Giá Bitcoin is experiencing a pullback as this content is being typed. But after last night’s close in the DXY Dollar Currency Index, the top cryptocurrency could be cleared for liftoff.

The dollar lost a key level that in the past that led to some of the largest rallies in BTC history.

Correlations Between Crypto And Fiat Currency

Correlation is commonly found to some degree across almost all assets. It is rare that two assets show no correlation, and instead tend to exhibit strong and weak, positive and negative correlations.

Technical analysts or investors look at asset correlations for diversification purposes, and to reduce risk in a portfolio. For example, a crypto-heavy portfolio wouldn’t benefit much from adding tech stocks due to a strong correlation. It could even increase risk as an entire portfolio draws down at once.

Few assets are as negatively correlated as Bitcoin versus the dollar. This is because the most dominant trading pairs feature both BTC and USD. In the trading pair BTCUSD, BTC is the base currency, and USD là đồng tiền định giá.

This is precisely why the DXY Dollar Currency Index losing a key level could have a dramatic impact on the price per BTC.

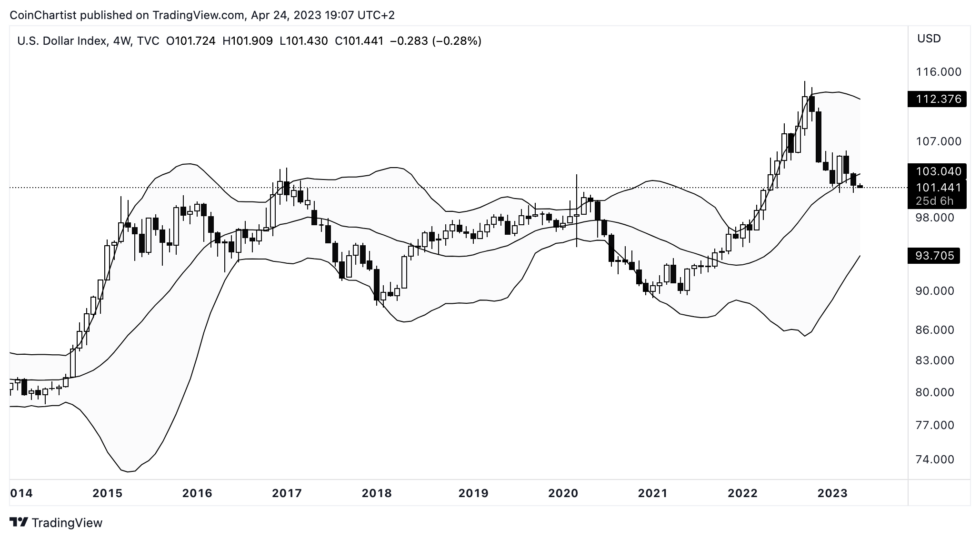

The dollar has lost the middle-Bollinger Band | DXY trên TradingView.com

Why The Dollar Dropping Means Bitcoin Popping

The DXY Dollar Currency Index is a weighted basket of top currencies from around the globe. None of which are Bitcoin. However, there is no better measure of the strength of the dollar than the DXY.

In phân tích kỹ thuật, higher timeframes produce the most dominant signals. Not all timeframes are treated equally, so experimentation can provide early clues about what’s to come. For example, the 4-week timeframe trims just 2-3 days off each one-month interval. This timeframe yields slightly earlier signals than the monthly.

While the monthly DXY is resting upon the middle Bollinger Band, on the 4-week timeframe the level has already been lost. The last candle close finished below the 20-period SMA, which makes up the basis of the upper and lower bands.

How does this have anything to do with Bitcoin, you ask? When USD was strong in 2022, it crushed BTC on the trading pair. If the dollar is poised to plummet, then the BTC side of the trading pair should soar again. In fact, each time the DXY lost this level, BTCUSD had one of its largest rallies of the past decade.

Sản phẩm $ DXY opened its 4W candle below the mid-BB.

After a close, it commonly moves to the lower Bollinger Band.

Each time this happened, resulted in the biggest, most bullish moves in #Bitcoin trong thập kỷ qua.

But yeah, no new ATHs this year because halving 🙄 pic.twitter.com/i7X0FsfjYN

— Tony “Con bò tót” (@tonythebullBTC) 24 Tháng Tư, 2023

- Phân phối nội dung và PR được hỗ trợ bởi SEO. Được khuếch đại ngay hôm nay.

- Platoblockchain. Web3 Metaverse Intelligence. Khuếch đại kiến thức. Truy cập Tại đây.

- Đúc kết tương lai với Adryenn Ashley. Truy cập Tại đây.

- nguồn: https://bitcoinist.com/dollar-index-loses-key-level-bitcoin-liftoff/

- : có

- :là

- :không phải

- $ LÊN

- 2022

- 500

- 8

- a

- Giới thiệu

- ngang qua

- tư vấn

- Sau

- Tất cả

- Đã

- an

- phân tích

- Các nhà phân tích

- và

- LÀ

- xung quanh

- AS

- tài sản

- Tài sản

- At

- BAND

- cơ sở

- cơ sở

- giỏ

- BE

- bởi vì

- được

- được

- phía dưới

- hưởng lợi

- Hơn

- giữa

- lớn nhất

- Bitcoin

- blockchain

- cả hai

- BTC

- BTCUSD

- bò

- Tăng

- nhưng

- CAN

- Bảng xếp hạng

- Đóng

- Đến

- thông thường

- xem xét

- nội dung

- Tương quan

- có thể

- Crypto

- cryptocurrency

- Loại tiền tệ

- Tiền tệ

- tiền thưởng

- Ngày

- thập kỷ

- Bằng cấp

- đa dạng hóa

- do

- Đô la

- Chỉ số đô la

- có ưu thế

- xuống

- đáng kể

- Rơi

- dxy

- mỗi

- Sớm hơn

- Đầu

- Đào tạo

- Tư vấn Giáo dục

- Toàn bộ

- như nhau

- Ether (ETH)

- Ngay cả

- ví dụ

- Dành riêng

- triển lãm

- trải qua

- Đặc tính

- đặc sắc

- sự đồng ý

- Trong

- tìm thấy

- từ

- toàn cầu

- Giảm một nửa

- đã xảy ra

- Có

- cao hơn

- lịch sử

- Tuy nhiên

- HTTPS

- hình ảnh

- Va chạm

- in

- Tăng lên

- chỉ số

- những hiểu biết

- thay vì

- đầu tư

- Các nhà đầu tư

- IT

- ITS

- chỉ

- Key

- lớn nhất

- Họ

- Led

- Cấp

- Xem

- Mất

- mất

- LÀM CHO

- thị trường

- hiểu biết thị trường

- max-width

- có nghĩa

- đo

- Tên đệm

- hàng tháng

- hầu hết

- di chuyển

- tiêu cực

- tiêu cực

- Mới

- NewsBTC

- of

- on

- ONE

- mot thang

- mở

- or

- kết thúc

- cặp

- qua

- plato

- Thông tin dữ liệu Plato

- PlatoDữ liệu

- xin vui lòng

- Dây chì

- danh mục đầu tư

- tích cực

- Chính xác

- giá

- sản xuất

- cho

- kéo lại

- mục đích

- cuộc biểu tình

- HIẾM HOI

- giảm

- Nguy cơ

- nên

- hiển thị

- tín hiệu

- SMA

- So

- một số

- CỔ PHIẾU

- sức mạnh

- mạnh mẽ

- công nghệ cao

- cổ phiếu công nghệ

- Kỹ thuật

- Phân tích kỹ thuật

- hơn

- việc này

- Sản phẩm

- Đó

- điều này

- năm nay

- thời gian

- khung thời gian

- đến

- Tony

- hàng đầu

- Giao dịch

- cặp giao dịch

- TradingView

- đúng

- Đô la Mỹ

- Versus

- là

- cái nào

- tại sao

- với

- năm

- sản lượng

- bạn

- zephyrnet