- The yen’s decline to nearly a one-year low raised concerns among traders about potential intervention.

- The narrowly avoided US government shutdown might relieve the markets.

- BOJ policymakers discussed various factors to consider when gradually ending their ultra-loose monetary policy.

On Monday, the dollar kicked off the last quarter of the year on an upward trajectory, making the USD/JPY forecast bullish. The dollar rise came from the expectation of sustained high US interest rates. Simultaneously, the yen’s decline to nearly a one-year low raised concerns among traders about potential intervention by Japanese authorities.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Moreover, analysts noted that the narrowly-avoided US government shutdown might relieve the markets. The yen weakened to 149.83 per dollar, marking its lowest point in over 11 months. Furthermore, it inched closer to the crucial 150 mark. Some traders believe breaching this level could prompt Japanese authorities to intervene to bolster the currency as they did last year.

Meanwhile, a summary of opinions from the BOJ’s September meeting came out on Monday. It revealed that policymakers discussed various factors to consider when gradually ending their ultra-loose monetary policy.

Elsewhere, the US Congress passed a temporary funding bill with strong Democratic support to prevent the fourth partial government shutdown in a decade.

Therefore, there is now certainty that the US Labor Department will release nonfarm payroll data on the upcoming Friday, along with the US CPI report on October 12, which might not have been the case if the government had shut down.

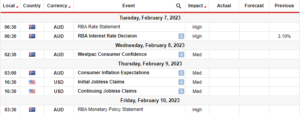

USD/JPY key events today

Investors expect key reports from the US today that include:

- The ISM Manufacturing PMI.

- ISM Manufacturing prices.

- A speech from Fed Chair Jerome Powell.

USD/JPY technical forecast: RSI exhibiting bearish divergence.

On the technical side, the USD/JPY price has made a new high above the 149.50 key level. This indicates that the bullish trend remains intact. Additionally, the move has driven the price above the 30-SMA and the RSI near the overbought region.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

However, although the RSI is in bullish territory, it has made a bearish divergence. The divergence indicates a weakness in bullish momentum that might allow bears to take control. If the divergence plays out, the price will likely break below the 149.50 level and the 30-SMA support. Moreover, it would clear the path for a retest of the 148.51 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-forecast-dollars-rise-instigating-yen-intervention/

- :has

- :is

- :not

- 1

- 11

- 12

- 150

- 50

- 51

- a

- About

- above

- Accounts

- Additionally

- allow

- along

- Although

- among

- an

- Analysts

- and

- AS

- At

- Authorities

- avoided

- bearish

- bearish divergence

- Bears

- been

- believe

- below

- Bill

- bolster

- Break

- Bullish

- by

- came

- CAN

- case

- certainty

- CFDs

- Chair

- check

- clear

- closer

- Concerns

- Congress

- Consider

- control

- could

- CPI

- crucial

- Currency

- data

- decade

- Decline

- democratic

- Department

- detailed

- DID

- discussed

- Divergence

- Dollar

- down

- driven

- ending

- events

- Exhibiting

- expect

- expectation

- factors

- Fed

- Fed Chair

- Fed Chair Jerome Powell

- For

- Forecast

- forex

- Fourth

- Friday

- from

- funding

- Furthermore

- Government

- gradually

- had

- Have

- High

- HTTPS

- if

- in

- include

- indicates

- interest

- Interest Rates

- interested

- intervene

- intervention

- Invest

- investor

- IT

- ITS

- Japanese

- jerome

- jerome powell

- Key

- labor

- Labor Department

- Last

- Last Year

- learning

- Level

- leveraged

- likely

- lose

- losing

- Low

- lowest

- made

- Making

- manufacturing

- mark

- Markets

- marking

- max-width

- meeting

- might

- Momentum

- Monday

- Monetary

- Monetary Policy

- money

- months

- more

- Moreover

- move

- Near

- nearly

- New

- Nonfarm

- noted

- now

- october

- of

- off

- on

- Opinions

- our

- out

- over

- passed

- path

- Payroll

- per

- plato

- Plato Data Intelligence

- PlatoData

- plays

- pmi

- Point

- policy

- policymakers

- potential

- Powell

- prevent

- price

- Prices

- provider

- Quarter

- raised

- Rates

- region

- release

- remains

- report

- Reports

- retail

- Revealed

- Rise

- Risk

- rsi

- s

- September

- should

- Shut down

- shutdown

- side

- simultaneously

- some

- speech

- strong

- SUMMARY

- support

- support level

- sustained

- Take

- Technical

- temporary

- territory

- that

- The

- their

- There.

- they

- this

- to

- today

- trade

- Traders

- Trading

- trajectory

- Trend

- upcoming

- upward

- us

- us congress

- US CPI

- us government

- USD/JPY

- various

- weakness

- when

- whether

- which

- will

- with

- would

- Yahoo

- year

- Yen

- you

- Your

- zephyrnet