Captives, banks, and many credit unions saw declines in

return-to-market loyalty, and many have yet to

recover.

Whether customers were leasing or buying vehicles, their loyalty

to automotive finance institutions eroded significantly during the

pandemic.

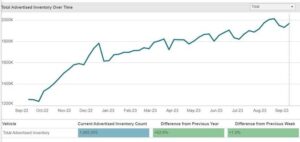

Across new-vehicle lease and loan, more than half of all

customers defected to a new finance source when returning to

market, with the numbers trending steadily downward from the onset

of the pandemic in early 2020 through the end of 2022, according to

analysis by S&P Global Mobility and TransUnion.

Automaker captive finance companies in particular felt the

upheaval in a turbulent marketplace, as inventory shortages made

loyalty to specific vehicle brands also plummet.

“Nearly two-thirds of consumers have been switching banks,” said

Thomas Libby, associate director of loyalty solutions and industry

analysis for S&P Global Mobility. “There’s a nomadic element to

this with households moving from one bank to another. That’s less

loyalty than the banks would like.”

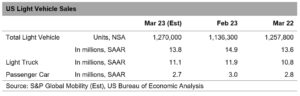

At a macro level, the microchip shortage from 2020 through 2022

tilted the supply and demand balance in the direction of sellers.

Leasing took a particularly hard hit as the incentives that had

driven low monthly payments largely evaporated – there was no need

for distressed merchandise tactics, as dealers marked up rare sheet

metal as they saw fit. As a result,

consumer loyalties overall plummeted, as whichever dealers had

inventory on site saw gains, prior brand preferences be damned.

This carried over into the lending world as well.

“There was no need for any discounting,” Libby said. “The

dynamics of the market completely changed.”

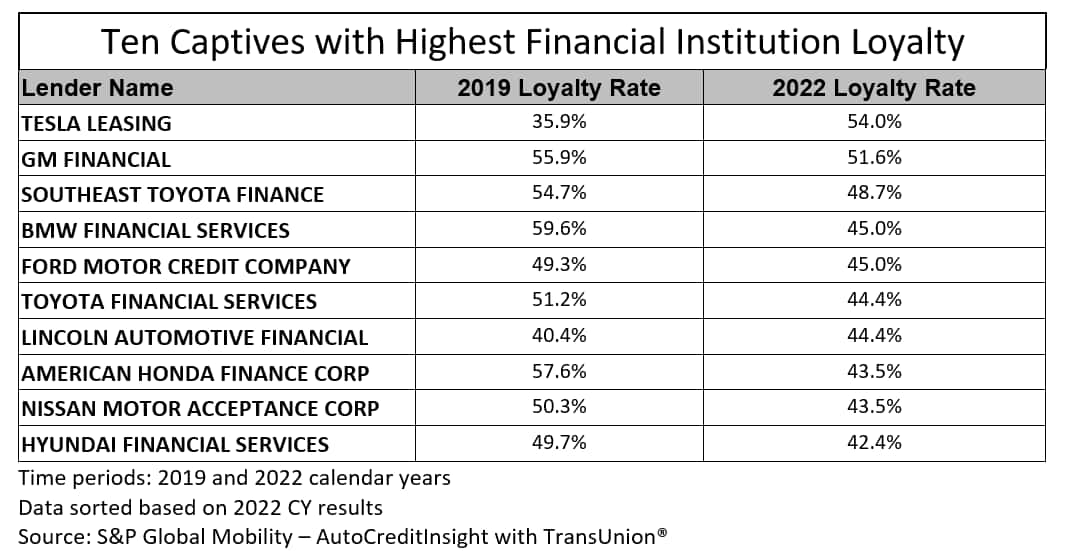

At the end of 2019, four of the top-ten captives – BMW Financial

Services, Mercedes-Benz Financial, GM Financial, and World Omni

Financial (Southeast Toyota Distributors’ main lender) –

successfully retained more than half their customers returning to

market. But three years later, those numbers had dropped

dramatically, with only GM Financial managing to keep even half of

its customers, according to analysis from S&P Global Mobility

AutoCreditInsight and TransUnion.

Even the captive that topped the 2019 chart — BMW Financial

Services — managed to retain just 45.0% of returning customers,

when new-vehicle lease and loan numbers were combined, according to

S&P Global Mobility AutoCreditInsight and TransUnion. Following

GM Financial were Southeast Toyota Finance, then BMW Financial and

Ford Motor Credit.

Although Tesla Leasing had a 54% loyalty to technically lead the

pack, in 2022 its return-to-market volume vastly trailed that of

more-established captives. (S&P Global Mobility’s methodology

for loyalty to the financial institution measures households that

returned to market and whether they returned to the same lending

institution.)

Meanwhile, Mercedes-Benz Financial, which was second to BMW

Financial in the calendar 2019 loyalty scores at 57.5%, dropped out

of the top 10 in calendar 2022 at 39.4%.

When asked for an explanation for their decline, a Mercedes-Benz

Financial spokesperson said, “Leasing has decreased since the

pandemic throughout the premium auto segment. Increases in lease

customers’ equity in their vehicles led to a large number of lease

buyouts in 2022, and increased interest rates led to a high number

of cash purchases. Both factors contributed to lower lease levels

than in previous years. On the financing side, higher interest

rates have also led to increased competition from traditional

lenders, in particular credit unions and regional banks.”

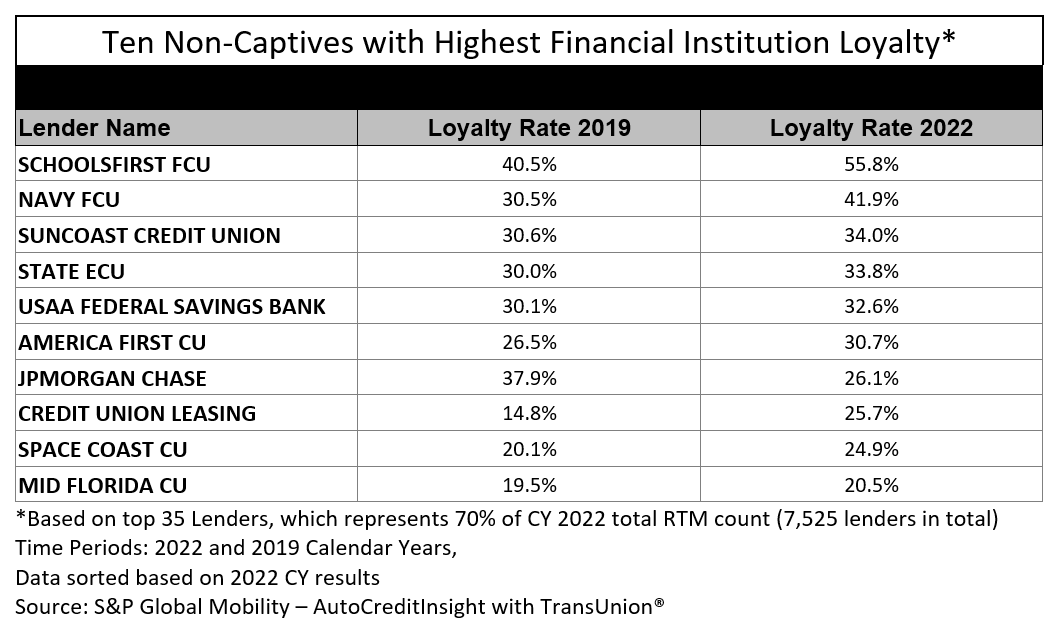

While all the major captives saw loyalty levels drop between

calendar 2019 and 2022, some non-captives achieved gains – albeit

with a far smaller return-to-market basis.

Some of the big gainers were Navy FCU and USAA Federal Savings

Bank. But the largest of the Top 10 non-captive lenders, JPMorgan

Chase, saw its 2019 loyalty rate fall from 37.9% to 26.1% in

calendar 2022. The leader in loyalty, the SchoolsFirst FCU

representing California teachers, is a smaller player – which could

have seen its dramatic swing having little to do with macro

conditions.

“Captive finance companies command the leasing market because they

are able to more accurately forecast residual values,” Libby said.

Pre-pandemic, the captives were able to artificially inflate

residuals, making leasing a more attractive option for

discount-conscious consumers, particularly among luxury brands. But

as inventories shrank, that advantage faded.

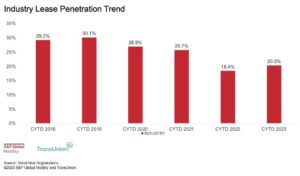

Indeed, the rate of leasing dropped sharply downward – from 30%

penetration in 2019 to just 18% in 2022, as more customers resorted

to borrowing or paying cash for new vehicles, according to S&P

Global AutoCreditInsight data with TransUnion.

“The whole leasing business cratered because there were no

longer any incentives,” Libby said. “Basically, the dealers have

had a huge amount of leverage because of the imbalance between

supply and demand. That affected the lease-loans ratio to a huge

extent.”

While leasing penetration skidded, loyalty to finance

institutions on the leasing side declined from 56.9% in 2019 to

52.6% in 2022, according to S&P Global Mobility

AutoCreditInsight data. Loyalty on the loan side dropped from 22.9%

to 21.9%. One caveat, Libby noted: “When a lease customer switches

to a loan, that decreases loyalty since lessees in general are more

loyal than owners.”

There were bright spots on the lease loyalty side in 2022. Both

GM Financial and Ford Motor Credit Co. stood out, retaining 69.5%

and 67.8% of returning lease customers respectively.

But as leasing slipped, the loan market grew hypercompetitive,

Libby said: “Only one out of every five customers who return with a

loan will go back to the same financial institution. That points

out how incredibly competitive the loan market is. The independent

banks are doing whatever it takes to get the business.”

World Omni Financial Corp. was best at retaining its loan

customers with 44.0% loyalty in 2022, while the Navy FCU and Toyota

Financial Services were the only other two institutions that kept

better than one-in-three loan customers loyal.

Finance institutions are fully aware of the comparative lack of

loyalty on the loan side. Said Libby: “It’s a self-fulfilling

prophecy. Because they realize the customer is so likely to switch,

they’ll be exceptionally aggressive to get the business.”

As pandemic disruptions have diminished, there are signs the

market is shifting back toward some semblance of balance. Leasing

penetration has crept back up to 20% for the first four months of

2023, but it’s still a far cry from where it was before the bottom

dropped out of the market.

AUTO-FINANCE DELINQUENCIES RISE PAST GREAT RECESSION PEAK,

BUT…

2023 AUTOMOTIVE LOYALTY AWARD WINNERS

LOWER-CREDIT BUYERS PUSHED OUT OF NEW VEHICLES

MEASURING VEHICLE LOYALTY, CONQUEST, AND DEFECTION

HOW GENERAL MOTORS MAINTAINS ITS LOYALTY LEAD AMID DECLINING

SALES

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/consumer-loyalty-to-finance-companies-fell-sharply.html

- :has

- :is

- :not

- :where

- ][p

- $UP

- 10

- 2019

- 2020

- 2022

- 2023

- 22

- 26

- 39

- 52.6%

- 67

- a

- Able

- According

- accurately

- achieved

- ADvantage

- aggressive

- All

- also

- Amid

- among

- amount

- an

- analysis

- and

- Another

- any

- ARE

- article

- AS

- Associate

- At

- attractive

- auto

- automotive

- award

- aware

- back

- Balance

- Bank

- Banks

- Basically

- basis

- BE

- because

- been

- before

- BEST

- Better

- between

- Big

- BMW

- Borrowing

- both

- Bottom

- brand

- brands

- Bright

- business

- but

- buyers

- Buying

- Buyouts

- by

- Calendar

- california

- carried

- Cash

- changed

- Chart

- chase

- CO

- combined

- Companies

- competition

- competitive

- completely

- conditions

- consumer

- Consumers

- contributed

- Corp

- could

- credit

- Credit Unions

- customer

- Customers

- data

- Decline

- Declines

- Declining

- decreases

- Demand

- direction

- Director

- disruptions

- distressed

- distributors

- Division

- do

- doing

- downward

- dramatic

- dramatically

- driven

- Drop

- dropped

- during

- dynamics

- Early

- element

- end

- equity

- Ether (ETH)

- Even

- Every

- explanation

- extent

- factors

- Fall

- far

- Far Cry

- Federal

- finance

- financial

- financial institution

- financial services

- financing

- First

- fit

- five

- following

- For

- Ford

- Forecast

- four

- from

- fully

- Gainers

- Gains

- General

- General Motors

- get

- Global

- GM

- Go

- great

- had

- Half

- Hard

- Have

- having

- High

- higher

- Hit

- households

- How

- HTML

- HTTPS

- huge

- imbalance

- in

- Incentives

- increased

- Increases

- incredibly

- independent

- industry

- Institution

- institutions

- interest

- Interest Rates

- into

- inventory

- IT

- ITS

- JPMorgan

- just

- Keep

- kept

- Lack

- large

- largely

- largest

- later

- lead

- leader

- leasing

- Led

- lender

- lenders

- lending

- less

- Level

- levels

- Leverage

- like

- likely

- little

- ll

- loan

- longer

- Low

- lower

- loyal

- Loyalty

- Luxury

- Macro

- made

- Main

- maintains

- major

- Making

- managed

- managing

- many

- marked

- Market

- marketplace

- measures

- measuring

- merchandise

- metal

- Methodology

- mobility

- monthly

- months

- more

- Motor

- Motors

- moving

- nearly

- Need

- New

- no

- noted

- number

- numbers

- of

- Omni

- on

- ONE

- only

- Option

- or

- Other

- out

- over

- overall

- owners

- Pack

- pandemic

- particular

- particularly

- past

- paying

- payments

- Peak

- penetration

- plato

- Plato Data Intelligence

- PlatoData

- player

- Plummet

- points

- preferences

- Premium

- previous

- Prior

- published

- purchases

- pushed

- RARE

- Rate

- Rates

- ratings

- ratio

- realize

- recession

- Recover

- regional

- representing

- respectively

- result

- retain

- retaining

- return

- returning

- Rise

- s

- S&P

- S&P Global

- Said

- same

- Savings

- saw

- scores

- Second

- seen

- segment

- Sellers

- Services

- sheet

- SHIFTING

- shortage

- shortages

- side

- significantly

- Signs

- since

- site

- smaller

- So

- Solutions

- some

- Source

- specific

- spokesperson

- Still

- Successfully

- supply

- Supply and Demand

- Swing

- Switch

- tactics

- takes

- teachers

- technically

- Tesla

- than

- that

- The

- their

- then

- There.

- they

- this

- those

- three

- Through

- throughout

- to

- took

- top

- Top 10

- topped

- toward

- toyota

- traditional

- Transunion

- trending

- turbulent

- two

- two-thirds

- Unions

- upheaval

- Values

- vehicle

- Vehicles

- volume

- was

- WELL

- were

- whatever

- when

- whether

- which

- while

- WHO

- whole

- will

- with

- world

- would

- years

- yet

- zephyrnet