- There was an uptick in Japan’s core consumer price growth.

- The dollar has declined by 2.8% for the month, heading for its weakest monthly performance.

- Japan’s factory activity contracted for the sixth consecutive month in November.

The USD/JPY price analysis on Friday suggested a subtle bearish sentiment, with the yen gaining strength in response to an increase in Japan’s core consumer price growth. This upward trend further bolstered the anticipation that the Bank of Japan could potentially withdraw its monetary stimulus in the near future.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Notably, Japan’s core consumer price growth slightly increased in October, countering the previous month’s drop. Consequently, investors expect persistent inflation to push the Bank of Japan to scale back its monetary stimulus soon. At the same time, ING economists anticipate the BOJ to shift away from its dovish stance next year.

The Japanese yen strengthened by 0.21% to 149.23 per dollar, gradually recovering from the near 33-year low of 151.92. Additionally, it has seen a 1.5% increase for the month.

Furthermore, a business survey on Friday revealed that Japan’s factory activity contracted for the sixth consecutive month in November. Japan’s economy remains fragile amid weak demand and inflation.

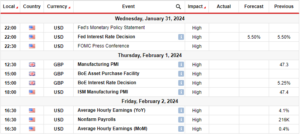

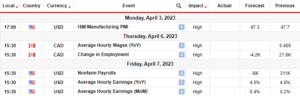

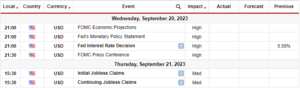

Meanwhile, the dollar fell 0.058% to 103.71, remaining close to the two-and-a-half-month low of 103.17 earlier in the week. Moreover, the dollar has declined by 2.8% for the month, heading for its weakest monthly performance in a year. This decline was due to growing expectations that the Fed would conclude its interest rate hikes and start rate cuts next year.

However, market expectations for Fed rate cuts in 2024 have decreased. At the moment, futures indicate a 26% chance of a rate cut at the March 2024 policy meeting. It is down from a 33% chance the previous week.

USD/JPY key events today

- The US S&P Global Services PMI (Nov)

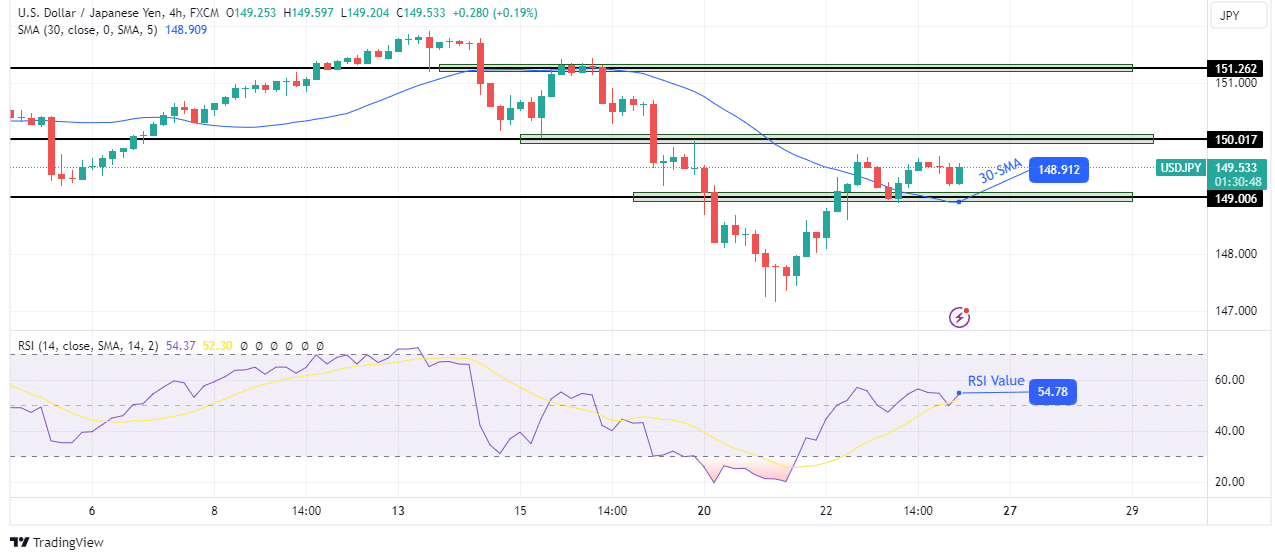

USD/JPY technical price analysis: Bulls struggle to sever ties with the 30-SMA

On the technical side, the USD/JPY price trades between the 149.00 support and the 150.01 resistance level. This move comes after bulls took over by pushing the price above the 149.00 level and the 30-SMA. Moreover, the RSI has risen above 50 to support solid bullish momentum.

–Are you interested to learn more about crypto signals? Check our detailed guide-

However, the price is still pulling back to retest the SMA and is yet to make a big bullish swing. Therefore, to confirm the new bullish trend, bulls must detach from the 30-SMA and take out the 150.01 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-analysis-yen-gains-on-japans-inflation-uptick/

- :has

- :is

- ][p

- 01

- 1

- 150

- 17

- 2024

- 23

- 50

- a

- above

- Accounts

- activity

- Additionally

- After

- Amid

- an

- analysis

- and

- anticipate

- anticipation

- At

- away

- back

- Bank

- bank of japan

- bearish

- between

- Big

- boj

- Bullish

- Bulls

- business

- by

- CAN

- CFDs

- Chance

- check

- Close

- comes

- conclude

- Confirm

- consecutive

- Consequently

- Consider

- consumer

- Core

- could

- countering

- Cut

- cuts

- Decline

- decreased

- Demand

- detailed

- Dollar

- Dovish

- down

- Drop

- due

- Earlier

- economists

- economy

- events

- expect

- expectations

- factory

- Fed

- For

- forex

- Friday

- from

- further

- future

- Futures

- gaining

- Gains

- Global

- gradually

- Growing

- Growth

- Have

- Heading

- High

- Hikes

- HTTPS

- in

- Increase

- increased

- indicate

- inflation

- ING

- interest

- INTEREST RATE

- INTEREST RATE HIKES

- interested

- Invest

- investor

- Investors

- IT

- ITS

- Japan

- Japan’s

- Japanese

- Japanese Yen

- Key

- LEARN

- Level

- lose

- losing

- Low

- make

- March

- March 2024

- Market

- max-width

- meeting

- moment

- Momentum

- Monetary

- money

- Month

- monthly

- more

- Moreover

- move

- must

- Near

- New

- next

- nov

- November

- now

- october

- of

- on

- our

- out

- over

- per

- performance

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- policy

- potentially

- previous

- price

- Price Analysis

- provider

- pulling

- Push

- Pushing

- Rate

- rate hikes

- recovering

- remaining

- remains

- Resistance

- response

- retail

- Revealed

- Risen

- Risk

- rsi

- s

- S&P

- S&P Global

- same

- Scale

- seen

- sentiment

- Services

- shift

- should

- side

- sixth

- SMA

- solid

- Soon

- stance

- start

- Still

- stimulus

- strength

- strengthened

- Struggle

- support

- Survey

- Swing

- Take

- Technical

- that

- The

- the Fed

- therefore

- this

- Ties

- time

- to

- took

- trade

- trades

- Trading

- Trend

- upward

- us

- USD/JPY

- was

- week

- when

- whether

- with

- withdraw

- would

- year

- Yen

- yet

- you

- Your

- zephyrnet