- The bias remains bullish after failing to take out the 148.25 obstacle.

- The US inflation figures should move the rate today.

- A valid breakout through the range’s resistance validates further growth.

The USD/JPY price is trading at 149.09 at the time of writing with no clear directional bias. The pair has turned to the upside as the Yen shows weakness.

–Are you interested to learn more about forex options trading? Check our detailed guide-

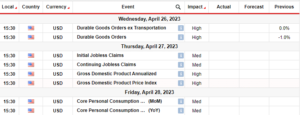

The greenback took the lead versus the JPY even though the Dollar Index was in a corrective phase. The price climbed as much as 149.32 as the US reported positive data yesterday. The PPI rose by 0.5%, beating the 0.3% growth estimated, while the Core PPI surged by 0.3%, exceeding the 0.2% growth expected.

Today, the Japanese data came in worse than expected. The PPI reported a 2.0% growth versus the 2.4% growth estimated. Core Machinery Orders dropped by 0.5% even if the specialists expected a 0.7% growth, while Bank Lending registered only a 2.9% growth less compared to the 3.1% forecasted.

Later, the US data could be decisive. The US CPI m/m may report a 0.3%, CPI y/y is expected at 3.6%, while Core CPI could register a 0.3% growth again.

Lower inflation could weaken the greenback, while higher-than-expected inflation should boost the USD. Furthermore, the Unemployment Claims indicator will be released as well.

USD/JPY Price Technical Analysis: Bullish Bias

The USD/JPY price is trapped between 148.25 and 149.33 levels. Escaping from the formation could bring new opportunities. The false breakdown with great separation below 148.25 announced a potential leg higher and invalidated a larger drop.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Technically, the price action signaled a potential downside reversal in the short term after taking out the uptrend line. False breakouts through the 149.33 may announce a new sell-off within the range pattern. So, the rate could extend its sideways movement. Still, a valid breakout above the range’s resistance activates further growth.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-price-ranging-above-149-0-ahead-of-us-cpi/

- :has

- :is

- 09

- 2%

- 25

- 32

- 33

- a

- About

- above

- Accounts

- Action

- After

- again

- ahead

- analysis

- and

- Announce

- announced

- AS

- At

- Bank

- BE

- below

- between

- bias

- boost

- Breakdown

- breakout

- breakouts

- bring

- Bullish

- by

- came

- CAN

- CFDs

- check

- claims

- clear

- Climbed

- compared

- Consider

- Core

- could

- CPI

- data

- decisive

- detailed

- Dollar

- dollar index

- downside

- Drop

- dropped

- estimated

- Even

- expected

- extend

- failing

- false

- Figures

- forex

- formation

- from

- further

- Furthermore

- great

- Greenback

- Growth

- High

- higher

- HTTPS

- if

- in

- index

- Indicator

- inflation

- inflation figures

- interested

- Invest

- investor

- ITS

- Japanese

- JPY

- larger

- lead

- LEARN

- lending

- less

- levels

- Line

- lose

- losing

- machinery

- max-width

- May..

- money

- more

- move

- movement

- much

- New

- no

- now

- obstacle

- of

- only

- opportunities

- Options

- orders

- our

- out

- pair

- Pattern

- phase

- plato

- Plato Data Intelligence

- PlatoData

- positive

- potential

- ppi

- price

- PRICE ACTION

- provider

- range

- ranging

- Rate

- register

- registered

- released

- remains

- report

- Reported

- Resistance

- retail

- Reversal

- Risk

- ROSE

- sell-off

- Short

- should

- Shows

- sideways

- So

- specialists

- Still

- Surged

- Take

- taking

- Technical

- Technical Analysis

- term

- than

- The

- this

- though?

- Through

- time

- to

- today

- took

- trade

- Trading

- Turned

- unemployment

- Upside

- uptrend

- us

- US CPI

- us inflation

- USD

- USD/JPY

- valid

- validates

- Versus

- was

- weakness

- WELL

- when

- whether

- while

- will

- with

- within

- worse

- writing

- Yahoo

- Yen

- yesterday

- you

- Your

- zephyrnet