- The dollar was on course for its lengthiest weekly winning streak in nine years.

- Robust US economic data cast doubts on the Federal Reserve’s aggressive rate-hike strategy.

- Most economists expect the ECB to maintain interest rates on September 14.

Today’s EUR/USD price analysis is bearish. The dollar was on course for its lengthiest weekly winning streak in nine years on Friday. Meanwhile, the euro, the dollar index’s primary component, faced eight consecutive weeks of losses.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

Robust economic data drove the dollar’s strength. Consequently, investors are questioning the Federal Reserve’s aggressive rate-hike strategy. Dane Cekov, a senior macro and FX strategist at Nordea Markets, remarked, “The focus has returned to the relative disparity between the US and European economies, causing the weakening dollar narrative to fade.”

This week’s data revealed unexpected growth in the US services sector for August. Moreover, the US reported the lowest jobless claims since February. In contrast, in July, there was a slightly larger-than-anticipated decline in industrial production in Germany, the largest European economy.

Cekov from Nordea noted, “While the US economy continues to show strength, the European economy appears to be plateauing. The dollar typically performs well when the US outpaces its counterparts, and currently, the US stands out.”

Elsewhere, most economists surveyed by Reuters expect the European Central Bank to maintain interest rates on September 14. However, just under half anticipate another hike this year to combat inflation.

ECB President Christine Lagarde increased the likelihood of pausing with her July news conference statement, “Do we have more ground to cover? At this point, I wouldn’t say so.”

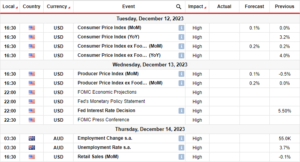

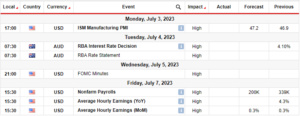

EUR/USD key events today

Investors will absorb data from the busy week as the US and the Eurozone will not release any major reports today.

EUR/USD technical price analysis: Sellers eye a break below 1.0700 support.

The EUR/USD is making another attempt at the 1.0700 support level on the charts. The pair extended the previous downtrend when the price broke below the 1.0775 support level. Now, it has paused at yet another strong support level.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

The indicators on the chart point to a continuation of the downtrend. The 30-SMA is above the price, showing bears are holding the reins. Similarly, the RSI supports sellers as it trades near the oversold region. Therefore, sellers might soon push below the 1,0700 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-price-analysis-heading-for-straight-8-weeks-of-losses/

- :has

- :is

- :not

- 1

- 14

- 8

- a

- About

- above

- Accounts

- aggressive

- analysis

- and

- Another

- anticipate

- any

- ARE

- AS

- At

- AUGUST

- Bank

- BE

- bearish

- Bears

- below

- between

- Break

- Broke

- busy

- by

- CAN

- causing

- central

- Central Bank

- CFDs

- Chart

- Charts

- check

- Christine

- CHRISTINE LAGARDE

- claims

- combat

- component

- Conference

- consecutive

- Consequently

- Consider

- continuation

- continues

- contrast

- course

- cover

- Currently

- data

- Decline

- detailed

- Dollar

- ECB

- Economic

- economies

- economists

- economy

- EUR/USD

- Euro

- European

- European Central Bank

- European economy

- Eurozone

- events

- expect

- eye

- faced

- fade

- February

- Federal

- Federal Reserve’s

- Focus

- For

- forex

- Friday

- from

- FX

- Germany

- Ground

- Growth

- Half

- Have

- Heading

- her

- High

- Hike

- holding

- However

- HTTPS

- i

- in

- increased

- Indicators

- industrial

- Industrial Production

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- ITS

- jobless claims

- July

- just

- Key

- Lagarde

- largest

- LEARN

- Level

- likelihood

- lose

- losing

- losses

- lowest

- Macro

- maintain

- major

- Making

- Markets

- max-width

- Meanwhile

- might

- money

- more

- Moreover

- most

- NARRATIVE

- Near

- news

- Nordea

- noted

- now

- of

- on

- our

- out

- pair

- performs

- plato

- Plato Data Intelligence

- PlatoData

- Point

- president

- previous

- price

- Price Analysis

- primary

- Production

- provider

- Push

- Rates

- region

- reins

- relative

- release

- remarked

- Reported

- Reports

- reserves

- retail

- Reuters

- Revealed

- Risk

- rsi

- say

- sector

- Sellers

- senior

- September

- Services

- should

- show

- showing

- Similarly

- since

- So

- Soon

- stands

- Statement

- straight

- Strategist

- Strategy

- strength

- strong

- support

- support level

- Supports

- surveyed

- Take

- Technical

- The

- There.

- therefore

- this

- this year

- to

- today

- trade

- trades

- Trading

- typically

- under

- Unexpected

- us

- US economy

- was

- we

- week

- weekly

- Weeks

- WELL

- when

- whether

- will

- winning

- with

- Yahoo

- year

- years

- yet

- you

- Your

- zephyrnet