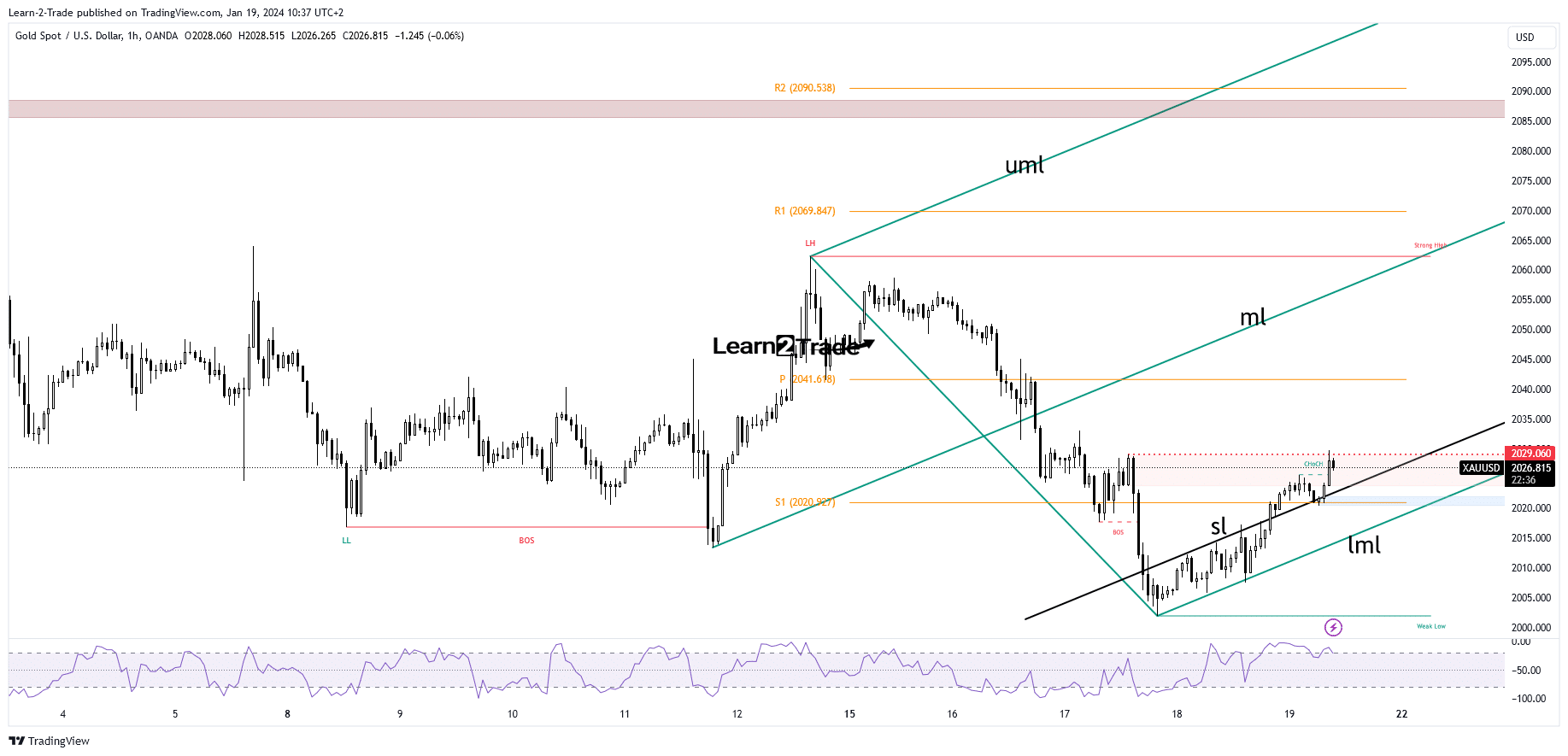

- XAU/USD could resume its growth if it stays above the sliding line (sl).

- A new higher high activates further growth.

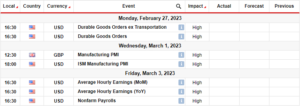

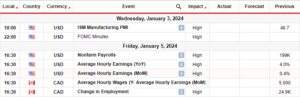

- The US and the Canadian figures could change the sentiment.

The gold price is trading at $2,028 at the time of writing. The metal seems determined to extend its growth as the US dollar looks exhausted. The USD’s depreciation should help the XAU/USD to hit new highs.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The greenback showed overbought signs in the short term even if the US reported positive economic data in the last days. Yesterday, the Unemployment Claims, Building Permits, and Housing Starts came in better than expected, while the retail sales data beat expectations on Tuesday.

Today, the price of gold also targets new highs after the United Kingdom Retail Sales reported a 3.2% drop versus the 0.5% drop estimated and after the 1.4% growth in the previous reporting period. Still, I believe only the US and Canadian economic data should have a big impact today and could change the sentiment.

The Canadian Retail Sales indicator may report a 0.0% growth, while the Core Retail Sales could announce a 0.1% growth. Furthermore, the US Prelim UoM Consumer Sentiment could jump from 69.7 to 69.8 points, while Existing Home Sales is expected at 3.83M, above 3.82M in the previous reporting period.

Gold Price Technical Analysis: Leg Higher

Technically, the XAU/USD reached the former high of $2,029, and it is trying to take it out. The upside pressure is high after jumping and stabilizing above the S1 (2,020) and most importantly, beyond the ascending pitchfork’s inside sliding line (sl).

–Are you interested to learn about forex robots? Check our detailed guide-

The bias is bullish as long as it stays above this broken dynamic resistance. Still, only a new higher high, jumping and closing above $2,032 confirms an upside continuation. The weekly pivot point of $2,041 and the median line (ml) are upside targets.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/19/gold-price-challenging-2029-resistance-focus-on-us-data/

- :is

- 1

- 2%

- 7

- 8

- a

- About

- above

- Accounts

- After

- also

- an

- analysis

- and

- Announce

- ARE

- AS

- At

- beat

- believe

- Better

- Beyond

- bias

- Big

- Broken

- Building

- Bullish

- came

- CAN

- Canadian

- Canadian Retail Sales

- CFDs

- challenging

- change

- check

- claims

- closing

- Consider

- consumer

- consumer sentiment

- continuation

- Core

- could

- data

- Days

- depreciation

- detailed

- determined

- Dollar

- Drop

- dynamic

- Economic

- estimated

- Even

- existing

- expectations

- expected

- extend

- Figures

- Focus

- forex

- Former

- from

- further

- Furthermore

- Gold

- gold price

- Greenback

- Growth

- Have

- help

- High

- higher

- Highs

- Hit

- Home

- housing

- HTTPS

- i

- if

- Impact

- importantly

- in

- Indicator

- inside

- interested

- Invest

- investor

- IT

- ITS

- jump

- Kingdom

- Last

- LEARN

- Line

- Long

- LOOKS

- lose

- losing

- max-width

- May..

- metal

- ML

- money

- more

- most

- New

- now

- of

- on

- only

- Options

- our

- out

- period

- permits

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- Point

- points

- positive

- pressure

- previous

- price

- provider

- reached

- report

- Reported

- Reporting

- Resistance

- resume

- retail

- Retail Sales

- Risk

- sales

- seems

- sentiment

- Short

- should

- showed

- Signs

- sliding

- starts

- Still

- Take

- targets

- Technical

- Technical Analysis

- term

- than

- The

- the United Kingdom

- The Weekly

- this

- time

- to

- today

- trade

- Trading

- trying

- Tuesday

- unemployment

- United

- United Kingdom

- UoM Consumer Sentiment

- Upside

- us

- US Dollar

- Versus

- weekly

- when

- whether

- while

- with

- writing

- XAU/USD

- yesterday

- you

- Your

- zephyrnet