- The US dollar is on track for a monthly loss.

- Preliminary data indicated a contraction in Canada’s economy in June.

- US inflation rose at the slowest pace in more than two years in June.

Today’s USD/CAD outlook is slightly bearish. The US dollar was on track for a monthly loss. The prospect of the Fed’s aggressive rate-hike cycle potentially concluding with last week’s 25-basis-point increase weighed the currency’s strength.

-Are you looking for the best CFD broker? Check our detailed guide-

Meanwhile, the Canadian dollar fell against the US dollar as preliminary data on Friday indicated a contraction in the domestic economy in June. Consequently, there are concerns that higher borrowing costs might be slowing economic activity.

Notably, Canada’s economy had grown by 0.3% in May. Still, it likely contracted by 0.2% in June, indicating a slowdown. This could lead to the conclusion of the Bank of Canada’s monetary tightening campaign, which had pushed interest rates to a 22-year high.

According to Karl Schamotta, the chief market strategist at Corpay, the data indicates that the underlying momentum is weakening as higher borrowing costs take effect.

In contrast, separate data showed that annual US inflation rose at the slowest pace in more than two years in June. If this trend continues, the Federal Reserve could be closer to ending its rapid interest rate hiking cycle. The cycle has been the fastest since the 1980s.

The hope of a soft landing for the US economy boosted Wall Street and the oil price on Friday. US crude oil futures settled 0.6% higher at $80.58 a barrel.

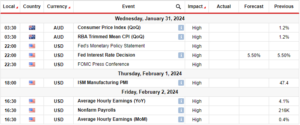

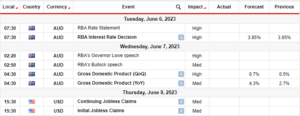

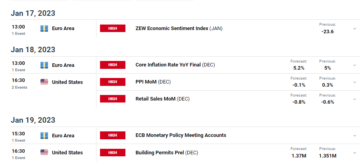

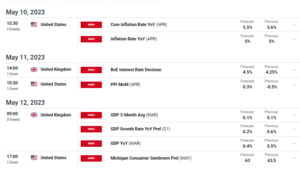

USD/CAD key events today

Given the absence of significant economic reports or data releases from both the United States and Canada, it is highly probable that the pair will enter a period of consolidation.

USD/CAD technical outlook: Bulls paving the way for upside potential.

On the charts, USD/CAD has broken above its range area. The pair has been consolidating with support at 1.3150 and resistance at 1.3225. However, the bulls have finally breached the range resistance. Bulls will likely head for the next hurdle at 1.3300 if the price stays above the resistance.

-If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

However, this could be a false breakout. If so, bears will return to push the price back below 1.3225, returning it into the consolidation area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/usd-cad-outlook-heading-to-monthly-loss-on-end-to-fed-hikes/

- :has

- :is

- 1

- 167

- 2%

- 30

- a

- above

- Accounts

- activity

- against

- aggressive

- and

- annual

- ARE

- AREA

- AS

- At

- back

- Bank

- BE

- bearish

- Bears

- been

- below

- BEST

- Boosted

- Borrowing

- both

- breakout

- Broken

- brokers

- Bulls

- by

- Campaign

- CAN

- Canada

- Canadian

- Canadian Dollar

- CFDs

- Charts

- check

- chief

- closer

- Concerns

- conclusion

- Consequently

- Consider

- consolidating

- consolidation

- Container

- continues

- contraction

- contrast

- Costs

- could

- crude

- Crude oil

- cycle

- data

- detailed

- Dollar

- Domestic

- Economic

- economy

- effect

- end

- Enter

- events

- false

- fastest

- Fed

- fed hikes

- Federal

- federal reserve

- Finally

- For

- forex

- Forex Brokers

- Friday

- from

- Futures

- grown

- had

- Have

- head

- Heading

- High

- higher

- highly

- Hikes

- hiking

- hope

- However

- HTTPS

- if

- in

- Increase

- indicated

- indicates

- indicating

- inflation

- interest

- INTEREST RATE

- Interest Rates

- interested

- into

- Invest

- investor

- IT

- ITS

- june

- karl

- Key

- landing

- Last

- lead

- likely

- looking

- lose

- losing

- loss

- Market

- max-width

- May..

- might

- Momentum

- Monetary

- monetary tightening

- money

- monthly

- more

- next

- now

- of

- Oil

- oil price

- on

- or

- our

- Outlook

- Pace

- pair

- Paving

- period

- plato

- Plato Data Intelligence

- PlatoData

- potential

- potentially

- price

- prospect

- provider

- Push

- pushed

- range

- rapid

- Rate

- Rates

- Releases

- Reports

- Reserve

- Resistance

- retail

- return

- returning

- Risk

- ROSE

- ROW

- separate

- Settled

- should

- showed

- significant

- since

- Slowdown

- Slowing

- So

- Soft

- States

- Still

- Strategist

- street

- strength

- support

- SVG

- Take

- Technical

- than

- that

- The

- There.

- this

- tightening

- to

- track

- trade

- Trading

- Trend

- two

- underlying

- United

- United States

- Upside

- us

- US Dollar

- US economy

- us inflation

- USD/CAD

- Wall

- Wall Street

- was

- Way..

- when

- whether

- which

- will

- with

- years

- you

- Your

- zephyrnet