- Data revealed that the UK’s economy experienced only a partial recovery in August.

- There was a higher-than-expected increase in US consumer prices for September.

- Investors will focus on the UK inflation figure next week.

The GBP/USD weekly forecast is bearish as the dollar could strengthen further amid hotter-than-expected US inflation.

Ups and downs of GBP/USD

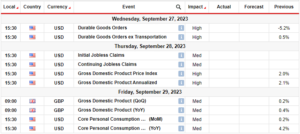

The pound closed the week lower, with investors absorbing UK and US data. The UK released GDP data, while the US released the FOMC minutes and inflation data.

–Are you interested in learning more about STP brokers? Check our detailed guide-

On Thursday, the pound dipped from a three-week peak. This drop came after data revealed that the UK’s economy experienced only partially recovered in August following a significant decline the previous month.

Meanwhile, the dollar saw a significant surge following a higher-than-expected increase in US consumer prices for September. The elevated cost of rent drove this uptick. Consequently, it increased the possibility of the Federal Reserve maintaining high interest rates over an extended period.

Next week’s key events for GBP/USD

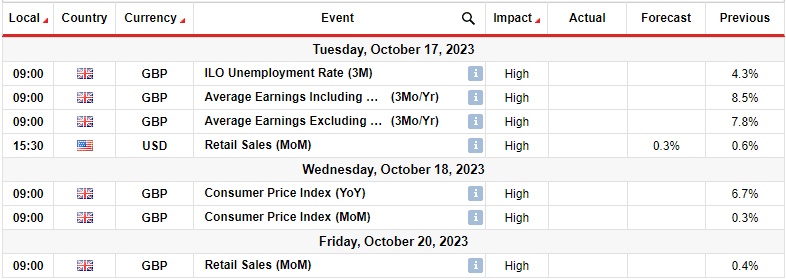

Investors will receive employment, retail sales, and inflation data from the UK in the coming week. Meanwhile, the US will release data on retail sales. Employment and retail sales data will give a recent picture of the UK economy.

Still, investors will focus on the UK inflation figure, influencing the BOE’s policy direction. The central bank paused last month but might resume hikes depending on the state of inflation.

Meanwhile, the US retail sales report will show the country’s consumer spending state. This might also influence the Fed’s policy outlook.

GBP/USD weekly technical forecast: Price inches closer to 1.2100 support.

The pound is approaching the 1.2100 support level after failing to trade above the 22-SMA. Bears made a big step in the downtrend by breaking below the 1.2400 key support level. However, bulls entered the market when the price reached the 1.2100 support level. They threatened to take over when the price broke above the 22-SMA.

–Are you interested in learning more about making money with forex? Check our detailed guide-

However, they failed to sustain a move higher, giving bears the chance to return stronger. Bears are now looking to retest the 1.2100 support. A break below this level would signal a continuation of the downtrend, likely taking out the 1.2001 support level.

However, there is also a chance that the 1.2100 support will hold firm. In that case, the bulls might get another chance to break above the 22-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-weekly-forecast-hotter-us-cpi-boost-greenback/

- :is

- 1

- 2001

- a

- About

- above

- Accounts

- After

- also

- Amid

- an

- and

- Another

- approaching

- ARE

- AS

- At

- AUGUST

- Bank

- bearish

- Bears

- below

- Big

- boost

- Break

- Breaking

- Broke

- Bulls

- but

- by

- came

- CAN

- case

- central

- Central Bank

- CFDs

- Chance

- check

- closed

- closer

- coming

- Consequently

- Consider

- consumer

- continuation

- Cost

- could

- country’s

- CPI

- daily

- data

- Decline

- Depending

- detailed

- direction

- Dollar

- downs

- Drop

- economy

- elevated

- employment

- entered

- events

- experienced

- Failed

- failing

- Federal

- federal reserve

- Figure

- Firm

- Focus

- following

- FOMC

- fomc minutes

- For

- Forecast

- forex

- from

- further

- GBP/USD

- GDP

- get

- Give

- Giving

- Greenback

- High

- higher

- Hikes

- hold

- However

- HTTPS

- in

- inches

- Increase

- increased

- inflation

- influence

- influencing

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- Key

- Last

- learning

- Level

- likely

- looking

- lose

- losing

- lower

- made

- maintaining

- Market

- max-width

- Meanwhile

- might

- minutes

- money

- Month

- more

- move

- next

- next week

- now

- of

- on

- only

- our

- out

- Outlook

- over

- paused

- Peak

- period

- picture

- plato

- Plato Data Intelligence

- PlatoData

- policy

- possibility

- pound

- previous

- price

- Prices

- provider

- Rates

- reached

- receive

- recent

- recovery

- release

- released

- Rent

- report

- Reserve

- resume

- retail

- Retail Sales

- return

- Revealed

- Risk

- sales

- saw

- September

- should

- show

- Signal

- significant

- Spending

- State

- Step

- Strengthen

- stronger

- support

- support level

- surge

- Take

- taking

- Technical

- that

- The

- The State

- the UK

- There.

- they

- this

- thursday

- to

- trade

- Trading

- Uk

- UK Inflation

- us

- US CPI

- us inflation

- US Retail Sales

- was

- week

- weekly

- when

- whether

- while

- will

- with

- would

- Yahoo

- you

- Your

- zephyrnet