- The bias is bullish in the short term as the DXY is bearish.

- The Eurozone and US economic figures could bring high action today.

- A new lower low activates more declines.

The EUR/USD price retreated slightly in the last hours and is now at 1.0575. Despite positive US data, it rose as the US dollar slipped lower. In the short term, the bias is bullish, but an upside continuation is far from being confirmed.

–Are you interested in learning more about STP brokers? Check our detailed guide-

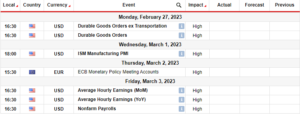

Yesterday, the Eurozone ZEW Economic Sentiment came in at 2.3 points versus -7.7 points expected, while the German ZEW Economic Sentiment was reported at -1.1 compared to -9.1 points forecasted.

On the other hand, the US Capacity Utilization Rate, Industrial Production, Retail Sales, and Core Retail Sales reported better than expected figures. Still, the USD ignored the fundamentals.

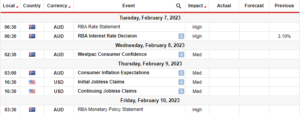

Today, the Eurozone Final CPI may report a 4.3% growth, while the Final Core CPI could announce a 4.5% growth. Later, the United States Building Permits is expected at 1.45M, below 1.54M in the previous reporting period, while Housing Starts may jump to 1.39M from 1.28 M.

In addition, the FOMC members’ speeches could have an impact. Tomorrow, the US Unemployment Claims and the Fed Chair Powell Speaks represent high-impact events.

EUR/USD Price Technical Analysis: Minor Range

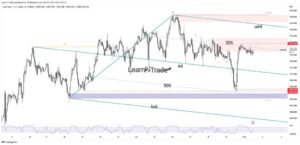

From the technical point of view, the EUR/USD pair is trapped between the 1.0594 and 1.0558 levels. As you can see on the H1 chart, the rate dropped below the lower median line (LML), signaling a downside continuation.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Still, after its sell-off, a rebound was natural. The rate could test and retest the near-term resistance before going down. Probably, a new lower low may announce a deeper drop.

The warning line (wl1) is seen as a potential downside target. Taking out this obstacle activates more declines. On the contrary, a new higher high activates an upside continuation, at least towards the lower median line (LML).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-price-pares-gains-eyes-on-eu-cpi-fomc-speech/

- :is

- 1

- 28

- 54M

- 7

- a

- About

- Accounts

- Action

- addition

- After

- an

- analysis

- and

- Announce

- AS

- At

- bearish

- before

- being

- below

- Better

- between

- bias

- bring

- Building

- Bullish

- but

- came

- CAN

- Capacity

- CFDs

- Chair

- Chart

- check

- claims

- compared

- CONFIRMED

- Consider

- continuation

- contrary

- Core

- could

- CPI

- data

- Declines

- deeper

- Despite

- detailed

- Dollar

- down

- downside

- Drop

- dropped

- Dxy

- Economic

- EU

- EUR/USD

- Eurozone

- events

- expected

- Eyes

- far

- Fed

- Fed Chair

- Fed Chair Powell

- Figures

- final

- FOMC

- forex

- from

- Fundamentals

- Gains

- German

- German ZEW Economic Sentiment

- going

- Growth

- hand

- Have

- High

- higher

- HOURS

- housing

- HTTPS

- Impact

- in

- industrial

- Industrial Production

- interested

- Invest

- investor

- IT

- ITS

- jump

- Last

- later

- learning

- least

- levels

- Line

- lose

- losing

- Low

- lower

- max-width

- May..

- minor

- money

- more

- Natural

- New

- now

- obstacle

- of

- on

- Other

- our

- out

- pair

- period

- permits

- plato

- Plato Data Intelligence

- PlatoData

- Point

- Point of View

- points

- positive

- potential

- Powell

- previous

- price

- probably

- Production

- provider

- Rate

- rebound

- report

- Reported

- Reporting

- represent

- Resistance

- retail

- Retail Sales

- Risk

- ROSE

- sales

- see

- seen

- sell-off

- sentiment

- Short

- should

- Speaks

- speech

- speeches

- starts

- States

- Still

- Take

- taking

- Target

- Technical

- Technical Analysis

- term

- test

- than

- The

- the Fed

- this

- to

- today

- tomorrow

- towards

- trade

- Trading

- unemployment

- United

- United States

- Upside

- us

- US Dollar

- US Unemployment Claims

- USD

- Versus

- View

- warning

- was

- when

- whether

- while

- with

- Yahoo

- you

- Your

- zephyrnet