- The likelihood of a BOJ policy tweak during next month’s rate review is low.

- Japan’s inflation has consistently exceeded the BOJ’s 2% target for over a year.

- BOJ policymakers believe inflation will fall due to a weak global economic outlook.

Today’s USD/JPY forecast is bullish. Notably, Bank of Japan board member Seiji Adachi stated the likelihood of adjusting the bank’s yield curve control policy in July is low. This is because of diminishing market distortions and a lack of price trend data.

-If you are interested in forex day trading then have a read of our guide to getting started-

Additionally, Adachi emphasized that the central bank does not utilize monetary policy to counteract declines in the yen. Consequently, this prevents any immediate changes to Japan’s ultra-low interest rates.

He mentioned that if market conditions remain relatively stable, the chances of modifying yield curve control in July to address any distortion would be minimal. These statements mark the strongest dovish stance thus far from a BOJ policymaker. He ruled out the possibility of policy adjustments during the upcoming July 27-28 meeting.

Moreover, inflation has consistently exceeded the BOJ’s 2% target for over a year. For this reason, it is widely anticipated that the bank will revise its price forecasts higher. Furthermore, this has led some market participants to speculate that the BOJ might consider adjusting its yield curve control policy in July. This would address market distortions resulting from its rigorous defense of the 0% cap on the 10-year yield.

Adachi is among the few advocates of aggressive easing on the BOJ board. He expressed his view that long-term risks to the price outlook are biased towards the downside due to a weak global economic outlook.

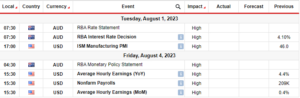

USD/JPY key events today

Investors will pay attention to Fed Chair Jerome Powell’s testimony to Congress. This will likely give hints on the future of the Fed’s monetary policy.

USD/JPY technical forecast: Bulls finding acceptance above 142.0

The bias for USD/JPY on the 4-hour chart is bullish. However, bulls face a strong resistance level that has kept the uptrend at bay for some time. The price has constantly pushed lower after reaching the 142.00 resistance.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Still, it has stayed above the 30-SMA, indicating a bullish trend. With the RSI showing solid momentum above 50, the price will likely break above the 142.00 resistance and retest the 142.50 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-forecast-bojs-july-policy-adjustment-hopes-fade/

- :has

- :is

- :not

- 1

- 167

- 2%

- 30

- 50

- a

- above

- acceptance

- Accounts

- address

- Adjustment

- adjustments

- advocates

- After

- aggressive

- among

- and

- Anticipated

- any

- ARE

- At

- attention

- Bank

- bank of japan

- Bay

- BE

- because

- believe

- BEST

- bias

- biased

- board

- board member

- boj

- Break

- Bullish

- Bulls

- CAN

- cap

- central

- Central Bank

- CFDs

- Chair

- chances

- Changes

- Chart

- check

- conditions

- Congress

- Consequently

- Consider

- constantly

- Container

- control

- curve

- data

- day

- Declines

- Defense

- detailed

- diminishing

- does

- Dovish

- downside

- due

- during

- easing

- Economic

- emphasized

- events

- exceeded

- expressed

- Face

- fade

- Fall

- far

- Fed

- Fed Chair

- few

- finding

- For

- Forecast

- forecasts

- forex

- from

- Furthermore

- future

- getting

- Give

- Global

- Global Economic

- guide

- Have

- he

- High

- higher

- hints

- his

- hopes

- However

- HTTPS

- if

- immediate

- in

- indicating

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- IT

- ITS

- Japan

- Japan’s

- jerome

- July

- kept

- Key

- Lack

- Led

- Level

- likely

- long-term

- looking

- lose

- losing

- Low

- lower

- mark

- Market

- market conditions

- max-width

- meeting

- member

- mentioned

- might

- minimal

- Momentum

- Monetary

- Monetary Policy

- money

- next

- notably

- now

- of

- on

- our

- out

- Outlook

- over

- participants

- Pay

- plato

- Plato Data Intelligence

- PlatoData

- policy

- policymakers

- possibility

- Powell’s

- prevents

- price

- provider

- pushed

- Rate

- Rates

- reaching

- Read

- reason

- relatively

- remain

- Resistance

- resulting

- retail

- review

- rigorous

- Risk

- risks

- ROW

- rsi

- ruled

- s

- should

- showing

- solid

- some

- stable

- stated

- statements

- stayed

- strong

- SVG

- Take

- Target

- Technical

- testimony

- that

- The

- The Future

- then

- These

- this

- time

- to

- towards

- trade

- Trading

- Trend

- upcoming

- uptrend

- USD/JPY

- utilize

- View

- when

- whether

- widely

- will

- with

- would

- year

- Yen

- Yield

- yield curve

- yield curve control

- you

- Your

- zephyrnet