- British inflation hit an annual rate of 3.9% in October, marking a two-year low.

- Investors have fully priced in a Bank of England rate cut by May 2024.

- Analysts anticipate an easing in Friday’s US core personal consumption expenditure.

The GBP/USD forecast maintained its bearish outlook on Thursday as the pair grappled with losses ahead of highly anticipated US GDP figures. Wednesday witnessed a notable plunge in the currency, marking its most substantial drop in two months. This downturn resulted from British inflation figures, which fell below expectations.

–Are you interested to learn more about forex options trading? Check our detailed guide-

British inflation hit an annual rate of 3.9% in October, marking a two-year low. Consequently, traders factored in potential Bank of England rate cuts as early as May.

Notably, the annual increase in consumer prices dropped, reaching its lowest level since September 2021. Moreover, investors have fully priced in a Bank of England rate cut by May 2024 and now perceive a nearly 50% likelihood of a cut by March.

Vassili Serebriakov from UBS noted that several banks had observed a front-loading of pricing for interest rate cuts. Furthermore, he mentioned that the Bank of England was slightly lagging due to higher inflation but is now aligning its direction with others.

Serebriakov also noted that the pound had experienced positive momentum recently. Therefore, the current trend represents a reversal of some of those previous movements.

Meanwhile, analysts anticipate a similar easing in Friday’s US core personal consumption expenditure data. They believe the annual inflation rate will slow to 3.3%, its lowest since 2021. There were also expectations of further dollar weakening amid projections of 150 basis points of Federal Reserve cuts in 2024. However, investors remained cautious, temporarily preventing additional dollar selling.

GBP/USD key events today

- Final US GDP q/q

- US unemployment claims

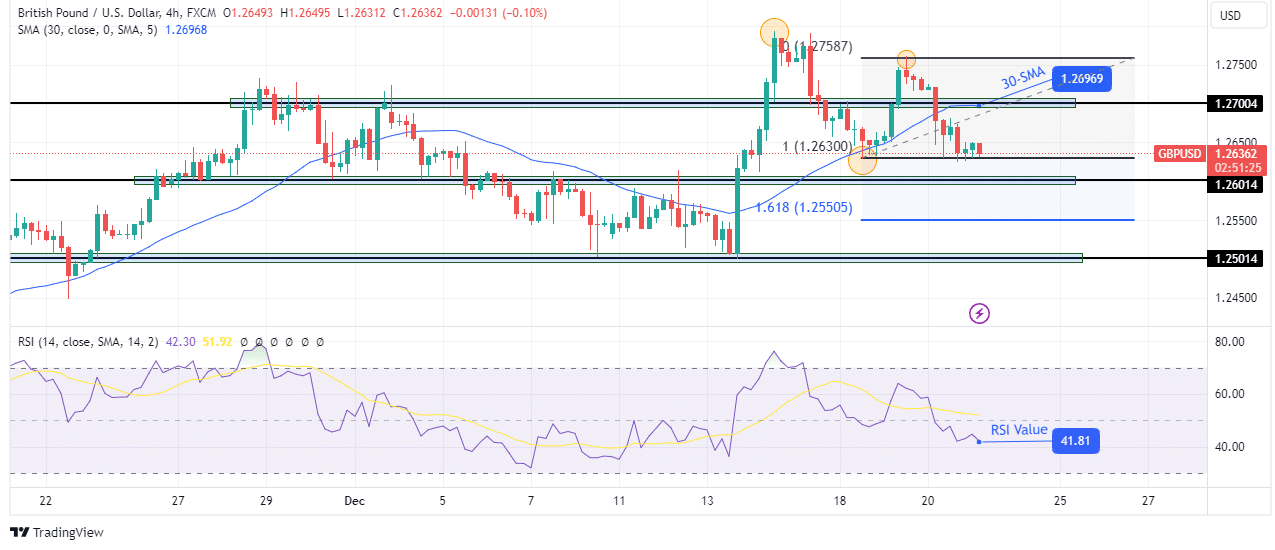

GBP/USD technical forecast: Price is poised for a lower low

On the technical side, the pound is on the verge of breaking below strong support to make a lower low. This would further confirm the new bearish direction. The trend recently changed when the price broke below the 30-SMA, and the RSI dipped into bearish territory below 50.

–Are you interested to learn more about forex tools? Check our detailed guide-

This came after bulls weakened and failed to make a higher high. Instead, the price made a lower high and could soon make a lower low. Furthermore, a continuation of the downtrend would likely lead to a break below the 1.2601 support level. The target for bears is at the 1.618 fib extension level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/21/gbp-usd-forecast-pound-nurses-losses-ahead-of-us-gdp/

- :is

- 1

- 150

- 2021

- 2024

- 50

- a

- About

- Accounts

- Additional

- After

- ahead

- aligning

- also

- Amid

- an

- Analysts

- and

- annual

- anticipate

- Anticipated

- AS

- At

- Bank

- Bank of England

- Banks

- basis

- bearish

- Bears

- believe

- below

- Break

- Breaking

- British

- Broke

- Bulls

- but

- by

- came

- CAN

- cautious

- CFDs

- changed

- check

- Confirm

- Consequently

- Consider

- consumer

- consumption

- continuation

- Core

- could

- Currency

- Current

- Cut

- cuts

- data

- detailed

- direction

- Dollar

- DOWNTURN

- Drop

- dropped

- due

- Early

- easing

- England

- events

- expectations

- experienced

- extension

- factored

- Failed

- Federal

- federal reserve

- Figures

- For

- Forecast

- forex

- from

- fully

- further

- Furthermore

- GBP/USD

- GDP

- had

- Have

- he

- High

- higher

- highly

- Hit

- However

- HTTPS

- in

- Increase

- inflation

- inflation figures

- inflation rate

- instead

- interest

- INTEREST RATE

- interested

- into

- Invest

- investor

- Investors

- ITS

- Key

- lagging

- lead

- LEARN

- Level

- likelihood

- likely

- lose

- losing

- losses

- Low

- lower

- lowest

- lowest level

- made

- make

- March

- marking

- max-width

- May 2024

- May..

- mentioned

- Momentum

- money

- months

- more

- Moreover

- most

- movements

- nearly

- New

- notable

- noted

- now

- observed

- october

- of

- on

- Options

- Others

- our

- Outlook

- pair

- personal

- plato

- Plato Data Intelligence

- PlatoData

- plunge

- points

- poised

- positive

- potential

- pound

- preventing

- previous

- price

- Prices

- pricing

- projections

- provider

- Rate

- reaching

- recently

- remained

- represents

- Reserve

- resulted

- retail

- Reversal

- Risk

- rsi

- Selling

- September

- several

- should

- side

- similar

- since

- slow

- some

- Soon

- strong

- substantial

- support

- support level

- Take

- Target

- Technical

- territory

- that

- The

- therefore

- they

- this

- those

- thursday

- to

- trade

- Traders

- Trading

- Trend

- two

- ubs

- unemployment

- us

- US GDP

- verge

- was

- Wednesday

- were

- when

- whether

- which

- will

- with

- witnessed

- would

- you

- Your

- zephyrnet