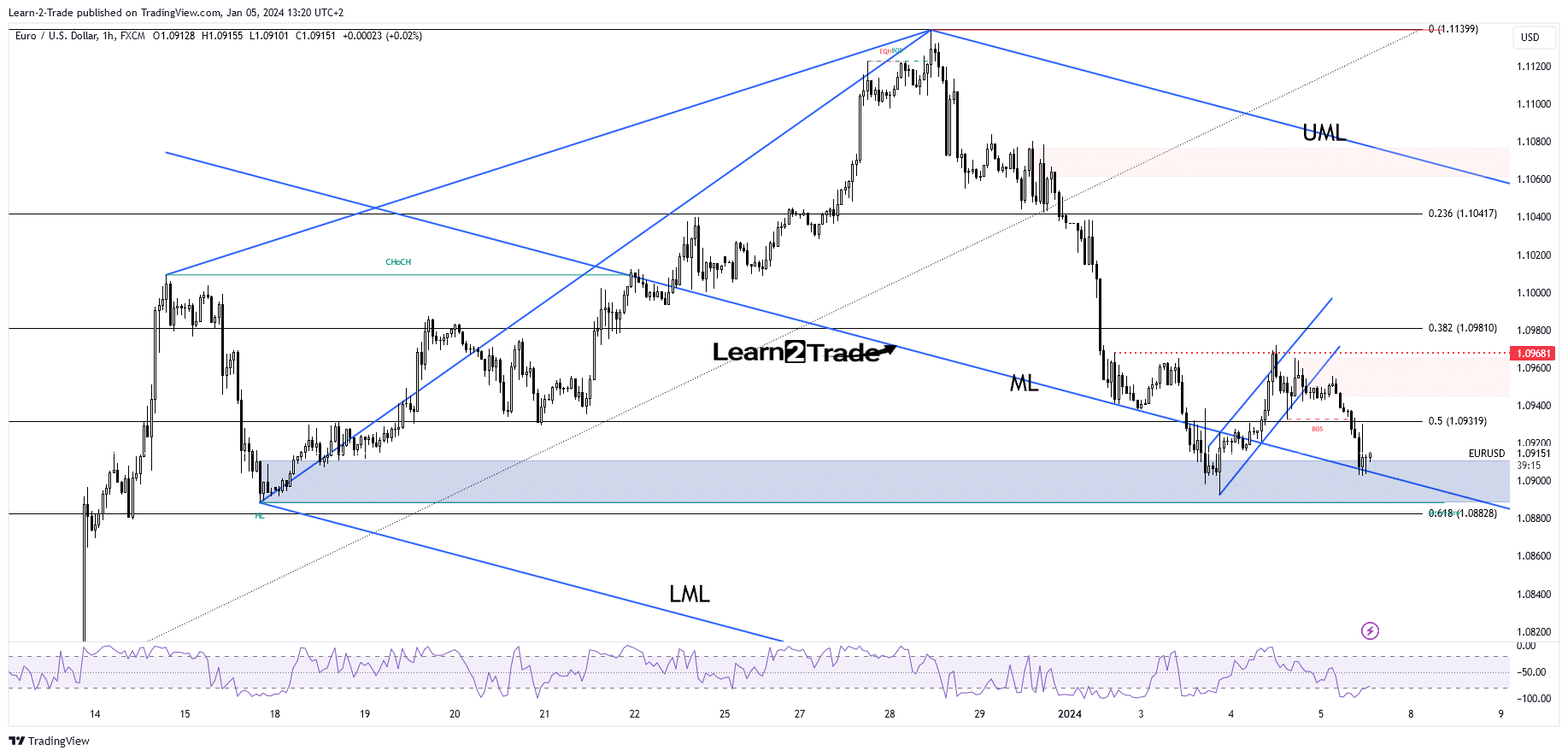

EUR/USD Price Technical Analysis: 1.0900 Protecting Buyers

As you can see on the H1 chart, the price found resistance at 1.0968, and now it has reached the median line (ML) of the descending pitchfork again. This represents a dynamic support, while the 1.09 psychological level represents a static downside obstacle.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Technically, the downside pressure remains high after failing to make a new higher high. Making a new lower low and invalidating the demand zone validates more declines. A valid breakdown below the 61.8% (1.0882) can confirm a reversal. However, staging above the 1.09 level and making only false breakdowns below the immediate support level may announce a new leg higher.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/05/eur-usd-price-playing-within-demand-zone-ahead-of-us-nfp/

- :has

- :is

- 09

- 1

- a

- above

- Accounts

- adp

- After

- again

- ahead

- analysis

- and

- Announce

- ARE

- At

- average

- below

- Better

- Breakdown

- brokers

- by

- came

- CAN

- Canada

- CFDs

- change

- Chart

- check

- claims

- compared

- Confirm

- Consider

- Core

- could

- CPI

- data

- December

- Declines

- Demand

- detailed

- Dollar

- downside

- drive

- Drop

- dropped

- dynamic

- Earnings

- Economic

- employment

- estimate

- estimated

- EUR/USD

- Eurozone

- Eurozone CPI

- expectations

- expected

- factory

- failing

- Fall

- false

- Figures

- final

- Flash

- forex

- Forex Brokers

- Forex Trading

- found

- Friday

- from

- fundamentally

- German

- German Retail Sales

- Greenback

- Growth

- hand

- helping

- High

- higher

- However

- HTTPS

- immediate

- in

- interested

- Invest

- investor

- IT

- ITS

- jump

- Last

- less

- Level

- Line

- lose

- losing

- lost

- Low

- lower

- make

- Making

- max-width

- May..

- ML

- money

- more

- New

- nfp

- Non-farm payrolls

- November

- now

- obstacle

- of

- on

- only

- orders

- our

- pair

- Payrolls

- period

- plato

- Plato Data Intelligence

- PlatoData

- playing

- pmi

- positive

- ppi

- pressure

- previous

- price

- protecting

- provider

- psychological

- Publishes

- Rate

- reached

- received

- release

- remains

- Reported

- Reporting

- represents

- Resistance

- retail

- Retail Sales

- Reversal

- Risk

- sales

- see

- Services

- session

- shine

- should

- staging

- support

- support level

- Take

- Technical

- Technical Analysis

- than

- The

- this

- time

- to

- trade

- Trading

- unemployment

- unemployment rate

- upbeat

- us

- US Dollar

- us NFP

- valid

- validates

- Versus

- when

- whether

- while

- will

- with

- within

- writing

- you

- Your

- zephyrnet