- Taking out the 1.2101 signaled more gains.

- The downtrend line stands as a potential target.

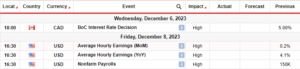

- The US economic figures should move the rate today.

The GBP/USD price rallied, passing above 1.2100 handle, far above today’s low of 1.2037. The DXY’s retreat favors the risk assets.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The US dollar may enter a corrective phase after gaining for 11 consecutive months. The Dollar Index showed overbought signs even though the US JOLTS Job Openings and Wards Total Vehicle Sales came in better than expected.

Today, the British Pound received a helping hand from the United Kingdom Final Services PMI data. The economic indicator came in at 49.3 points versus 47.3 points expected and 47.2 points in the previous reporting period.

Later, the US data should bring high volatility. The ADP Non-Farm Employment Change is expected at 154K in September versus 177K in August.

ISM Services PMI may drop to 53.5 points from 54.5 points. Final Services PMI could remain steady at 50.2 points, while Factory Orders may register a 0.2% growth after the 2.1% fall in the previous reporting period.

Tomorrow, the UK Construction PMI and the US Unemployment Claims should bring some action.

GBP/USD Price Technical Analysis: Bullish Momentum

The GBP/USD price dropped within a down-channel pattern. It has failed to retest the downside line, signaling exhausted sellers. It has registered a false breakdown with great separation below 1.2052 former low, confirming strong upside pressure.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

As you can see from the hourly chart, the rate jumped above the former high of 1.2101, activating a larger rebound. Still, after its bullish momentum, we cannot exclude a temporary retreat. The rate could come back to test and retest the broken levels (support) before extending its leg higher.

The weekly pivot point of 1.2190, the median line (ml), and the downtrend line represent upside targets.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-price-gains-above-1-21-as-dollar-takes-breather/

- :has

- :is

- 1

- 11

- 2%

- 2037

- 49

- 50

- 53

- 54

- a

- About

- above

- Accounts

- Action

- activating

- adp

- After

- analysis

- and

- AS

- Assets

- At

- AUGUST

- back

- before

- below

- Better

- Breakdown

- bring

- British

- British Pound

- Broken

- Bullish

- came

- CAN

- cannot

- CFDs

- change

- Chart

- check

- claims

- come

- consecutive

- Consider

- construction

- could

- data

- detailed

- Dollar

- dollar index

- downside

- Drop

- dropped

- Economic

- employment

- Enter

- Even

- expected

- extending

- factory

- Failed

- Fall

- false

- far

- favors

- Figures

- final

- For

- forex

- Former

- from

- gaining

- Gains

- GBP/USD

- great

- Growth

- hand

- handle

- helping

- High

- higher

- HTTPS

- in

- index

- Indicator

- interested

- Invest

- investor

- IT

- ITS

- Job

- JOLTS Job Openings

- Kingdom

- larger

- learning

- levels

- leveraged

- Line

- lose

- losing

- Low

- max-width

- May..

- ML

- Momentum

- money

- months

- more

- move

- now

- of

- openings

- orders

- our

- out

- Passing

- Pattern

- period

- phase

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- points

- potential

- pound

- pressure

- previous

- price

- provider

- Rate

- rebound

- received

- register

- registered

- remain

- Reporting

- represent

- retail

- Retreat

- Risk

- risk assets

- sales

- see

- Sellers

- September

- Services

- should

- showed

- Signs

- some

- stands

- steady

- Still

- strong

- support

- Take

- takes

- Target

- targets

- Technical

- Technical Analysis

- temporary

- test

- than

- The

- the UK

- the United Kingdom

- this

- though?

- to

- today

- today’s

- Total

- trade

- Trading

- Uk

- UK Construction PMI

- unemployment

- United

- United Kingdom

- Upside

- us

- US Dollar

- US JOLTS Job Openings

- US Unemployment Claims

- vehicle

- Versus

- Volatility

- we

- weekly

- when

- whether

- while

- with

- within

- Yahoo

- you

- Your

- zephyrnet