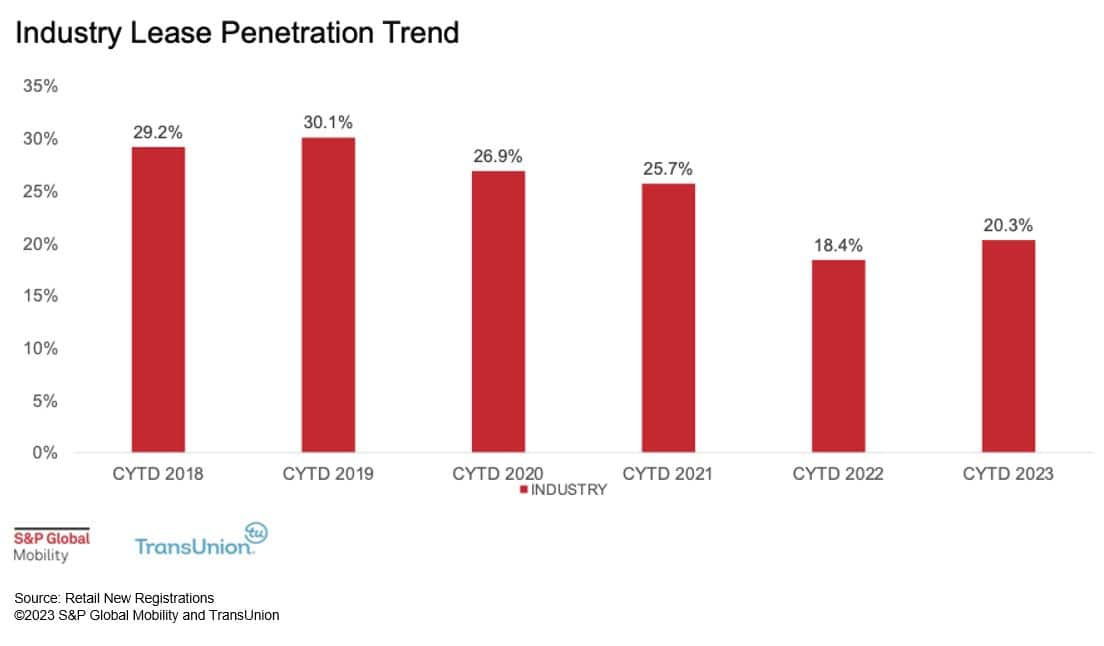

In the years before the pandemic, new car leasing accounted for 25-30% of all retail transactions, and market penetration was as high as 53% in the luxury sector. But during the pandemic, new vehicle leases fell to as low as 17%, and the recovery has been slow. A market analysis of data from S&P Global Mobility and TransUnion predicts leasing will return to form when inventory levels creep nearer to traditional levels which then leads to a need for increased incentives. But it has a long way to recover.

At a time when a lack of vehicle affordability is crushing household budgets, leasing should be an effective way to lure shoppers with Champagne tastes but beer budgets. Data from AutoCreditInsight from S&P Global Mobility and TransUnion shows that leasing penetration has scarcely recovered from its pandemic low, with just a slight rebound to 20.3% for CYTD 2023 through September.

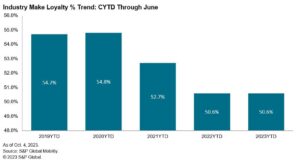

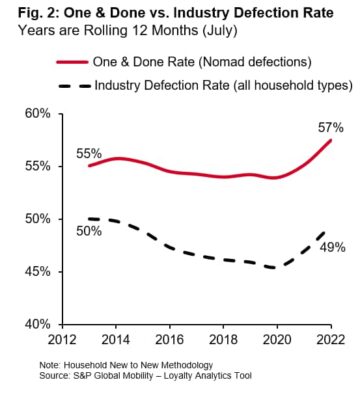

The recent underlying lease trends are not healthy. While nearly half of lease returnees opted to lease again in 2019, that number dropped to 28% in 2022. What's more, first-time lessees in 2022 were less than 30 percent of the leasing market.

This is bad news for dealers and OEMs, because fewer first-time lessees decrease the long-term value of that consumer as a potential returning customer - along with decreased opportunities for certified pre-owned sales in the future.

Leasing and brand loyalty

To understand the decline in leasing, you must return to the new vehicle inventory crisis of 2021. As new vehicle inventories declined due to logistical issues and chip shortages, dealer mark-ups rose, and consumer incentives disappeared. Dealers wanted a profitable purchase transaction over leasing; consumers in need of a vehicle were not in a position to negotiate and thus were not presented with leasing options at the dealership.

The combination of these market conditions meant leasing was a tertiary thought for everyone involved. As these tight conditions retreat, the market will see a return of inventory and negotiating power for the consumers - and leasing will again to be considered by the dealers.

Because of the quick-turn nature of leasing, the strength of the captive leasing incentive programs, and the likely return of the vehicle to the original dealer - compared to a new vehicle that was financed for a longer term - leasing carries far stronger loyalty rates.

If one were to apply the lease penetration rate from 2022 to the volume of 2023, it's estimated that there would have been more than 630,000 additional vehicles leased. When applying the lease loyalty lift vs purchase or finance, there would have been nearly 103,000 more transactions that likely would have stayed brand loyal, according to S&P Global Mobility estimates.

To jumpstart the idea of leasing, manufacturers will realize the need to re-start the incredibly valuable marketing machine they created. But it will take baseline factors of declining interest rates, pricing stability, and normalization of inventory levels.

"Manufacturers were selling to the walls every month when inventories were constrained, so they had no reason to offer incentives. In fact, the most popular vehicles were regularly being sold for over MSRP," said Jill Louden, associate director for AutoCreditInsight at S&P Global Mobility.

"The stars will align if manufacturers would turn on subvented leasing once they are more comfortable with inventory days' supply and start to see increased competition. Leasing business flows through their own captive finance companies as there is less competition from other lenders in leasing," Louden added.

Louden said subvented leases may seem short-sighted, but they lead to loyalty to the brand. In fact, 79 percent of consumers who lease again are make-loyal - which makes it prudent for dealers to stay in touch with leasing customers to keep them from defecting to another brand. This is especially true with luxury brands.

Consumer benefits of leasing start with a lower monthly payment for the equivalent vehicle, approximately $175 less per month on new non-luxury payments.

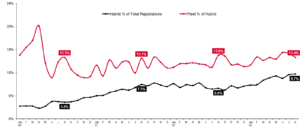

However, monthly lease payments have not escaped the inflationary spiral in the retail car business. Lease payments today are as high as finance payments were just a few years ago. So instead of leasing, consumers are increasingly financing new vehicle purchases for longer terms. Loans of 84 months have grown from 5.4% of retail loans in 2021 to 10.4% in 2023, according to S&P Global Mobility and TransUnion AutoCreditInsight analysis.

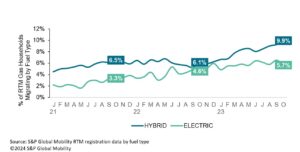

Leasing also benefits OEMs by fostering a faster return to market. Nearly two-thirds of lease households RTM within 36 months, compared to 51% of purchase households. This can enhance brand engagement, facilitate more opportunities to upsell or cross-sell, and strengthen loyalty to the brand.

"With leasing, OEMs will see a competitive advantage for their captive finance companies in segments and markets where the banks and credit unions would not be as competitive or participate at all," Louden said.

Lease returns dropping in late '24

However, the inventory constraints of the past few years will delay the leasing party from starting up again anytime soon. In fact, while expected lease terminations are expected to rise to about 800,000 units by Q2 2024, they should steadily decline in Q3 and Q4, ending 2024 at fewer than 500,000 units, according to the TransUnion consumer credit database.

As a result, unless prompted by external factors, recent trends indicate that the popularity of leasing is several years away at best, said Satyan Merchant, senior vice president for the automotive line of business at TransUnion.

"Leasing will be in vogue again when manufacturers want it to be, because leasing and lending incentives are determined by inventories," Merchant said. "It's like the iPhone: People want a new vehicle every few years and they can get that through auto leasing."

CHECK OUT OUR RTM AND LEASE-ENDING DATA

LEARN MORE FROM AUTOCREDITINSIGHT

CONSUMER LOYALTY TO FINANCE COMPANIES FELL SHARPLY DURING PANDEMIC

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/when-will-car-leasing-be-cool-again.html

- :has

- :is

- :not

- :where

- ][p

- $UP

- 000

- 10

- 20

- 2019

- 2021

- 2022

- 2023

- 2024

- 30

- 36

- 500

- 84

- a

- About

- According

- accounted

- added

- Additional

- ADvantage

- again

- ago

- align

- All

- along

- also

- an

- analysis

- and

- Another

- Apply

- Applying

- approximately

- ARE

- article

- AS

- Associate

- At

- auto

- automotive

- away

- Bad

- Banks

- Baseline

- BE

- because

- been

- beer

- before

- being

- benefits

- BEST

- brand

- brands

- Budgets

- business

- but

- by

- CAN

- Can Get

- car

- Certified

- Champagne

- chip

- combination

- comfortable

- Companies

- compared

- competition

- competitive

- conditions

- considered

- constraints

- consumer

- Consumers

- Cool

- created

- credit

- Credit Unions

- crisis

- customer

- Customers

- data

- Database

- Days

- dealer

- Decline

- Declining

- decrease

- decreased

- delay

- determined

- Director

- Division

- dropped

- Dropping

- due

- during

- Effective

- ending

- engagement

- enhance

- Equivalent

- especially

- estimated

- estimates

- Ether (ETH)

- Every

- everyone

- expected

- external

- facilitate

- fact

- factors

- faster

- few

- fewer

- finance

- financed

- financing

- Flows

- For

- form

- fostering

- from

- future

- get

- Global

- grown

- had

- Half

- Have

- healthy

- High

- household

- households

- HTML

- HTTPS

- idea

- if

- in

- Incentive

- Incentives

- increased

- increasingly

- incredibly

- indicate

- Inflationary

- instead

- interest

- inventory

- involved

- iPhone

- issues

- IT

- ITS

- jpg

- just

- Keep

- Lack

- Late

- lead

- Leads

- lease

- leasing

- lenders

- lending

- less

- levels

- like

- likely

- Line

- Loans

- Long

- long-term

- longer

- Low

- lower

- loyal

- Loyalty

- Luxury

- machine

- MAKES

- managed

- Manufacturers

- Market

- Market Analysis

- market conditions

- Marketing

- Markets

- May..

- meant

- Merchant

- mobility

- Month

- monthly

- months

- more

- most

- Most Popular

- must

- Nature

- nearly

- Need

- New

- news

- no

- number

- of

- offer

- on

- once

- ONE

- opportunities

- Options

- or

- original

- Other

- our

- out

- over

- own

- pandemic

- participate

- party

- past

- payment

- payments

- penetration

- People

- per

- percent

- plato

- Plato Data Intelligence

- PlatoData

- Popular

- popularity

- position

- potential

- power

- Predicts

- presented

- president

- pricing

- profitable

- Programs

- published

- purchase

- purchases

- Q2

- Q3

- Rate

- Rates

- ratings

- realize

- reason

- rebound

- recent

- Recover

- recovery

- regularly

- result

- retail

- Retreat

- return

- returning

- returns

- Rise

- ROSE

- RTM

- s

- S&P

- S&P Global

- Said

- sales

- sector

- see

- seem

- segments

- Selling

- senior

- September

- several

- Shoppers

- shortages

- should

- Shows

- slow

- So

- sold

- Soon

- Stability

- Stars

- start

- Starting

- stay

- stayed

- steadily

- strength

- Strengthen

- stronger

- supply

- Take

- term

- terms

- tertiary

- than

- that

- The

- The Future

- their

- Them

- then

- There.

- These

- they

- this

- thought

- Through

- Thus

- time

- to

- today

- touch

- traditional

- transaction

- Transactions

- Transunion

- Trends

- true

- TURN

- two-thirds

- underlying

- understand

- Unions

- units

- Valuable

- value

- vehicle

- Vehicles

- vice

- Vice President

- vogue

- volume

- vs

- want

- wanted

- was

- Way..

- were

- What

- when

- which

- while

- WHO

- will

- with

- within

- would

- years

- you

- zephyrnet