- Investors awaited the outcome of the two-day Fed meeting.

- US and Japanese authorities continued to make fresh remarks regarding the potential for currency intervention.

- Market participants regard the 150 level as a crucial threshold for Tokyo.

Today’s USD/JPY forecast is bullish as the dollar strengthens before the FOMC meeting. The dollar was strong on Wednesday as investors awaited the outcome of the two-day Fed meeting. However, the focus remained squarely on the yen as US and Japanese authorities continued to make fresh remarks regarding the potential for currency intervention.

-If you are interested in social trading apps, check our detailed guide-

Masato Kanda, Japan’s chief financial diplomat, reiterated warnings on Wednesday. He emphasized that Japanese authorities constantly communicate with US and international policymakers on currency matters. Moreover, they closely monitor market developments with a “high sense of urgency.”

Meanwhile, US Treasury Secretary Janet Yellen responded to inquiries about whether Washington would support another yen-buying intervention by Japan. She stated that it “depends on the details” of the situation.

Notably, Japan made rare moves into the currency market in September and October of the previous year to bolster the yen. The currency slid and eventually reached a 32-year low of 151.94 against the dollar.

Although the yen has since rebounded from that low, many market participants regard the 150 level as a crucial threshold for Tokyo. If breached, it could trigger another round of intervention. A weaker yen benefits Japanese exporters by boosting their profits. However, it poses challenges for households and retailers as it drives up the costs of importing raw materials and fuel.

Speculation has been growing about a potential earlier-than-expected departure from the Bank of Japan’s ultra-loose policy. However, the central bank will likely maintain ultra-low interest rates on Friday.

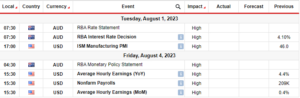

USD/JPY key events today

Investors have all their focus on the FOMC meeting, where they will watch for the following:

- Fed economic projections

- Fed statement

- Fed rate decision

- FOMC press conference.

USD/JPY technical forecast: Bulls overpower resistance at 148.03.

On the charts, the USD/JPY pair is on the verge of breaking above a strong resistance zone and the 148.03 level. The bullish bias is strong but weakened when the price approached the 148.03 key level. Bulls struggled to push the price higher, making small candles. Moreover, the price stayed close to the 30-SMA.

-If you are interested in brokers with Nasdaq, check our detailed guide-

However, bulls have suddenly gained momentum, puncturing the 148.03 resistance level. If the price closes above this level, it might rise higher to take out the 148.51 level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-forecast-dollar-stays-resilient-in-wake-of-fomc/

- :has

- :is

- :where

- $UP

- 1

- 150

- 51

- a

- About

- above

- Accounts

- against

- All

- and

- Another

- ARE

- AS

- At

- Authorities

- Bank

- been

- before

- benefits

- bias

- bolster

- boosting

- Breaking

- Bullish

- Bulls

- but

- by

- CAN

- Candles

- central

- Central Bank

- CFDs

- challenges

- Charts

- check

- chief

- Chief Financial

- Close

- closely

- Closes

- communicate

- Conference

- Consider

- constantly

- continued

- Costs

- could

- crucial

- Currency

- currency intervention

- detailed

- developments

- Dollar

- drives

- Economic

- emphasized

- events

- eventually

- Fed

- fed meeting

- financial

- Focus

- following

- FOMC

- For

- Forecast

- forex

- fresh

- Friday

- from

- Fuel

- gained

- Growing

- Have

- he

- High

- higher

- households

- However

- HTTPS

- if

- importing

- in

- Inquiries

- interest

- Interest Rates

- interested

- International

- intervention

- into

- Invest

- investor

- Investors

- IT

- Japan

- Japan’s

- Japanese

- Key

- Level

- likely

- lose

- losing

- Low

- made

- maintain

- make

- Making

- many

- Market

- materials

- Matters

- max-width

- meeting

- might

- Momentum

- money

- Monitor

- Moreover

- moves

- now

- october

- of

- on

- our

- out

- Outcome

- pair

- participants

- plato

- Plato Data Intelligence

- PlatoData

- policy

- policymakers

- poses

- potential

- press

- previous

- price

- profits

- provider

- Push

- RARE

- Rate

- Rates

- Raw

- reached

- regard

- regarding

- remained

- resilient

- Resistance

- retail

- retailers

- Rise

- Risk

- round

- secretary

- sense

- Sense of Urgency

- September

- she

- should

- since

- situation

- small

- stated

- stayed

- Strengthens

- strong

- support

- Take

- Technical

- that

- The

- their

- they

- this

- threshold

- to

- tokyo

- trade

- Trading

- treasury

- treasury secretary

- trigger

- urgency

- us

- US Treasury

- USD/JPY

- verge

- Wake

- was

- washington

- Watch

- Wednesday

- when

- whether

- will

- with

- would

- Yahoo

- year

- yellen

- Yen

- you

- Your

- zephyrnet