- The bias remains bearish despite the current rebound.

- The US economic figures should bring sharp movements later today.

- Taking out the supply zone may announce a larger rebound.

The gold price rebounded after reaching $1,857 yesterday’s low. Now, it is located at $1,871 at the time of writing.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Still, the downside pressure remains high despite the current rebound. XAU/USD turned to the upside only because the US dollar saw some correction.

The USD lost significant ground versus its rivals as the US Pending Home Sales, Final GDP Price Index and Final GDP came in worse than expected in the last session.

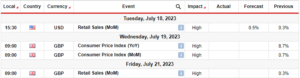

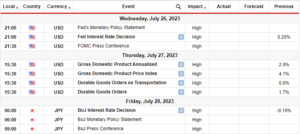

Today, the fundamentals could be decisive, so talking about a larger rebound is premature. Today, the Japanese, UK, and Eurozone data came in mixed.

The Eurozone CPI Flash Estimate reported only a 4.3% growth versus the 4.5% growth forecasted, while the Core CPI Flash Estimate rose by 4.5% less compared to the 4.8% growth expected.

Later, the Canadian GDP could report a 0.1% growth after a 0.2% drop in the previous reporting period.

In addition, the US is to release high-impact data as well. Revised UoM Consumer Sentiment could remain steady at 67.7 points. The Core PCE Price Index may register a 0.2% growth, while the Chicago PMI is expected to drop to 47.5 points from 48.7 points.

The Prelim Wholesale Inventories, Goods Trade Balance, Personal Income, and Personal Spending data will also be published. Poor US figures should help the XAU/USD to jump higher.

Gold Price Technical Analysis: Rebound

XAU/USD found support on the weekly S3 of $1,861, which has now turned to the upside. It has registered only false breakdowns below the S3 and under the 150% Fibonacci line of descending pitchfork.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Now, it challenges the lower median line (LML) after jumping above the channel’s downside line, and it stands right below a strong supply zone. Testing the resistance levels registering only false breakouts may announce a new sell-off. Only invalidating the supply zone and making a new higher high indicates a larger rebound.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gold-price-finds-breather-as-us-dollar-corrects-after-soft-data/

- :has

- :is

- 2%

- 67

- 7

- a

- About

- above

- Accounts

- addition

- After

- also

- analysis

- and

- Announce

- AS

- At

- Balance

- BE

- bearish

- because

- below

- bias

- breakouts

- bring

- by

- came

- CAN

- Canadian

- CFDs

- challenges

- check

- chicago

- Chicago PMI

- compared

- Consider

- consumer

- consumer sentiment

- Core

- could

- CPI

- Current

- data

- decisive

- Despite

- detailed

- Dollar

- downside

- Drop

- Economic

- estimate

- Eurozone

- Eurozone CPI

- expected

- false

- Fibonacci

- Figures

- final

- finds

- Flash

- forex

- found

- from

- Fundamentals

- GDP

- Gold

- gold price

- goods

- Ground

- Growth

- help

- High

- higher

- Home

- HTTPS

- in

- Income

- index

- indicates

- interested

- Invest

- investor

- IT

- ITS

- Japanese

- jump

- larger

- Last

- later

- learning

- less

- levels

- Line

- located

- lose

- losing

- lost

- Low

- lower

- Making

- max-width

- May..

- mixed

- money

- more

- movements

- New

- now

- of

- on

- only

- our

- out

- pce

- pending

- period

- personal

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- poor

- Premature

- pressure

- previous

- price

- provider

- published

- reaching

- rebound

- register

- registered

- registering

- release

- remain

- remains

- report

- Reported

- Reporting

- Resistance

- retail

- right

- Risk

- rivals

- ROSE

- sales

- saw

- sell-off

- sentiment

- session

- sharp

- should

- significant

- So

- Soft

- some

- Spending

- stands

- steady

- strong

- supply

- support

- Take

- talking

- Technical

- Technical Analysis

- Testing

- than

- The

- The Weekly

- this

- time

- to

- today

- trade

- Trading

- Turned

- Uk

- under

- UoM Consumer Sentiment

- Upside

- us

- US Dollar

- USD

- Versus

- weekly

- WELL

- when

- whether

- which

- while

- wholesale

- will

- with

- worse

- writing

- XAU/USD

- Yahoo

- you

- Your

- zephyrnet