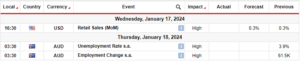

- Australia’s retail sales fell in December after a big surge the previous month.

- There is a 70% probability of an RBA rate cut in August.

- The US Department of Labor Statistics will release data on job openings later on Tuesday.

Tuesday’s AUD/USD outlook leans towards a bearish tilt following the revelation of a dip in Australia’s retail sales for December, retracting from the previous month’s surge. As a result, this downturn has heightened investor confidence that the RBA is unlikely to implement a rate hike next week. Additionally, there is a 70% probability of an RBA rate cut in August.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Meanwhile, investors are awaiting the highly anticipated four-quarter inflation report coming on Wednesday. Economists predict that headline consumer inflation might drop to a two-year low of 4.3%.

On the other hand, the US dollar was mostly flat ahead of employment data and the Fed’s monetary policy decision tomorrow. Traders will look for insights into potential rate cuts by the US central bank.

The US will release job openings data later on Tuesday, giving a preview of the upcoming payroll report on Friday. Meanwhile, tomorrow, the Fed will likely keep interest rates unchanged. However, everyone will focus on the messaging by Fed Chair Jerome Powell in Wednesday’s press conference.

Markets are currently pricing in a 46.6% chance of the US central bank starting rate cuts in March, down from 73.4% a month ago. This shift came after data showed that the US economy remains resilient.

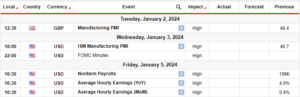

AUD/USD key events today

- US CB Consumer Confidence

- US JOLTS Job Openings

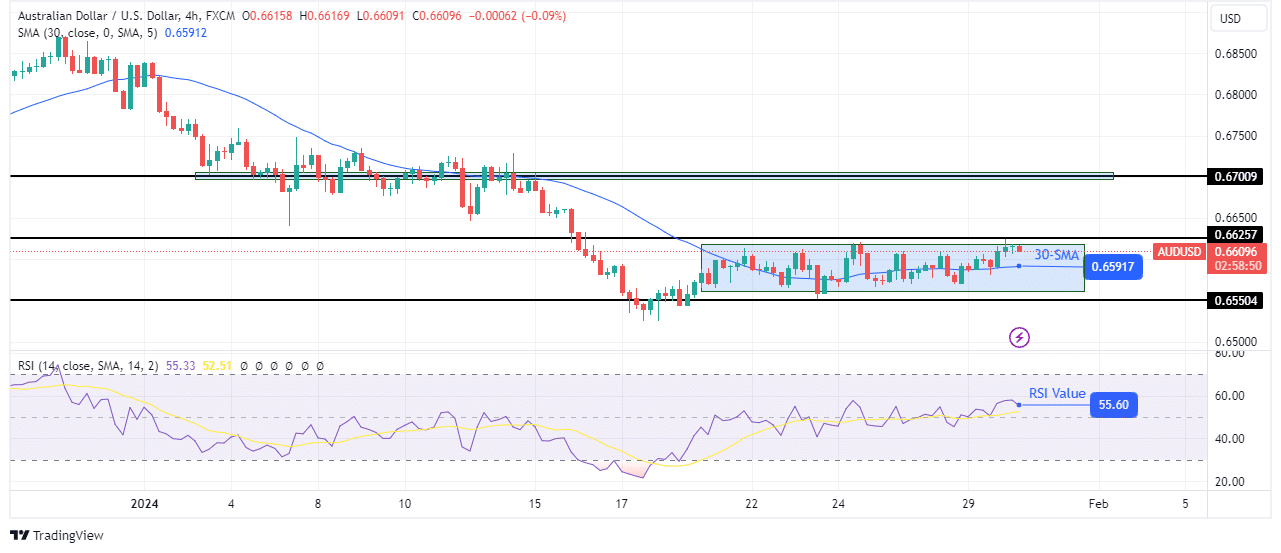

AUD/USD technical outlook: Price trades in a tight range

On the technical side, AUD/USD is trapped in consolidation, with the nearest support at 0.6550 and the nearest resistance at 0.6625. The ranging market came after a strong bearish trend that failed to go below the 0.6550 support level. Consequently, the price pulled back to the 30-SMA. At this point, the price confirmed a range by chopping through the SMA. Similarly, the RSI started chopping through the pivotal 50 level.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

If this consolidation is a pause in the downtrend, then the price will likely soon break below the range support and the 0.6550 support level. On the other hand, the trend will reverse to bullish if the price breaks above the 0.6625 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/30/aud-usd-outlook-australias-sales-dip-following-nov-surge/

- :has

- :is

- 1

- 46

- 50

- 73

- a

- About

- above

- Accounts

- Additionally

- After

- ago

- ahead

- an

- and

- Anticipated

- ARE

- AS

- At

- AUD/USD

- AUGUST

- Australia

- awaiting

- back

- Bank

- bearish

- below

- Big

- Break

- breaks

- Bullish

- by

- came

- CAN

- CB

- central

- Central Bank

- CFDs

- Chair

- Chance

- check

- chopping

- coming

- Conference

- confidence

- CONFIRMED

- Consequently

- Consider

- consolidation

- consumer

- Currently

- Cut

- cuts

- data

- December

- decision

- Department

- Department of Labor

- detailed

- Dip

- Dollar

- down

- DOWNTURN

- Drop

- economists

- economy

- employment

- events

- everyone

- Failed

- Fed

- Fed Chair

- Fed Chair Jerome Powell

- flat

- Focus

- following

- For

- forex

- Friday

- from

- Giving

- Go

- hand

- headline

- heightened

- High

- highly

- Hike

- However

- HTTPS

- if

- implement

- in

- inflation

- insights

- interest

- Interest Rates

- interested

- into

- Invest

- investor

- Investors

- jerome

- jerome powell

- Job

- Keep

- Key

- labor

- later

- learning

- Level

- likely

- Look

- lose

- losing

- Low

- March

- Market

- max-width

- Meanwhile

- messaging

- might

- Monetary

- Monetary Policy

- money

- Month

- more

- mostly

- next

- next week

- nov

- now

- of

- on

- openings

- Other

- our

- Outlook

- pause

- Payroll

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- potential

- Powell

- predict

- press

- Preview

- previous

- price

- pricing

- probability

- provider

- range

- ranging

- Rate

- Rate Hike

- Rates

- RBA

- RBA rate

- release

- remains

- report

- resilient

- Resistance

- result

- retail

- Retail Sales

- revelation

- reverse

- Risk

- rsi

- s

- sales

- shift

- should

- showed

- side

- Similarly

- SMA

- Soon

- started

- Starting

- statistics

- strong

- support

- support level

- surge

- Take

- Technical

- that

- The

- the Fed

- then

- There.

- this

- Through

- to

- tomorrow

- towards

- trade

- Traders

- trades

- Trading

- trapped

- Trend

- Tuesday

- unlikely

- upcoming

- us

- US Central Bank

- US Dollar

- US economy

- was

- Wednesday

- week

- when

- whether

- will

- with

- you

- Your

- zephyrnet