- The bias remains bullish despite minor retreats.

- A new higher high may activate further growth.

- Only a valid breakdown below the pivot point opens the door for a corrective phase.

The gold price resumed its growth today, reaching the $1,990 level. The bias is bullish despite minor downside corrections. The XAU/USD returned higher even though the Dollar Index rallied after the US Flash Services PMI and Flash Manufacturing PMI announced expansion. Gold has taken its position as a safe haven asset.

-Are you interested in learning about the forex signals telegram group? Click here for details-

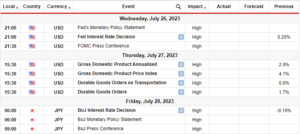

The BoC maintained the monetary policy yesterday, while the Australian inflation data exceeded expectations. Today, the European Central Bank should really shake the markets.

The Main Refinancing Rate is expected to remain at 4.50%, but the Monetary Policy Statement and the ECB Press Conference should bring high volatility. Also, the US will release high-impact data, so the fundamentals should drive the XAU/USD.

The Advance GDP is expected to report a 4.5% growth compared to the 2.1% growth in the previous reporting period, while the Unemployment Claims indicator could jump from 198K to 208K in the last week.

Furthermore, the Pending Home Sales, Advance GDP Price Index, Durable Goods Orders, Core Durable Goods Orders, Goods Trade Balance, and Prelim Wholesale Inventories data will also be released.

Gold Price Technical Analysis: Challenging Resistance

From the technical point of view, the XAU/USD failed to take out the weekly pivot point of 1,962, and now it has tested and retested the broken uptrend line. Now, it challenges the historical level of $1,987, representing a static resistance. It remains to see how it reacts inside the $1,987 – 1,997 supply zone.

-Are you interested in learning about forex indicators? Click here for details-

False breakouts through the immediate resistance levels may announce an overbought. An upside continuation could only be activated if the rate jumps and closes above $1,997 and the uptrend line. On the other hand, a corrective phase could be confirmed after taking out the weekly pivot point of $1,962.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gold-price-clinging-to-highs-under-2000-eyes-on-ecb/

- :has

- :is

- 000

- 1

- 990

- a

- About

- above

- Accounts

- activated

- advance

- After

- also

- an

- analysis

- and

- Announce

- announced

- AS

- asset

- At

- Australian

- Australian Inflation

- Balance

- Bank

- BE

- below

- bias

- BoC

- Breakdown

- breakouts

- bring

- Broken

- Bullish

- but

- CAN

- central

- Central Bank

- CFDs

- challenges

- challenging

- claims

- click

- Closes

- compared

- Conference

- CONFIRMED

- Consider

- continuation

- Core

- Corrections

- could

- data

- Despite

- Dollar

- dollar index

- Door

- downside

- drive

- ECB

- European

- European Central Bank

- Even

- exceeded

- expansion

- expectations

- expected

- Eyes

- Failed

- Flash

- For

- forex

- from

- Fundamentals

- further

- GDP

- Gold

- gold price

- goods

- Growth

- hand

- haven

- here

- High

- higher

- Highs

- historical

- Home

- How

- HTTPS

- if

- immediate

- in

- index

- Indicator

- inflation

- inside

- interested

- Invest

- investor

- IT

- ITS

- jump

- jumps

- Last

- learning

- Level

- levels

- Line

- lose

- losing

- Main

- manufacturing

- Markets

- max-width

- May..

- minor

- Monetary

- Monetary Policy

- money

- New

- now

- of

- on

- only

- opens

- orders

- Other

- out

- pending

- period

- phase

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- Point of View

- policy

- position

- press

- previous

- price

- provider

- Rate

- reaching

- Reacts

- really

- release

- released

- remain

- remains

- report

- Reporting

- representing

- Resistance

- retail

- Risk

- safe

- Safe Haven

- sales

- see

- Services

- should

- signals

- So

- Statement

- supply

- Take

- taken

- taking

- Technical

- Technical Analysis

- Telegram

- tested

- The

- The Weekly

- this

- though?

- Through

- to

- today

- trade

- Trading

- under

- unemployment

- Upside

- uptrend

- us

- valid

- View

- Volatility

- week

- weekly

- when

- whether

- while

- wholesale

- will

- with

- XAU/USD

- Yahoo

- yesterday

- you

- Your

- zephyrnet