- The bias remains bullish despite minor retreats.

- False breakouts through the immediate resistance levels may announce a new sell-off.

- The US data should have a major impact today.

The GBP/USD price retreated slightly after posting a new high of 1.2569 in the last session. The pair is trading at 1.2534 at the time of writing.

The price has changed little in the short term as the US banks were closed in observance of Thanksgiving Day.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

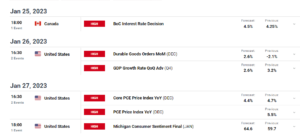

Fundamentally, the price stays higher as the United Kingdom reported positive data yesterday. The Flash Manufacturing PMI jumped from 44.8 to 46.7 points, above 45.0 points expected, while the Flash Services PMI was reported at 50.5, above 49.5 points expected, confirming expansion. Today, the Gfk Consumer Confidence came in at -24 points versus the forecasted -28 points.

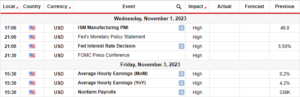

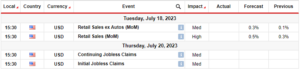

Later, the US economic figures should be decisive. The Flash Services PMI could drop from 50.6 points to 50.4 points, while Flash Manufacturing PMI is expected to drop to 49.9 points from 50.0 points, indicating contraction again.

Better than expected, US data should boost the greenback across the board. Also, the Canadian Retail Sales and Core Retail Sales should significantly impact the USD.

GBP/USD Price Technical Analysis: Potential Sell Zone

Technically, the GBP/USD price failed to stay above the 1.2548 historical level and the ascending pitchfork’s median line (ml), signaling exhausted buyers. Still, the bias remains bullish, taking out the weekly R1 (1.2570), coming back above the median line, and making a new higher high may activate further growth.

–Are you interested to learn more about crypto signals? Check our detailed guide-

On the contrary, new false breakouts through the immediate resistance levels may announce a new sell-off. A bearish pattern could signal a strong correction toward the ascending pitchfork’s lower median line (LML).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-price-overbought-near-1-2550-on-a-dull-day/

- :has

- :is

- 1

- 46

- 49

- 50

- 7

- 8

- 9

- a

- above

- Accounts

- across

- After

- again

- also

- analysis

- and

- Announce

- AS

- At

- back

- Banks

- BE

- bearish

- bias

- board

- boost

- breakouts

- Bullish

- buyers

- came

- CAN

- Canadian

- Canadian Retail Sales

- CFDs

- changed

- check

- closed

- coming

- confidence

- Consider

- consumer

- contraction

- contrary

- Core

- could

- data

- day

- decisive

- Despite

- detailed

- Drop

- Economic

- expansion

- expected

- Failed

- false

- Figures

- Flash

- forex

- from

- further

- GBP/USD

- Greenback

- Growth

- Have

- High

- higher

- historical

- HTTPS

- immediate

- Impact

- in

- indicating

- interested

- Invest

- investor

- Kingdom

- Last

- LEARN

- Level

- levels

- Line

- little

- lose

- losing

- lower

- major

- Making

- manufacturing

- max-width

- May..

- minor

- ML

- money

- more

- Near

- New

- now

- of

- on

- our

- out

- pair

- Pattern

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- positive

- potential

- price

- provider

- remains

- Reported

- Resistance

- retail

- Retail Sales

- Risk

- sales

- sell

- sell-off

- Services

- session

- Short

- should

- Signal

- significantly

- stay

- Still

- strong

- Take

- taking

- Technical

- Technical Analysis

- term

- than

- Thanksgiving

- The

- the United Kingdom

- The Weekly

- this

- Through

- time

- to

- today

- toward

- trade

- Trading

- United

- United Kingdom

- us

- US banks

- USD

- Versus

- was

- weekly

- were

- when

- whether

- while

- with

- writing

- yesterday

- you

- Your

- zephyrnet