- The ECB will announce its policy on Thursday.

- If the ECB maintains its hawkish stance, the euro will likely strengthen.

- There was a rise in US consumer confidence to a two-year high in July.

Today’s EUR/USD forecast is slightly bullish. The ECB will announce its policy on Thursday, supporting the euro. While a quarter-point hike is widely expected, concerns about a potential economic slowdown have raised doubts about another hike by year-end. The euro experienced an increase after hitting a two-week low on Tuesday.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

If the ECB maintains its hawkish stance, the euro will likely strengthen throughout the week. On the other hand, the dollar fell slightly but remained close to the two-week high reached on Tuesday. Money market traders view a quarter-point hike from the Federal Reserve later on Wednesday as highly probable. Still, they are more evenly divided on the odds of another hike later in the year.

The dollar index has been recovering from a 15-month low of 99.549 a week ago. Despite the Fed’s steep series of interest rate increases, it has received support from indications of a robust US economy.

Moreover, recent data showed a rise in US consumer confidence to a two-year high in July, attributed to a tight labor market and decreasing inflation. However, the economy still faces challenges, with mixed signals from the Tuesday survey by the Conference Board.

Notably, the Conference Board’s consumer confidence index surged to 117, marking its highest reading since July 2021, up from 110.1 in June. Economists surveyed by Reuters had anticipated the index to rise to 111.8.

However, consumers remain concerned about a potential recession in the next year following substantial interest rate hikes by the Federal Reserve.

EUR/USD key events today

All focus for EUR/USD traders will be on the FOMC policy meeting. Investors will mainly focus on the messaging after the policy decision for clues on future moves.

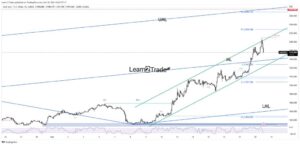

EUR/USD technical forecast: Bulls approach a solid resistance zone.

On the charts, the EUR/USD has rebounded and is approaching the 1.1105 resistance level. However, bears are still in control. This is because the price trades under the 30-SMA while the RSI is under 50, showing strong bearish momentum.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

The current rebound might retest 1.1105 and the 30-SMA resistance, where bears will be waiting. If this resistance zone holds firm, EUR/USD will likely plunge to the 1.1005 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-forecast-bulls-sustain-above-1-1050-eying-fed-ecb/

- :has

- :is

- :where

- $UP

- 1

- 110

- 167

- 2021

- 30

- 300

- 50

- 8

- a

- About

- above

- Accounts

- After

- ago

- an

- analysis

- and

- Announce

- Another

- Anticipated

- approach

- approaching

- ARE

- AS

- At

- Australian

- Australian Inflation

- BE

- bearish

- Bearish Momentum

- Bears

- because

- been

- board

- brokers

- Bullish

- Bulls

- but

- by

- CAN

- Canadian

- CFDs

- challenges

- Charts

- check

- Close

- concerned

- Concerns

- Conference

- conference board

- confidence

- Confidence Index

- Consider

- consumer

- Consumers

- Container

- control

- Current

- data

- decision

- Despite

- detailed

- divided

- Dollar

- dollar index

- ECB

- Economic

- economists

- economy

- EUR/USD

- Euro

- evenly

- events

- expected

- experienced

- Eyes

- faces

- Fed

- Federal

- federal reserve

- Firm

- Focus

- following

- FOMC

- FOMC policy meeting

- For

- Forecast

- forex

- Forex Brokers

- from

- future

- had

- hand

- Have

- Hawkish

- High

- highest

- highly

- Hike

- Hikes

- hitting

- holds

- However

- HTTPS

- if

- in

- Increase

- Increases

- index

- indications

- inflation

- interest

- INTEREST RATE

- INTEREST RATE HIKES

- interested

- Invest

- investor

- Investors

- IT

- ITS

- July

- june

- Key

- labor

- labor market

- later

- learning

- Level

- likely

- lose

- losing

- Low

- lower

- mainly

- maintains

- Market

- marking

- max-width

- meeting

- messaging

- might

- mixed

- Momentum

- money

- money market

- more

- moves

- my

- next

- now

- Odds

- of

- on

- Other

- our

- plato

- Plato Data Intelligence

- PlatoData

- plunge

- policy

- potential

- price

- Price Analysis

- provider

- raised

- Rate

- rate hikes

- reached

- Reading

- rebound

- received

- recent

- recession

- recovering

- remain

- remained

- Reserve

- Resistance

- retail

- Reuters

- Rise

- Risk

- robust

- ROW

- rsi

- Series

- should

- showed

- showing

- signals

- since

- Slowdown

- solid

- Still

- Strengthen

- strong

- substantial

- support

- support level

- Supporting

- Surged

- Survey

- surveyed

- SVG

- Take

- Technical

- The

- There.

- they

- this

- throughout

- thursday

- to

- today’s

- trade

- Traders

- trades

- Trading

- Tuesday

- under

- us

- US economy

- View

- Waiting

- was

- Wednesday

- week

- when

- whether

- while

- widely

- will

- with

- year

- you

- Your

- zephyrnet