- Traders will pay close attention to Fed Chair Jerome Powell’s news conference.

- Australian retail sales experienced their greatest decline in more than two years.

- The anticipated peak for the Reserve Bank of Australia’s cash rates dropped from 3.8% to 3.7%.

Today’s AUD/USD forecast is bullish. Before Wednesday’s highly anticipated Federal Reserve policy decision, the dollar was largely weaker than a basket of major currencies.

–Are you interested in learning more about forex robots? Check our detailed guide-

The market is almost confident that interest rates will climb by 25 basis points (bps) later on Wednesday, following a series of big rate hikes in 2022 to control inflation. However, traders will pay close attention to Fed Chair Jerome Powell’s news conference as they try to predict how long the Fed will likely remain hawkish.

As a result of sky-high inflation and rising borrowing prices, Australian retail sales experienced their greatest decline in more than two years in December. This economic shock may reduce the need for additional policy tightening.

According to Australian Bureau of Statistics statistics on Tuesday, retail sales decreased 3.9% in December from November after seeing gains for the previous 11 months. This suggests that rate hikes have been functioning as expected.

That was also the largest decline since August 2020, when the COVID-19 outbreak had parts of the nation on lockdown.

Investors responded by driving the Australian dollar from $0.7060 before the data to $0.7046 and lowering the anticipated peak for the Reserve Bank of Australia’s cash rates from 3.8% to 3.7%.

Inflation is already running at a 32-year high of 7.8%, with the trimmed mean, a closely monitored indicator of core inflation, rising to 6.9%.

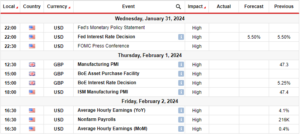

AUD/USD key events today

Investors will closely monitor US data releases, such as job reports, PMI data, and the FOMC meeting. These are probably going to increase the pair’s volatility significantly.

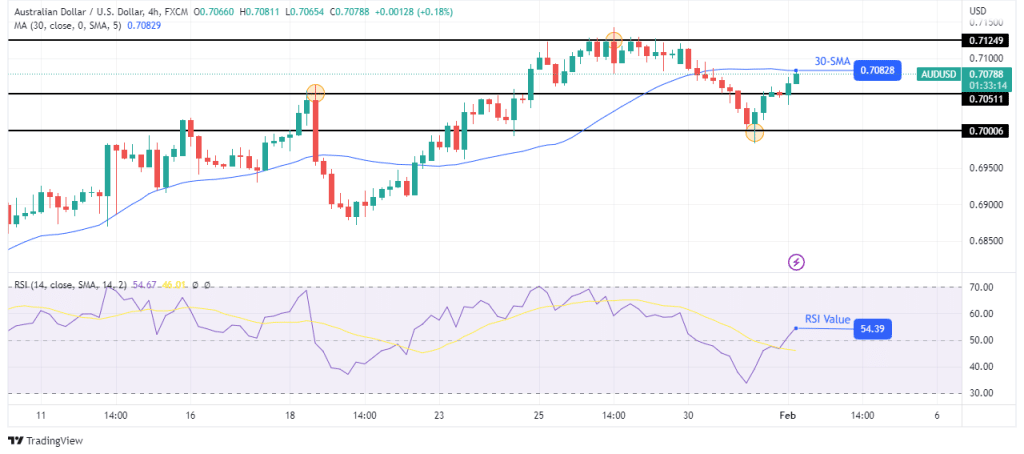

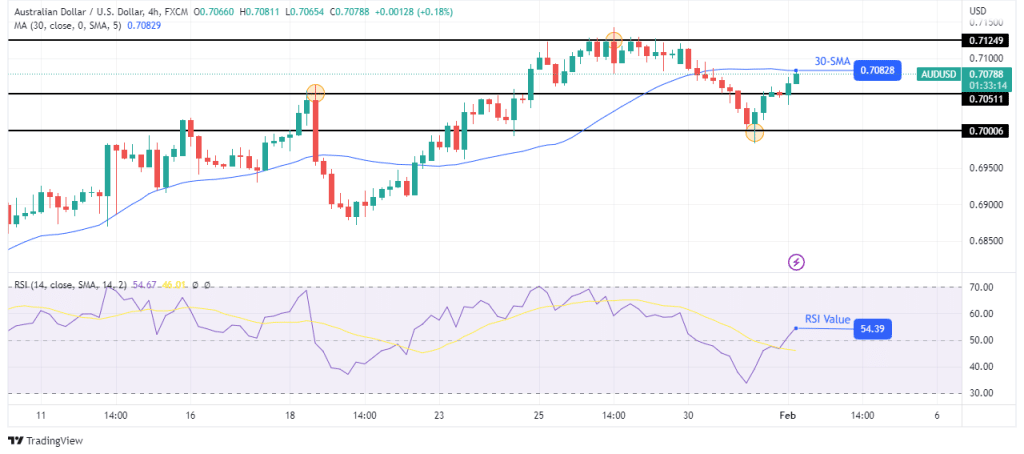

AUD/USD technical forecast: Strong bullish momentum below the 30-SMA

The 4-hour chart shows AUD/USD trading slightly below the 30-SMA while the RSI trades above 50. The RSI favors strong bullish momentum, which could see the price go above the 30-SMA.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

This move comes after the price found support at the 0.7000 level and broke above the 0.7051 resistance level. The bullish move will reverse if the SMA holds as resistance. However, if bulls are strong enough, we might see the price break above the SMA and retest the 0.7124 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/aud-usd-forecast-australian-retail-sales-nosedive-in-december/

- 1

- 11

- 2020

- 2022

- 7

- a

- About

- above

- Accounts

- Additional

- African

- After

- ahead

- already

- and

- Anticipated

- attention

- AUD/USD

- AUGUST

- Australia

- Australian

- Australian dollar

- Australian Retail Sales

- Bank

- basis

- basket

- before

- below

- Big

- Borrowing

- Break

- Broke

- Bullish

- Bulls

- Bureau

- Cash

- CFDs

- Chair

- Chart

- check

- climb

- Close

- closely

- Conference

- confident

- Consider

- Container

- control

- control inflation

- Core

- core inflation

- could

- COVID-19

- currencies

- data

- December

- decision

- Decline

- detailed

- Dollar

- driving

- dropped

- Economic

- enough

- events

- expected

- experienced

- favors

- Fed

- Fed Chair

- Fed Chair Jerome Powell

- Federal

- federal reserve

- following

- FOMC

- Forecast

- forex

- found

- from

- functioning

- Gains

- Go

- going

- greatest

- Hawkish

- High

- highly

- Hikes

- holds

- How

- However

- HTTPS

- in

- Increase

- Indicator

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- jerome powell

- Job

- Key

- largely

- largest

- learning

- Level

- likely

- lockdown

- Long

- lose

- losing

- major

- Market

- max-width

- meeting

- might

- Momentum

- money

- Monitor

- monitored

- months

- more

- move

- nation

- Need

- news

- November

- outbreak

- parts

- Pay

- Peak

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- policy

- Powell

- Powell’s

- predict

- previous

- price

- Prices

- probably

- provider

- Rate

- rate hikes

- Rates

- reduce

- Releases

- remain

- Reports

- Reserve

- reserve bank

- reserve bank of australia

- Resistance

- result

- retail

- Retail Sales

- reverse

- rising

- Risk

- robots

- ROW

- rsi

- running

- sales

- seeing

- Series

- should

- Shows

- significantly

- since

- SMA

- statistics

- strong

- such

- Suggests

- supply

- support

- SVG

- Take

- Technical

- Testing

- The

- the Fed

- their

- tightening

- to

- today’s

- trade

- Traders

- trades

- Trading

- Tuesday

- us

- Volatility

- Wednesday

- whether

- which

- while

- will

- years

- Your

- zephyrnet