- The dollar found some relief following its most significant weekly decline.

- China’s economy experienced sluggish growth in the second quarter.

- Policymakers might need to take further action to bolster the second-largest economy in the world.

Today’s AUD/USD forecast is slightly bearish. On Monday, the dollar found some relief following its most significant weekly decline of the year.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

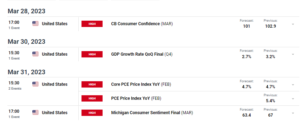

Traders paused and refrained from further selling as they awaited economic data and policy decisions that could influence the currency’s direction.

At the same time, the Aussie weakened after poor economic data from China. Notably, China’s economy experienced sluggish growth in the second quarter as domestic and international demand weakened. The momentum following the post-COVID period deteriorated rapidly.

Chinese authorities face the challenge of maintaining an economic recovery trajectory while simultaneously addressing unemployment concerns. However, implementing aggressive stimulus measures risks exacerbating debt and structural distortions within the economy.

Data disclosed by the National Bureau of Statistics on Monday revealed that gross domestic product grew by a mere 0.8% in April-June. This is compared to the previous quarter. Moreover, this growth rate fell short of analysts’ expectations, who had anticipated a 0.5% increase. Furthermore, it was considerably lower than the 2.2% expansion observed in the first quarter.

On a year-on-year basis, GDP expanded by 6.3% in the second quarter. It accelerated from the 4.5% growth recorded in the first three months. However, this growth rate fell well below the forecasted 7.3% growth.

Given the overall weak momentum and the risks of a global recession, there is a growing expectation that policymakers will need to take further action to bolster the second-largest economy in the world.

AUD/USD key events today

Investors are not expecting any key reports from Australia or the US today, so it might be a quiet day for AUD/USD.

AUD/USD technical forecast: Aussie pulls back within bullish trend.

AUD/USD has pulled back sharply from recent highs and is approaching the 0.6800 support level. However, the bias remains bullish since the price still trades above the 30-SMA, with the RSI over 50. This bias will only shift when bears break below the 30-SMA.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

However, if they respect the 0.6800 support, the price will bounce higher to retest the 0.6900 resistance. It would then likely make a higher high, continuing the uptrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/aud-usd-forecast-weak-chinese-data-threatens-aud/

- :has

- :is

- :not

- 1

- 167

- 2%

- 30

- 300

- 50

- 7

- a

- About

- above

- accelerated

- Accounts

- Action

- addressing

- After

- aggressive

- ahead

- an

- and

- Anticipated

- any

- approaching

- ARE

- AS

- At

- AUD

- AUD/USD

- aussie

- Australia

- Authorities

- back

- basis

- BE

- bearish

- Bears

- below

- bias

- bolster

- Bounce

- Break

- Bullish

- Bureau

- by

- CAN

- CFDs

- challenge

- check

- China

- Chinas

- chinese

- compared

- Concerns

- Consider

- Container

- continuing

- copy trading

- could

- Currency

- data

- day

- Debt

- decisions

- Decline

- Demand

- detailed

- direction

- Dollar

- Domestic

- Economic

- economic recovery

- economy

- events

- expanded

- expansion

- expectation

- expectations

- expecting

- experienced

- Face

- First

- following

- For

- Forecast

- forex

- found

- from

- further

- Furthermore

- GDP

- Global

- global recession

- gross

- Growing

- Growth

- had

- High

- higher

- Highs

- holds

- However

- HTTPS

- if

- implementing

- in

- Increase

- inflation

- influence

- interested

- International

- Invest

- investor

- IT

- ITS

- Key

- learning

- Level

- likely

- lose

- losing

- lower

- maintaining

- make

- max-width

- measures

- mere

- might

- Momentum

- Monday

- money

- months

- more

- Moreover

- most

- National

- Need

- notably

- now

- observed

- of

- on

- only

- or

- our

- Outlook

- over

- overall

- period

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- policy

- policymakers

- poor

- pound

- previous

- price

- Product

- provider

- Pulls

- Quarter

- rapidly

- Rate

- recent

- recession

- recorded

- recovery

- relief

- remains

- Reports

- Resistance

- respect

- retail

- Revealed

- Risk

- risks

- ROW

- rsi

- s

- same

- Second

- second quarter

- second-largest

- Selling

- shift

- Short

- should

- significant

- simultaneously

- since

- sluggish

- So

- some

- statistics

- steady

- Still

- stimulus

- structural

- support

- support level

- SVG

- Take

- Technical

- than

- that

- The

- the world

- then

- There.

- they

- this

- threatens

- three

- time

- to

- today

- today’s

- trade

- Traders

- trades

- Trading

- Trading Platforms

- trajectory

- Trend

- unemployment

- uptrend

- us

- was

- weekly

- WELL

- when

- whether

- while

- WHO

- will

- with

- within

- world

- would

- year

- you

- Your

- zephyrnet