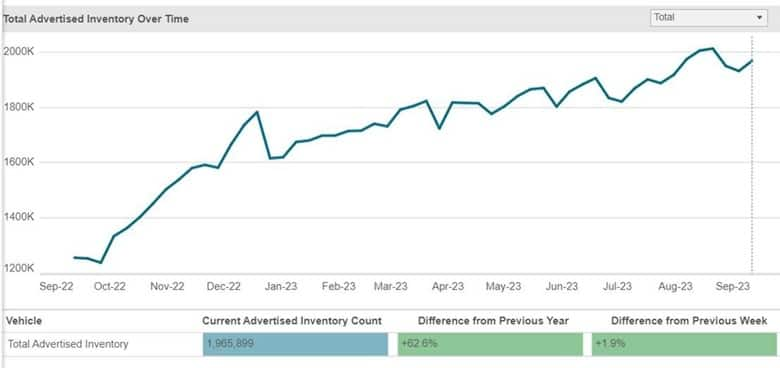

Pulling from advertised dealer

inventory data through the week of Sept. 11, S&P Global

Mobility delivers the following insights:

The auto industry continues its year-long trend

of seeing inventories drop at month-end, then surge through the

first two weeks of the following month. The total advertised dealer

inventory count is slightly down from last month’s high and now

stands at 1.966 million units as of the end of the week of Sept. 11

— still representing a substantial increase since the beginning

of the year. If you smooth the peaks and valleys to a trend line,

it is a stable climb of about 50,000 units of increased inventory

per month – from 1.6 million as of the week of Dec 22, 2022.

Source: S&P Global Mobility Dealer

Advertised Inventory data, week of Sept. 11, 2023 ©2023 S&P

Global Mobility

Full-size pickup trucks have gotten

really expensive

Full-size pickup trucks have been America’s

workhorse for decades. But the pricing ladder in the past year has

swung this segment firmly into luxury-vehicle territory. According

to inventories, it’s nearly impossible to purchase a full-size

pickup for less than $55,000. In fact, the percentage of big trucks

priced above $55,000 has soared compared to this time last year.

Meanwhile, vehicles with MSRPs below $55k represented 35% of the

advertised inventory a year ago; now this is down to 24%.

A year ago, 65 percent of full-size pickups

were advertised above $55,000; as of the week of Sept. 11, that

figure jumped to 76 percent. In the case of the Toyota Tundra and

GMC Sierra 1500, more than half of all advertised inventory is

above $65,000. The Ford F-150 has not had such a dramatic decrease

on the low end (27% to 24%), but vehicles with MSRPs over $65k have

moved from 32% of their advertised inventory to 47%.

Source: S&P Global Mobility Dealer

Advertised Inventory data, week of Sept. 11, 2023 ©2023 S&P

Global Mobility

Mid-sized trucks and the UAW

strike

If the UAW continues to strike the three

mid-sized pickup truck plants, might consumers face shortages, and

might rivals pounce to gain market share?

Here are the respective advertised inventories

as of the end of the week of Sept. 11, along with their most recent

quarterly sales figures.

INVENTORY* 2Q 2023 SALES

Jeep Gladiator 24,249 13,751

Chevrolet Colorado 7,835 19,190

GMC Canyon 2,407 6,708

Ford Ranger 1,358 12,6

Ford Maverick 3,386 21,021

* As of the end of the week of Sept. 11,

2023

Source: S&P Global Mobility Dealer

Advertised Inventory data ©2023 S&P Global Mobility

These numbers above, however, represent

advertised dealer inventory. Witnesses have seen parking lots near

the striking factories filled with finished (or possibly

unfinished) midsize trucks that might not yet be listed in dealer

inventories.

As for rivals to the Ford, GM, and Stellantis

mid-size trucks, the Toyota Tacoma has the most inventory, at about

31,000 units. But that doesn’t necessarily reflect a large days’

supply; Toyota sold 63,262 units in the second quarter. And while

Hyundai Santa Cruz dealer advertised inventories have doubled since

this time last year, to 5,755 units, Hyundai sold 10,753 units in

2Q 2023. Similar quick-to-turn ratios exist for the Honda Ridgeline

and Nissan Frontier. The possibility of conquesting share from the

legacy domestic brands appears incremental at best – especially if

the strike plants come back online soon.

MIDSIZE PICKUP TRUCK

INVENTORIES

Source: S&P Global Mobility Dealer

Advertised Inventory data, week of Sept. 11, 2023 ©2023 S&P

Global Mobility

Luxury brands managing the ’23

selldown

Moving outgoing model-year vehicles off the

showroom floor is a challenge for premium brands. Nothing says

luxury less than distressed merchandise. Overall, the luxury

segment is managing the 2023 model year selldown pretty well, from

305,000 units in mid-July down to 275,000 in mid-September.

To be sure, the Japanese luxury brands often

begin turning over their model year in October, so they still have

some time. However, Lexus’ 2023 dealer advertised inventory

increased in September.

Among the European brands, Audi engineered a

summer selldown of Q5 crossovers, giving it the largest inventory

decrease in the luxury segment – essentially the same unit count as

Lexus as of the week of Sept. 11. The brand with the most leftover

2023s — Mercedes-Benz — is seeing numbers come down

slightly. But the brand also had a spring launch of the big-selling

2024 model year GLC crossover, which might skew the ’23 to ’24

ratio. Volvo saw a summer spike in 2023 model availability, and has

managed to sell off a chunk of that number, but still has more ’23s

in inventory now than in mid-June.

REMAINING 2023 MODEL YEAR INVENTORIES

— LUXURY

Source: S&P Global Mobility Dealer

Advertised Inventory data, week of Sept. 11, 2023 ©2023 S&P

Global Mobility

Mainstream brand inventories tell

differing stories

Among mainstream brands, every OEM seems to

have a different resolution to sell down their 2023 inventory.

Overall, incoming stocks of 2024 models are

ramping up faster than the 2023s are selling down. Chevrolet

dealers are already advertising more 2024s than 23s. And Ram’s ’23

selldown is on pace with its ’24 ramp-up. However, the Ford brand

is at a new high for 2023 models in dealer stocks as of the week of

Sept. 11, and has hardly any 2024 models listed.

Toyota has faced a limited days’ supply of

inventories on many products, and their 2023 stocks have decreased

promptly over the past six weeks as dealers wait for 2024s.

Meanwhile, Honda has been well into supplying 2024 model year

vehicles since mid-late June – mostly due to the spring arrivals of

the 2024 CR-V and Accord.

REMAINING 2023 MODEL YEAR INVENTORIES

— MAINSTREAM

Source: S&P Global Mobility Dealer

Advertised Inventory data, week of Sept. 11, 2023 ©2023 S&P

Global Mobility

LIGHT VEHICLE SALES FORECASTING

THE AUTO INDUSTRY SHARE

WARS WILL RESUME IN ’23

SUBSCRIBE TO OUR TOP 10

INDUSTRY TRENDS NEWSLETTER

AVERAGE VEHICLE AGE

REACHES RECORD 12.5 YEARS

LOWER-CREDIT BUYERS

PUSHED OUT OF NEW VEHICLES

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/september-auto-inventory-trends.html

- :has

- :is

- :not

- ][p

- $UP

- 000

- 1

- 10

- 11

- 12

- 13

- 19

- 2022

- 2023

- 2024

- 22

- 23

- 237

- 24

- 31

- 35%

- 50

- 65

- 7

- a

- About

- above

- accord

- According

- Advertising

- age

- ago

- All

- along

- already

- also

- america

- and

- any

- ARE

- article

- AS

- At

- audi

- auto

- availability

- back

- BE

- been

- begin

- Beginning

- below

- BEST

- Big

- brand

- brands

- but

- buyers

- by

- case

- challenge

- Chevrolet

- climb

- Colorado

- come

- compared

- Consumers

- continues

- data

- Days

- dealer

- decades

- decrease

- decreased

- delivers

- different

- differing

- distressed

- Division

- doesn

- Domestic

- doubled

- down

- dramatic

- Drop

- due

- end

- especially

- essentially

- European

- Every

- exist

- Face

- faced

- fact

- factories

- faster

- Figure

- Figures

- filled

- firmly

- First

- Floor

- following

- For

- Ford

- from

- Frontier

- Gain

- Giving

- gladiator

- Global

- GM

- had

- Half

- Have

- High

- However

- HTML

- HTTPS

- Hyundai

- if

- impossible

- in

- Incoming

- Increase

- increased

- industry

- insights

- into

- inventory

- inventory data

- IT

- ITS

- Japanese

- jpg

- june

- ladder

- large

- largest

- Last

- Last Year

- launch

- Leftover

- Legacy

- less

- lexus

- light

- Limited

- Line

- Listed

- lots

- Low

- Luxury

- Mainstream

- managed

- managing

- many

- Market

- market share

- maverick

- Meanwhile

- merchandise

- mid-size

- might

- million

- mobility

- model

- models

- Month

- more

- most

- mostly

- moved

- MSRPs

- Near

- nearly

- necessarily

- New

- Nissan

- nothing

- now

- number

- numbers

- october

- of

- off

- often

- on

- online

- or

- our

- out

- over

- overall

- Pace

- parking

- past

- per

- percent

- percentage

- Pickup

- plants

- plato

- Plato Data Intelligence

- PlatoData

- possibility

- possibly

- Premium

- pretty

- pricing

- Products

- published

- purchase

- pushed

- Quarter

- RAM

- ramping

- ratings

- ratio

- Reaches

- really

- recent

- record

- reflect

- represent

- represented

- representing

- Resolution

- respective

- resume

- rivals

- s

- S&P

- S&P Global

- sales

- same

- Santa

- saw

- says

- Second

- second quarter

- seeing

- seems

- seen

- segment

- sell

- Selling

- sept

- September

- Share

- shortages

- similar

- since

- SIX

- skew

- smooth

- So

- soared

- sold

- some

- Soon

- spike

- spring

- stable

- stands

- Still

- Stocks

- strike

- substantial

- such

- summer

- supply

- supplying

- sure

- surge

- T

- Tacoma

- tell

- territory

- than

- that

- The

- their

- then

- they

- this

- three

- Through

- time

- to

- top

- Top 10

- Total

- toyota

- Trend

- Trends

- truck

- Trucks

- Turning

- two

- unit

- units

- vehicle

- Vehicles

- volvo

- wait

- was

- week

- Weeks

- WELL

- were

- which

- while

- will

- with

- XML

- year

- yet

- you

- zephyrnet