- Investors’ desire for riskier assets increased due to China’s reopening.

- Fed policymakers agreed to reduce the speed of its brisk interest rate increases.

- US manufacturing activity shrank in December, showing the effects of higher interest rates.

Today’s GBP/USD outlook is slightly bearish. Despite the Federal Reserve’s continued hawkish stance, the dollar made very small gains on Thursday as investors’ desire for riskier assets increased due to China’s reopening.

-Are you looking for automated trading? Check our detailed guide-

At the Federal Reserve’s policy meeting on December 13–14, all participants agreed that the American central bank should reduce the pace of its brisk interest rate increases.

The meeting’s minutes, which were made public on Wednesday, revealed that officials remained committed to slowing the rate of price increases that threatened to accelerate faster than expected and were concerned about any “misperception” in the financial markets that the Fed’s commitment was wavering.

However, policymakers admitted that they had made “substantial progress” in hiking rates sufficiently to reduce inflation during the previous year. Therefore, the central bank now had to strike a compromise between the risks of drastically slowing the economy and its fight against rising prices.

The U.S. economy is already feeling the effects of the Fed’s rash rate increases last year, as evidenced by the Institute for Supply Management’s (ISM) survey, which revealed that manufacturing activity shrank once more in December.

Neel Kashkari, president of the Minneapolis Fed, anticipated that the policy rate should pause at 5.4% and stated the Federal Reserve should keep raising interest rates at least through its upcoming meetings until it is certain that inflation has peaked.

GBP/USD key events today

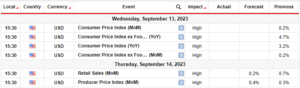

Investors will pay attention to PMI data from the UK and job reports from the US, including the ADP nonfarm payrolls and the initial jobless claims.

GBP/USD technical outlook: Bears stronger, lacking direction

Looking at the 4-hour chart, we see sterling moving sideways with no clear direction. The price is chopping through the 30-SMA and the RSI through 50. A closer look shows that the price currently trades slightly below the 30-SMA and RSI below 50. This is a sign that bears are slightly stronger.

-If you are interested in forex day trading then have a read of our guide to getting started-

If this strength continues, the price will look to take out support levels at 1.2000 and 1.1901. Bulls might also return if bears fail to push lower. This would mean retesting the 1.2109 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-outlook-fed-remains-committed-to-fight-inflation/

- 1

- a

- About

- accelerate

- Accounts

- activity

- admitted

- adp

- against

- All

- already

- American

- and

- Anticipated

- Assets

- attention

- Automated

- Automated Trading

- Bank

- bearish

- Bears

- below

- between

- Bulls

- central

- Central Bank

- certain

- CFDs

- Chart

- check

- China

- Chinas

- chopping

- claims

- clear

- closer

- commitment

- committed

- compromise

- concerned

- Consider

- Container

- continued

- continues

- Currently

- data

- day

- December

- Despite

- detailed

- direction

- Dollar

- drastically

- during

- economy

- effects

- events

- expected

- FAIL

- faster

- Fed

- Federal

- federal reserve

- Federal Reserve’s

- fight

- financial

- Forecast

- forex

- from

- Gains

- GBP/USD

- getting

- guide

- Hawkish

- High

- higher

- hiking

- HTTPS

- in

- Including

- increased

- Increases

- inflation

- inflation has peaked

- initial

- Institute

- interest

- INTEREST RATE

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- Job

- jobless claims

- Keep

- Key

- Last

- Last Year

- levels

- Look

- looking

- lose

- losing

- made

- manufacturing

- Markets

- max-width

- meeting

- meetings

- might

- minutes

- money

- more

- moving

- Nonfarm

- Nonfarm Payrolls

- Outlook

- Pace

- participants

- Pay

- Payrolls

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- policy

- policymakers

- president

- previous

- price

- Prices

- provider

- public

- Push

- raising

- rash

- Rate

- Rates

- Read

- reduce

- remained

- remains

- Reports

- Reserve

- reserves

- Resistance

- retail

- return

- Revealed

- rising

- Risk

- risks

- ROW

- rsi

- should

- Shows

- sideways

- sign

- Slowing

- small

- speed

- stated

- sterling

- strength

- strike

- stronger

- supply

- support

- support levels

- Survey

- SVG

- Take

- Technical

- The

- the UK

- therefore

- Through

- to

- today’s

- trade

- trades

- Trading

- u.s.

- U.S. economy

- Uk

- upcoming

- us

- Wednesday

- whether

- which

- will

- within

- would

- year

- Your

- zephyrnet