- The European Central Bank will likely raise borrowing costs on Thursday.

- The US Federal Reserve recently halted a series of 10 consecutive rate hikes.

- Inflation in the Eurozone remains unacceptably high for the ECB.

Today’s EUR/USD forecast is slightly bullish. The European Central Bank will likely raise borrowing costs on Thursday, reaching their highest level in 22 years. Moreover, the bank intends to leave room for additional rate hikes as it continues to combat high inflation. This is despite a weakening Eurozone economy.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

In contrast, the US Federal Reserve recently halted a series of 10 consecutive rate hikes. Consequently, global investors understood that the tightening cycle in developed economies is nearing its end. However, further rate hikes in the US is still possible.

On the other hand, inflation in the Eurozone remains unacceptably high for the ECB, standing at 6.1%, more than three times the target of 2%. However, underlying price growth, excluding food and energy, is only beginning to slow down.

These factors will likely keep the ECB on its current path of tightening. This is because it failed to predict the current bout of high inflation and initiated rate hikes later than many other global counterparts last year. The ECB will likely raise the deposit rate for the eighth consecutive time by 25 basis points to 3.5%, reaching the highest level since 2001.

Economists surveyed by Reuters expect another rate increase of the same magnitude in July, a move that several policymakers have already indicated.

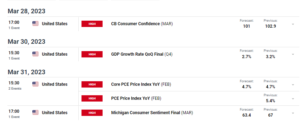

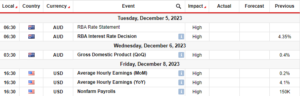

EUR/USD key events today

Investors await the ECB monetary policy meeting, where the central bank will likely lift rates by 25bps. At the same time, they expect a retail sales report from the US that will show the state of consumer spending in the country.

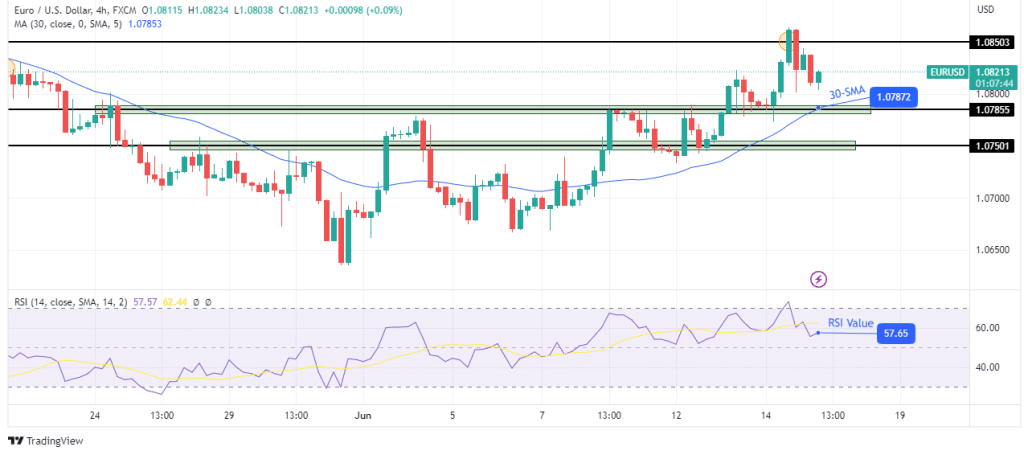

EUR/USD technical forecast: Bulls post fresh highs above 1.0850.

The EUR/USD has made a new high on the 4-hour chart, indicating a continuation of the bullish trend. Bears came in for a pullback when the price reached the 1.0850 resistance level. However, the pullback is approaching the 30-SMA and the 1.0785 support level, where it will likely find strong support.

–Are you interested to learn more about automated trading? Check our detailed guide-

If bulls are still strong enough to make new highs, the price will bounce higher to break above the 1.0850 resistance. However, bears have also gotten stronger, as seen in the big-bodied candles. This could see the price break below the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-forecast-economists-expect-ecb-to-hike-by-25bps/

- :has

- :is

- :where

- 1

- 10

- 167

- 2%

- 2001

- 22

- 25

- 30

- 300

- a

- About

- above

- Accounts

- Additional

- already

- also

- Amid

- analysis

- and

- Another

- approaching

- ARE

- AS

- At

- await

- Bank

- basis

- Bears

- because

- Beginning

- below

- Borrowing

- Bounce

- Break

- brokers

- Bullish

- Bulls

- by

- came

- CAN

- Candles

- central

- Central Bank

- CFDs

- Chart

- check

- combat

- consecutive

- Consequently

- Consider

- consumer

- Container

- continuation

- continues

- contrast

- Costs

- could

- country

- Current

- cycle

- day

- Day Trading

- deposit

- Despite

- detailed

- developed

- down

- ECB

- economies

- economists

- economy

- Eighth

- end

- energy

- enough

- EUR/USD

- European

- European Central Bank

- Eurozone

- events

- excluding

- expect

- Eyes

- factors

- Failed

- Federal

- federal reserve

- Find

- food

- For

- Forecast

- forex

- fresh

- from

- further

- Global

- Growth

- hand

- Have

- Hawkish

- High

- High inflation

- higher

- highest

- Highs

- Hike

- Hikes

- However

- HTTPS

- in

- Increase

- indicated

- indicating

- inflation

- intends

- interested

- Invest

- investor

- Investors

- IT

- ITS

- July

- Keep

- Key

- Last

- Last Year

- later

- LEARN

- Leave

- Level

- likely

- lose

- losing

- made

- make

- many

- max-width

- meeting

- Monetary

- Monetary Policy

- money

- more

- Moreover

- move

- my

- nearing

- New

- now

- of

- on

- only

- Other

- our

- Outlook

- path

- pause

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- policymakers

- possible

- Post

- predict

- price

- Price Analysis

- provider

- pullback

- raise

- Rate

- rate hikes

- Rates

- reached

- reaching

- recently

- remains

- report

- Reserve

- Resistance

- retail

- Retail Sales

- Reuters

- Risk

- Room

- ROW

- sales

- same

- see

- seen

- Series

- several

- should

- show

- since

- slow

- Soars

- Spending

- State

- Still

- strong

- stronger

- support

- support level

- surveyed

- SVG

- Take

- Target

- Technical

- than

- that

- The

- The State

- The US Federal Reserve

- their

- they

- this

- three

- thursday

- tightening

- time

- times

- to

- today’s

- trade

- Trading

- Trend

- underlying

- understood

- us

- US Federal

- us federal reserve

- when

- whether

- will

- with

- year

- years

- you

- Your

- zephyrnet