- The XAU/USD remains bearish as long as it stays below the S1 (1,940).

- The median line (ml) could attract the price.

- Tomorrow, the US Average Hourly Earnings, Unemployment Rate, and NFP should move the rate.

The gold price dropped as low as $1,929 today, registering a fresh weekly low. The sell-off was highly anticipated after the US ADP Nonfarm Employment Change was reported at 324K, above the 191K expected.

-Are you looking for the best CFD broker? Check our detailed guide-

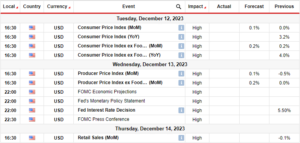

The metal has rebounded slightly and is located at $1,931 as the Dollar Index retreated after the US data. Fundamentally, the greenback took a hit from the US Unemployment Claims, which came in at 227K in the last week versus the 226K expected and compared to 221K in the previous reporting period.

Also, the Prelim Unit Labor Costs and Prelim Nonfarm Productivity came in worse than expected. Later, the ISM Services PMI represents a high-impact event expected at 53.1 points below 53.9 points in the previous reporting period.

In addition, Factory Orders could report at 2.0% while Final Services PMI could remain steady at 52.4 points.

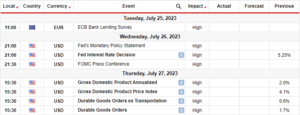

Tomorrow, the US and Canadian data could be decisive. The United States Nonfarm Employment Change is expected at 203K in July. Average Hourly Earnings may report a 0.3% growth, while the Unemployment Rate could remain at 3.6%.

Furthermore, the Canadian Employment Change and Unemployment Rate could be worse than the previous reporting period.

Gold Price Technical Analysis: Gains Capped by $1940

Technically, the XAU/USD extended its sell-off after escaping from the minor flag pattern and taking out the $1,942 former low. It has stabilized below the weekly S1 (1,940), signaling more declines. The current range could represent a distribution pattern. The yellow metal could approach new lows if it stays below the S1.

-If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

Dropping below 1,945 – 1,942, major downside obstacles announce a potential drop toward the median line (ml). Failing to retest the upper median line (uml) in the last attempt announced intense downside pressure. The median line (ml) acts as a magnet and can attract the rate if it stays within the pitchfork’s body.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/gold-price-weaker-rebound-on-downbeat-us-unemployment/

- :has

- :is

- 1

- 167

- 30

- 9

- a

- above

- Accounts

- acts

- addition

- adp

- After

- analysis

- and

- Announce

- announced

- Anticipated

- approach

- ARE

- AS

- At

- attract

- average

- BE

- bearish

- below

- BEST

- body

- brokers

- by

- came

- CAN

- Canadian

- CFDs

- change

- check

- claims

- compared

- Consider

- Container

- Costs

- could

- Current

- data

- decisive

- Declines

- detailed

- distribution

- Dollar

- dollar index

- downside

- Drop

- dropped

- Earnings

- employment

- Event

- expected

- factory

- failing

- final

- For

- forex

- Forex Brokers

- Former

- fresh

- from

- fundamentally

- Gains

- Gold

- gold price

- Greenback

- Growth

- High

- highly

- Hit

- HTTPS

- if

- in

- index

- interested

- Invest

- investor

- IT

- ITS

- July

- labor

- Last

- later

- Line

- located

- Long

- looking

- lose

- losing

- Low

- Lows

- major

- max-width

- May..

- metal

- minor

- ML

- money

- more

- move

- New

- nfp

- Nonfarm

- now

- obstacles

- of

- on

- orders

- our

- out

- Pattern

- period

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- potential

- pressure

- previous

- price

- productivity

- provider

- range

- Rate

- rebound

- registering

- remain

- remains

- report

- Reported

- Reporting

- represent

- represents

- retail

- Risk

- ROW

- sell-off

- Services

- should

- States

- steady

- SVG

- Take

- taking

- Technical

- Technical Analysis

- than

- The

- The Weekly

- this

- to

- today

- took

- toward

- trade

- Trading

- unemployment

- unemployment rate

- unit

- United

- United States

- us

- US Unemployment Claims

- Versus

- was

- week

- weekly

- when

- whether

- which

- while

- with

- within

- worse

- XAU/USD

- yellow

- you

- Your

- zephyrnet