- The number of Americans seeking new unemployment benefits unexpectedly decreased last week.

- BOE’s Catherine Mann argued that it was premature to halt rate hikes.

- The market is currently pricing a 95% chance of a 25 bps BOE rate hike in March.

Today’s GBP/USD price analysis is bearish. The dollar held onto modest gains versus its key counterparts, supported by solid economic data. This reinforced the belief that the US Federal Reserve’s tightening of monetary policy may need to be prolonged to reduce the highest inflation in decades.

–Are you interested in learning more about STP brokers? Check our detailed guide-

This month, the dollar has been supported by a string of better-than-anticipated figures and recent statements from “a few” policymakers in favor of more significant interest-rate increases. Meanwhile, the number of Americans seeking new unemployment benefits unexpectedly decreased last week, highlighting the nation’s stable economy and the labor market’s continued tightness.

On Thursday, the pound declined versus the dollar after a Bank of England policymaker made hawkish comments.

Catherine Mann, a Bank of England Monetary Policy Committee member, argued that it was premature to conclude that the concerns brought on by the spike in inflation last year had subsided and that the central bank should keep raising borrowing prices.

The market is currently pricing in a 95% chance of a 25-bps rate hike in March, after which it is anticipated that rate hikes will stop. This is due to favorable economic signals from a PMI survey earlier this week that increased the chances of another Bank of England interest rate rise in March.

Recent positive economic data emphasizes the BoE’s challenging goal of controlling inflation while averting a deeper UK recession.

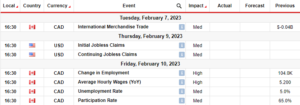

GBP/USD key events today

Investors will closely monitor the Fed’s favored inflation indicator, the core Personal Consumption Expenditure (PCE) price index. There will also be a report on new house sales in the US.

GBP/USD technical price analysis: A decline to the 1.1940 support is likely

The 4-hour chart shows GBP/USD trading below the 30-SMA and the RSI below the 50-level. Bears have taken over after breaking below the SMA and the 1.2040 support level. This comes after the bullish move failed to go beyond the 1.2126 resistance.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The price is currently retesting the recently broken SMA before likely falling to the next support at 1.1940. Bulls will take back control if the price goes above the SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-price-analysis-bulls-optimistic-above-1-2000/

- 1

- 95%

- a

- About

- above

- Accounts

- After

- Americans

- analysis

- and

- Another

- Anticipated

- back

- Bank

- Bank of England

- bearish

- Bears

- before

- belief

- below

- benefits

- better-than-anticipated

- Beyond

- BoE

- Borrowing

- Breaking

- Broken

- brought

- Bullish

- Bulls

- Catherine

- central

- Central Bank

- CFDs

- challenging

- Chance

- chances

- Chart

- check

- closely

- comments

- committee

- Concerns

- conclude

- Consider

- consumption

- Container

- continued

- control

- controlling

- Core

- Currently

- data

- decades

- Decline

- deeper

- detailed

- Dollar

- Earlier

- Economic

- economy

- emphasizes

- England

- events

- Failed

- Falling

- favor

- Federal

- Federal Reserve’s

- Figures

- forex

- from

- Gains

- GBP/USD

- Go

- goal

- Goes

- Hawkish

- Held

- High

- highest

- highlighting

- Hike

- Hikes

- House

- HTTPS

- in

- increased

- Increases

- index

- Indicator

- inflation

- interest

- INTEREST RATE

- interested

- Invest

- investor

- IT

- Keep

- Key

- labor

- Last

- Last Year

- learning

- Level

- likely

- lose

- losing

- made

- March

- Market

- max-width

- Meanwhile

- member

- Monetary

- Monetary Policy

- monetary policy committee

- money

- Monitor

- Month

- more

- move

- Nations

- Need

- New

- next

- number

- Optimistic

- pce

- personal

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- policy

- policymakers

- positive

- pound

- Premature

- price

- Price Analysis

- Prices

- pricing

- provider

- raising

- Rate

- Rate Hike

- rate hikes

- recent

- recently

- recession

- reduce

- report

- reserves

- Resistance

- retail

- Rise

- Risk

- ROW

- rsi

- sales

- seeking

- should

- Shows

- signals

- significant

- SMA

- solid

- spike

- stable

- statements

- Stop

- subsided

- support

- support level

- Supported

- Survey

- SVG

- Take

- Technical

- The

- this week

- tightening

- to

- trade

- Trading

- Uk

- uk recession

- unemployment

- us

- US Federal

- Versus

- week

- whether

- which

- while

- will

- year

- Your

- zephyrnet