Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision

Open to apply: 24 Oct 2023

Close to apply: 31 Oct 2023

Balloting: 02 Nov 2023

Listing date: 15 Nov 2023

Share Capital

Market cap: RM212.121 mil

Total Shares: 606.0606 mil shares

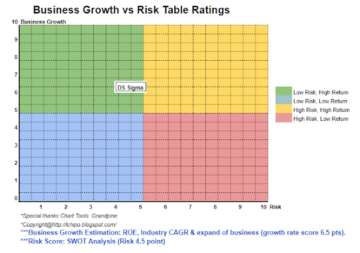

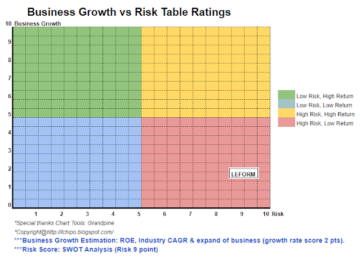

Industry CARG

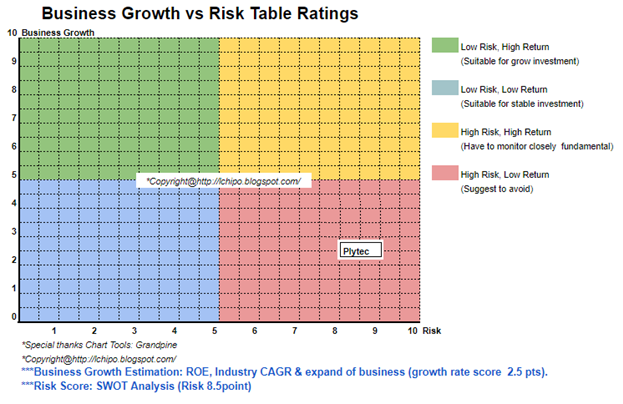

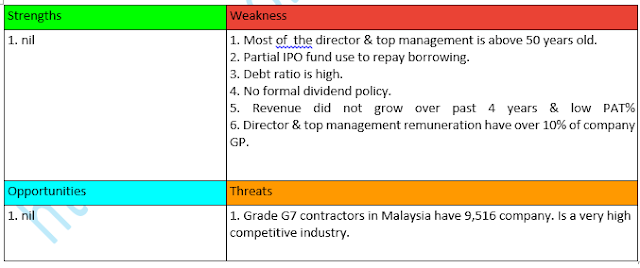

Local Contractors in the Malaysian Construction Industry as at 26 December 2023 (G7 grade): 9.516

Industry competitors comparison (net profit%)

Plytec: 8.69%

Peri Formwork Malaysia Sdn Bhd: 13.07%

BIMTECH Solutions Sdn Bhd: 14.21%

Doka Formwork Malaysia Sdn Bhd: 12.09%

Engtex Sdn Berhad: 6.97%

Others: -63.80% to 9.73%

Business (FPE 2023)

Construction engineering solutions and services as well as trading and distribution of building materials.

Business Segment

CME solution: 33.78%

Trading and distribution of building materials: 59.96%

DDE Solution: 4.54%

PC solution: 1.72%

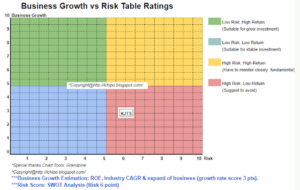

Fundamental

1.Market: Ace Market

2.Price: RM0.35

3.P/E: RM15.49

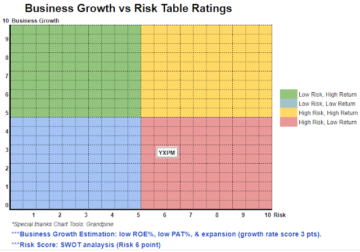

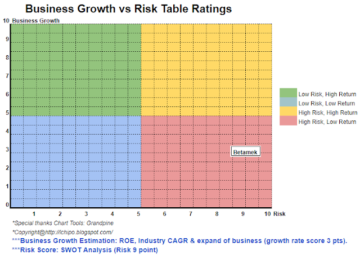

4.ROE(FPE2023): 5.48%

5.ROE: 16.38%(FYE2022), 14.97%(FYE2021), 11.66%(FYE2020), 14.56%(FYE2019)

6.Net asset: RM0.15

7.Total debt to current asset: 0.890 (Debt: 105.318mil, Non-Current Asset: 106.837mil, Current asset: 118.304mil)

8.Dividend policy: no formal dividend policy.

9. Shariah status: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FPE 31May, 5mth): RM62.581 mil (Eps: 0.0046), PAT: 4.54%

2022 (FYE 31Dec): RM158.091 mil (Eps: 0.0226), PAT: 8.69%

2021 (FYE 31Dec): RM112.712 mil (Eps: 0.0178), PAT: 9.62%

2020 (FYE 31Dec): RM113.792 mil (Eps: 0.0181), PAT: 6.30%

2019 (FYE 31Dec): RM190.111 mil (Eps: 0.0131), PAT: 4.16%

Major customer (FPE2023)

1.Siab Group of companies: 14.33%

2.Orangebeam Construction Sdn. Bhd: 9.10%

3.Eng Han Enginnering Sdn Bhd: 8.19%

4.Nestcon Builders Sdn Bhd.: 6.46%

5.Alphazen Contract Sdn Bhd: 4.02%

***total 42.10%

Major Sharesholders

1.Resilient Capital Holdings: 41.37% (direct)

2.Prestij Usaha: 32.63% (direct)

3.Yang Kian Lock: 74% (Indirect)

Directors & Key Management Remuneration for FYE2023

(from Revenue & other income 2022)

Total director remuneration: RM2.321 mil

key management remuneration: RM2.205 mil – RM2.250 mil

total (max): RM4.481 mil or 10.59%

Use of funds

1.Capital expenditure: 21.55%

2.Repayment of borrowings: 24.24%

3.Construction of factories and centralised labour quarters on the Olak Lempit Land: 21.01%

4.Purchase of software systems and hardware: 5.39%

5.Working capital: 17.03%

6.Estimated listing expenses: 10.78%

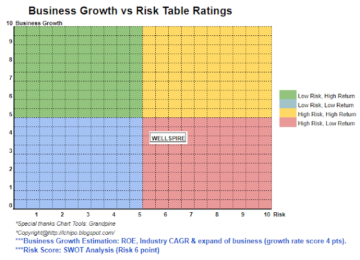

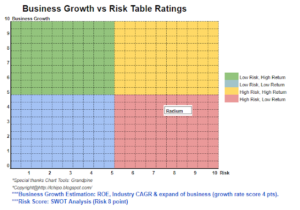

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is high risk industry in current situation.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://lchipo.blogspot.com/2023/10/plytec-holding-berhad.html

- :is

- :not

- $UP

- 1

- 10

- 11

- 118

- 12

- 121

- 13

- 14

- 15%

- 16

- 17

- 2022

- 2023

- 24

- 250

- 26

- 31

- 32

- 321

- 33

- 41

- 8

- 9

- adjust

- All

- and

- any

- Apply

- AS

- asset

- At

- bhd

- both

- builders

- Building

- Building Materials

- cap

- capital

- capital expenditure

- Center

- centralised

- change

- clear

- color

- Companies

- company

- comparison

- competitors

- construction

- contract

- contractors

- Current

- customer

- Date

- Debt

- December

- decision

- direct

- Director

- distribution

- dividend

- do

- Earning

- Engineering

- estimated

- Ether (ETH)

- Every

- expenses

- factories

- financial

- financial performance

- follow

- For

- Forecast

- formal

- from

- fundamental

- G7

- grade

- Group

- Hardware

- High

- holding

- Holdings

- homework

- HTTPS

- if

- in

- Income

- industry

- investment

- Key

- Labour

- Land

- left

- listing

- Malaysia

- Malaysian

- management

- Market

- materials

- max

- net

- New

- no

- normal

- Oct

- of

- on

- only

- Opinion

- or

- Other

- own

- per

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- purchase

- Quarter

- Reader

- Recommendation

- Red

- release

- remuneration

- repayment

- resilient

- result

- revenue

- Risk

- sdn

- Services

- Shares

- Shariah

- should

- situation

- Software

- solution

- Solutions

- Status

- Systems

- Take

- The

- their

- to

- Total

- Trading

- us

- value

- View

- WELL

- white

- will

- working

- wrote

- zephyrnet