- Australia experienced a significant surge in employment in August.

- Australia’s jobless rate remained steady at 3.7%, in line with analysts’ forecasts.

- US consumer prices experienced their most significant increase in August in 14 months.

Today’s AUD/USD outlook is bullish amid signs of a robust Australian labor market. In August, Australia experienced a significant surge in employment.

-Are you looking for automated trading? Check our detailed guide-

Moreover, the participation rate reached an all-time high while the unemployment rate remained stable. This trend indicates that despite interest rates at their highest levels in a decade, the tight labor market demand remains strong.

However, the robust employment figures primarily resulted from an increase in part-time positions and haven’t substantially altered the monetary policy outlook. Notably, net employment grew by 64,900 in August, rebounding from a revised upward decline of 1,400 in July. Meanwhile, market expectations had predicted an increase of around 23,000.

On the other hand, the jobless rate remained steady at 3.7%, in line with analysts’ forecasts. Market sentiment suggests that the Reserve Bank of Australia will maintain its current interest rates next month. Still, there is a 40% chance of a final rate hike early next year.

Despite high interest rates, the labor market has displayed remarkable resilience, with a net addition of 410,700 jobs in the 12 months leading up to August.

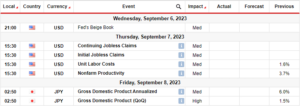

Elsewhere, US consumer price (CPI) data revealed that prices experienced their most significant increase in August in 14 months. This was primarily due to rising energy costs. However, the “core” CPI measure continued its gradual decline towards the Federal Reserve’s 2% annual inflation target.

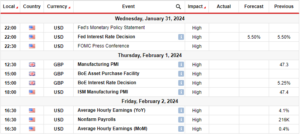

AUD/USD key events today

After Australia’s labor report, investors will now turn their focus to the US, which will release the following:

- The retail sales report.

- The initial jobless claims report.

- The producer price index report.

AUD/USD technical outlook: Bulls struggle to overcome the 0.6440 barrier.

The AUD/USD price has punctured the 0.6440 resistance on the charts before pulling back below. This shows that the level is proving difficult for bulls to break. Still, the bullish bias is strong as the price has made a higher low, and bulls are now looking to make a higher high.

-If you are interested in forex day trading then have a read of our guide to getting started-

Moreover, bulls have pushed off the 30-SMA, which acted as support, while the RSI shows solid bullish momentum above 50. Therefore, bulls might soon break above 0.6440 to revisit the 0.6480 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/aud-usd-outlook-australian-job-growth-skyrockets-in-august/

- :has

- :is

- $UP

- 000

- 1

- 12

- 12 months

- 14

- 2%

- 23

- 400

- 50

- 700

- a

- above

- Accounts

- addition

- altered

- Amid

- an

- and

- annual

- ARE

- around

- AS

- At

- AUD/USD

- AUGUST

- Australia

- Australian

- Automated

- back

- Bank

- barrier

- before

- below

- bias

- Break

- Bullish

- Bulls

- by

- CAN

- CFDs

- Chance

- Charts

- check

- claims

- Consider

- consumer

- continued

- Costs

- CPI

- Current

- data

- day

- decade

- Decline

- Demand

- Despite

- detailed

- difficult

- displayed

- due

- Early

- employment

- energy

- events

- expectations

- experienced

- Federal

- Federal Reserve’s

- Figures

- final

- Focus

- following

- For

- forecasts

- forex

- from

- getting

- gradual

- grew

- Growth

- guide

- had

- hand

- Have

- High

- higher

- highest

- Hike

- However

- HTTPS

- in

- Increase

- index

- indicates

- inflation

- initial

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- ITS

- Job

- jobless claims

- Jobs

- July

- Key

- labor

- labor market

- leading

- Level

- levels

- Line

- looking

- lose

- losing

- Low

- made

- maintain

- make

- Market

- market sentiment

- max-width

- Meanwhile

- measure

- might

- Momentum

- Monetary

- Monetary Policy

- money

- Month

- months

- most

- net

- next

- notably

- now

- of

- off

- on

- Other

- our

- Outlook

- Overcome

- participation

- plato

- Plato Data Intelligence

- PlatoData

- policy

- positions

- predicted

- price

- Prices

- primarily

- producer

- provider

- proving

- pulling

- pushed

- Rate

- Rate Hike

- Rates

- reached

- Read

- release

- remained

- remains

- remarkable

- report

- Reserve

- reserve bank

- reserve bank of australia

- reserves

- resilience

- Resistance

- resulted

- retail

- Retail Sales

- Revealed

- rising

- Risk

- robust

- rsi

- sales

- sentiment

- should

- Shows

- significant

- Signs

- Skyrockets

- solid

- Soon

- stable

- steady

- Still

- strong

- Struggle

- substantially

- Suggests

- support

- surge

- Take

- Target

- Technical

- that

- The

- their

- then

- There.

- therefore

- this

- to

- towards

- trade

- Trading

- Trend

- TURN

- unemployment

- unemployment rate

- upward

- us

- was

- when

- whether

- which

- while

- will

- with

- Yahoo

- year

- you

- Your

- zephyrnet