- Data revealed an acceleration in US job growth in November.

- There was a drop in the unemployment rate to 3.7%.

- There is speculation that the Bank of Japan might be nearing the end of its ultra-low interest rates policy.

An optimistic USD/JPY forecast set the tone for a bullish journey, fueled by the dollar’s promising start to the week. All eyes were fixed on the US inflation data and the Federal Reserve’s year-end policy meeting.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

The dollar strengthened on Friday after data revealed an acceleration in US job growth in November and a drop in the unemployment rate to 3.7%. Consequently, the report challenged expectations of looming Fed rate cuts in the early months of next year.

Moreover, the dollar rebounded against the yen, surpassing 145 yen, reversing some of its significant decline against the Japanese currency from last week. Last week, there was speculation that the Bank of Japan might be nearing the end of its ultra-low interest rates policy.

Bank of Japan Governor Kazuo Ueda indicated Thursday that the central bank would closely assess domestic demand strength and next year’s wage outlook when determining monetary policy.

The meeting between Ueda and Prime Minister Fumio Kishida was a routine exchange held quarterly. However, it came amid rising market expectations that the BOJ would soon exit years of ultra-low interest rates.

Furthermore, on Wednesday, Deputy Governor Ryozo Himino remarked on the potential economic impact of an exit from ultra-loose monetary policy. Inflation has consistently exceeded the BOJ’s 2% target for over a year. As a result, many market participants anticipate the gradual phasing out of the massive stimulus next year.

USD/JPY key events today

No high-impact events are coming from the US or Japan today. Therefore, traders will keep digesting the NFP report.

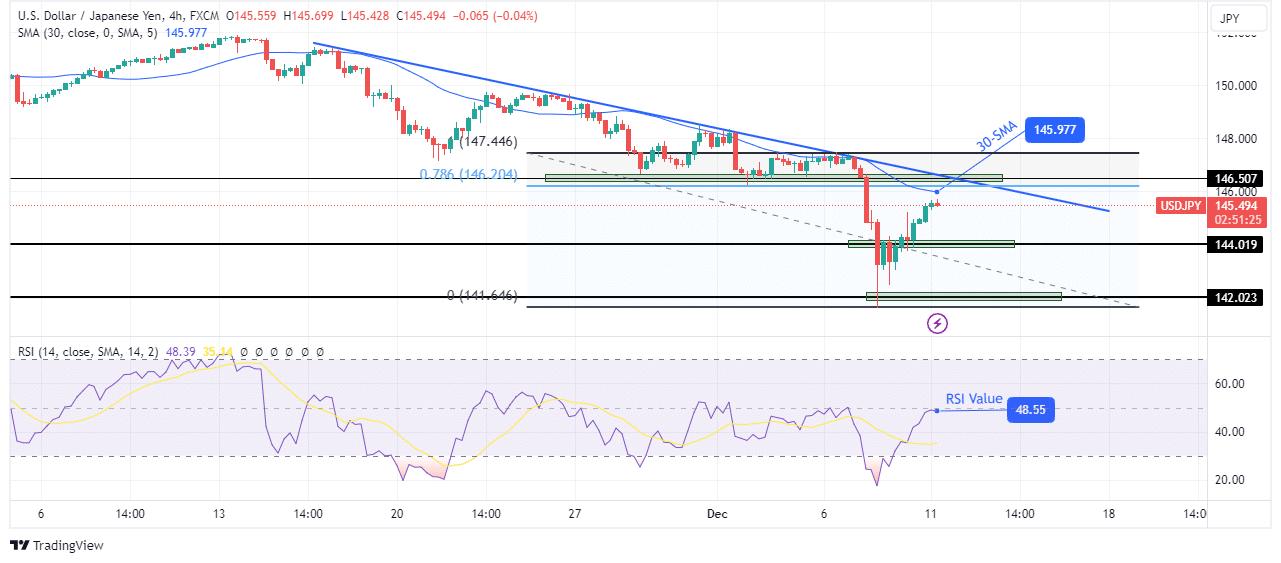

USD/JPY technical forecast: Strong resistance zone threatens recovery

The bias for USD/JPY on the charts is bearish. However, there has been a big recovery from last week’s collapse. The price fell and touched the 142.02 support before rebounding. Moreover, buyers have retraced more than 50% of the recent collapse, and the price is approaching the 30-SMA resistance.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Additionally, there is resistance from the 146.50 key level, the 0.786 fib retracement level, and the decline’s resistance trendline. All these levels form a strong resistance zone that will likely stop the bullish move. Therefore, the downtrend will resume if bears return to this resistance zone.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/11/usd-jpy-forecast-dollar-recovers-ahead-of-inflation-fed/

- :has

- :is

- 1

- 2%

- 50

- a

- About

- acceleration

- Accounts

- After

- against

- ahead

- All

- Amid

- an

- and

- anticipate

- approaching

- ARE

- AS

- assess

- At

- Bank

- bank of japan

- BE

- bearish

- Bears

- been

- before

- between

- bias

- Big

- boj

- Bullish

- buyers

- by

- came

- CAN

- central

- Central Bank

- CFDs

- challenged

- Charts

- check

- closely

- Collapse

- coming

- Consequently

- Consider

- consistently

- Currency

- cuts

- data

- Decline

- Demand

- deputy

- detailed

- determining

- Dollar

- Domestic

- Drop

- Early

- Economic

- Economic Impact

- end

- events

- exceeded

- exchange

- Exit

- expectations

- Eyes

- Fed

- Federal

- Federal Reserve’s

- fixed

- For

- Forecast

- forex

- form

- Friday

- from

- fueled

- Governor

- gradual

- Growth

- Have

- Held

- High

- However

- HTTPS

- if

- Impact

- in

- indicated

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- IT

- ITS

- Japan

- Japanese

- Job

- journey

- Keep

- Key

- Last

- LEARN

- Level

- levels

- likely

- looming

- lose

- losing

- many

- Market

- massive

- max-width

- meeting

- might

- minister

- Monetary

- Monetary Policy

- money

- months

- more

- Moreover

- move

- nearing

- next

- nfp

- November

- now

- of

- on

- Optimistic

- or

- our

- out

- Outlook

- over

- participants

- plato

- Plato Data Intelligence

- PlatoData

- policy

- potential

- price

- Prime

- prime minister

- promising

- provider

- Rate

- Rates

- recent

- Recovers

- recovery

- remarked

- report

- reserves

- Resistance

- result

- resume

- retail

- retracement

- return

- Revealed

- rising

- Risk

- routine

- set

- should

- significant

- some

- Soon

- speculation

- start

- stimulus

- Stop

- strength

- strengthened

- strong

- support

- surpassing

- Take

- Target

- Technical

- than

- that

- The

- There.

- therefore

- These

- this

- threatens

- thursday

- to

- today

- TONE

- touched

- trade

- Traders

- Trading

- unemployment

- unemployment rate

- us

- us inflation

- USD/JPY

- wage

- was

- Wednesday

- week

- were

- when

- whether

- will

- with

- would

- year

- years

- Yen

- you

- Your

- zephyrnet