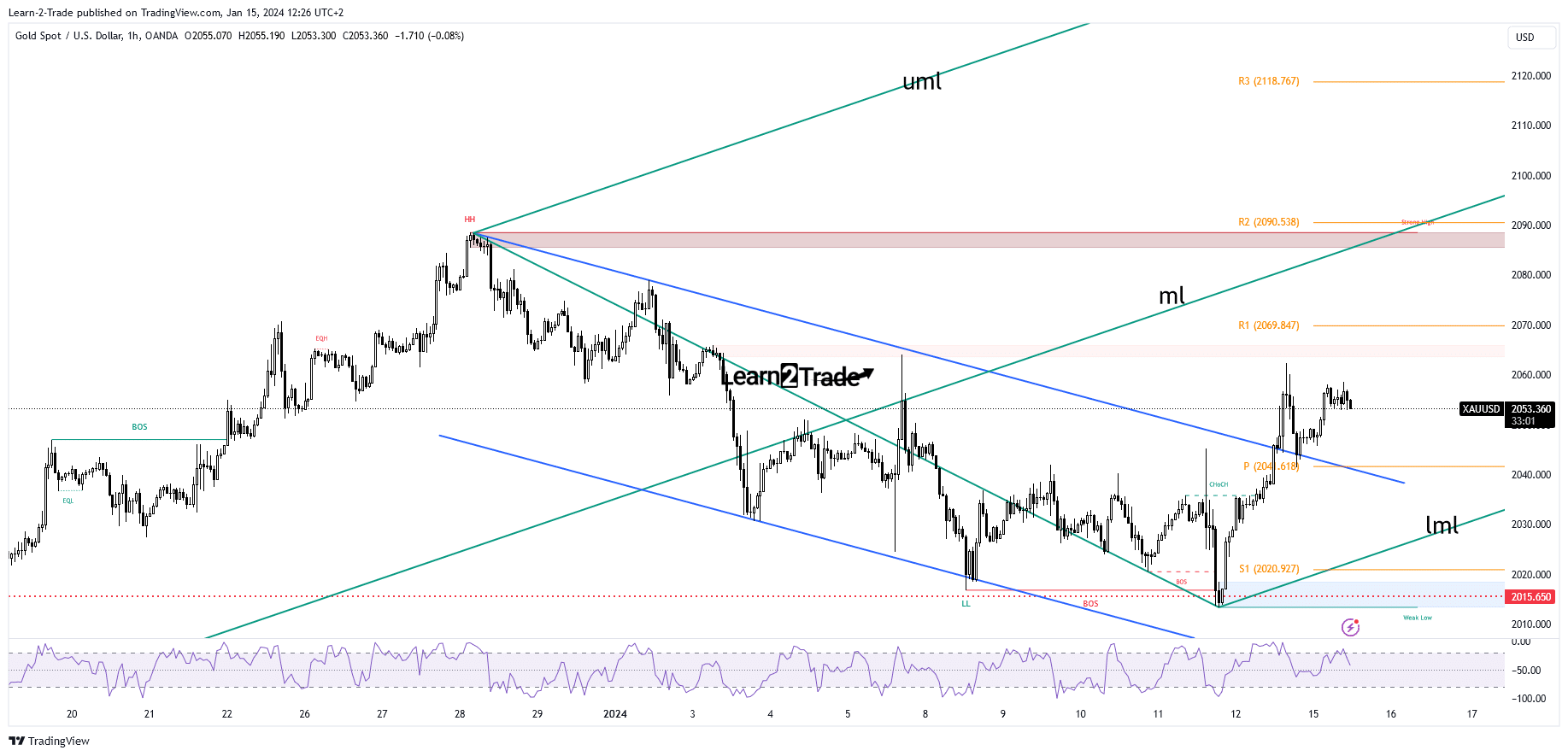

- The price validated its breakout through the downtrend line.

- It seems overbought after failing to reach Friday’s high.

- The Canadian inflation figures should move the rate tomorrow.

The gold price is trading at $2,053 at the time of writing. The precious metal is struggling to stay higher. The buyers lack conviction despite a strong rally.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The US dollar seems determined to extend its growth which could negatively impact the gold prices. The appreciation of the US dollar versus its rivals after the US reported higher inflation in December may force the yellow metal to drop.

Fundamentally, the XAU/USD tried to resume its growth as the US PPI reported a 0.1% drop versus a 0.1% growth expected on Friday, while the Core PPI rose by 0.0%, less compared to the 0.2% growth estimated.

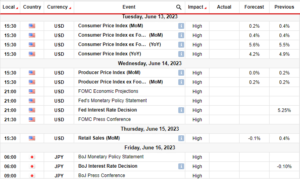

Today, the US Manufacturing Sales, Wholesale Sales, and the BOC Business Outlook Survey could move the markets. The fundamentals should be decisive tomorrow as Canada is to release the inflation figures.

The Consumer Price Index may announce a 0.3% drop versus the 0.1% growth in the previous reporting period. The Core, Median, Trimmed, and Common CPI data will also be published. Furthermore, the US Empire State Manufacturing Index also represents a high-impact event.

Gold Price Technical Analysis: Buyers’ Exhaustion

From a technical point of view, the gold price found strong support on the $2,015 static support, and now it has turned to the upside. It has passed above the downtrend line (channel’s resistance), signaling a potential broader upward movement.

–Are you interested to learn about forex robots? Check our detailed guide-

The metal has confirmed the breakout, but it seems a little overbought after failing to reach Friday’s high of $2,062 again. The broken downtrend line and the weekly pivot point of $2,041 represent key support levels. As long as it stays above these levels, the price could jump higher again despite minor retreats.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/15/gold-price-struggling-to-retain-gains-above-2050/

- :has

- :is

- 1% drop

- 2%

- a

- About

- above

- Accounts

- After

- again

- also

- analysis

- and

- Announce

- appreciation

- AS

- At

- BE

- BoC

- breakout

- broader

- Broken

- business

- but

- buyers

- by

- CAN

- Canada

- Canadian

- Canadian inflation

- CFDs

- check

- Common

- compared

- CONFIRMED

- Consider

- consumer

- consumer price index

- conviction

- Core

- could

- CPI

- CPI data

- data

- December

- decisive

- Despite

- detailed

- determined

- Dollar

- Drop

- Empire

- estimated

- Event

- expected

- extend

- failing

- Figures

- Force

- forex

- found

- Friday

- Fundamentals

- Furthermore

- Gains

- Gold

- gold price

- Gold Prices

- Growth

- High

- higher

- HTTPS

- Impact

- in

- index

- inflation

- inflation figures

- interested

- Invest

- investor

- IT

- ITS

- jump

- Key

- Lack

- LEARN

- less

- levels

- Line

- little

- Long

- lose

- losing

- manufacturing

- Markets

- max-width

- May..

- metal

- minor

- money

- more

- move

- movement

- negatively

- now

- of

- on

- Options

- our

- Outlook

- passed

- period

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- Point

- Point of View

- potential

- ppi

- Precious

- previous

- price

- Prices

- provider

- published

- rally

- Rate

- reach

- release

- Reported

- Reporting

- represent

- represents

- Resistance

- resume

- retail

- retain

- Risk

- rivals

- ROSE

- sales

- seems

- should

- State

- stay

- strong

- Struggling

- support

- support levels

- Survey

- Take

- Technical

- Technical Analysis

- The

- The Weekly

- These

- this

- Through

- time

- to

- tomorrow

- trade

- Trading

- tried

- Turned

- Upside

- upward

- us

- US Dollar

- US PPI

- validated

- Versus

- View

- weekly

- when

- whether

- which

- while

- wholesale

- will

- with

- writing

- XAU/USD

- yellow

- you

- Your

- zephyrnet