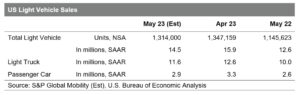

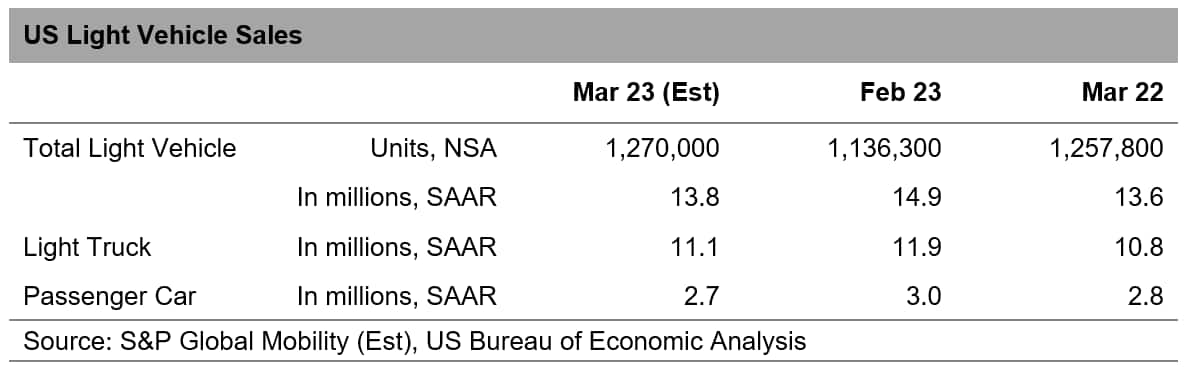

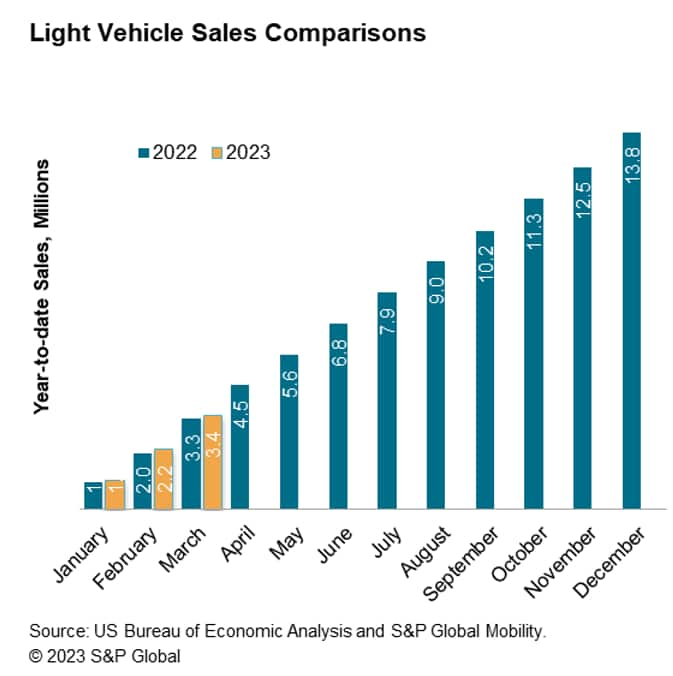

With volume for the month projected at 1.27 million units,

S&P Global Mobility analysts expect March 2023 to be up more

than 11% from the month-prior tally, attributable to three

additional selling days. The expected March 2023 volume would be

aligned with the year-ago period (with the same number of selling

days), reflecting that sales momentum will be difficult to sustain

given current economic headwinds and tailwinds.

March 2023 US auto sales are expected to translate to an

estimated sales pace of 13.8 million units (seasonally adjusted

annual rate: SAAR), down meaningfully from the January 2023 reading

of 15.9 million units. However, that pace would bring the first

quarter average sales rate to 14.9 million units. This would

represent the strongest quarterly pace since the second quarter of

2021 – albeit nowhere near the SAAR reading of 16.7 million units

at that time, when the auto market was still experiencing the

pleasantness of stimulus checks and before supply chain issues

began.

“Incoming reports of sustained – but still muted – retail demand

in March reflect that those auto consumers willing, ready, and able

to enter into a new vehicle agreement are continuing to do so, even

in light of rising interest rates and still-high vehicle price

levels,” said Chris Hopson, principal analyst at S&P Global

Mobility. “New vehicle incentives are rising slowly from

historically low levels as vehicle production advances. The specter

of further hikes in interest rates, and acceptance of current

unsettled economic conditions, may be providing impetus for those

considering purchasing a new vehicle.”

S&P Global Mobility projects calendar-year 2023 volume of

14.9 million units in the US, an 8% increase from the 2022 tally.

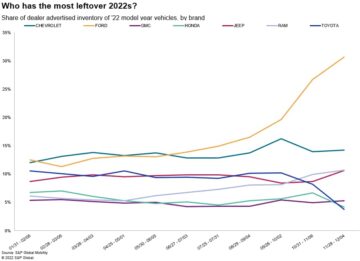

Auto sales will be supported by advancing production levels, along

with reports of sustained retail order books, recovering stock of

vehicles, and improved fleet demand.

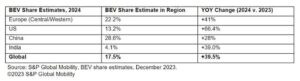

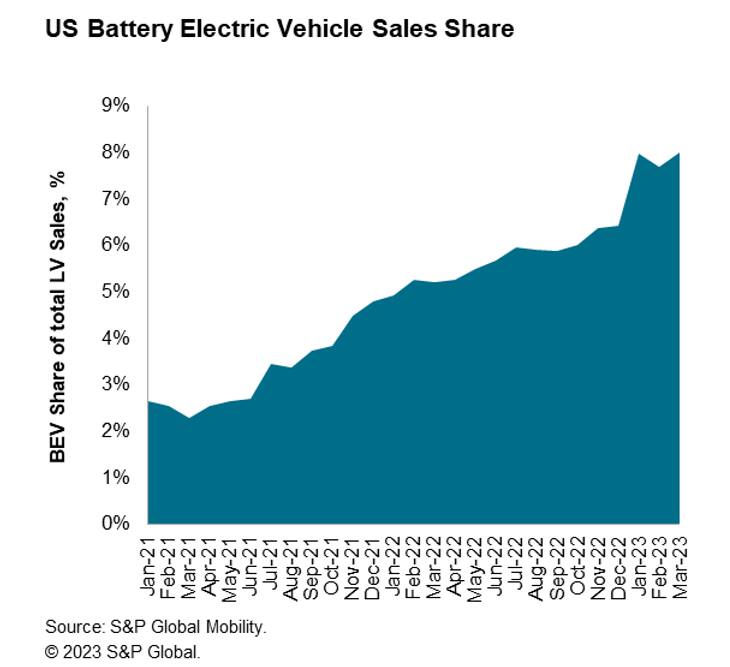

Sustained development of battery-electric vehicle (BEV) sales

remains a consistent assumption for 2023. BEV share has hovered

around 8% over the course of the first two months of the year. At a

projected level of 8.0% share is expected to remain strong. While

Tesla’s pricing adjustments were the first shot in a BEV price war,

the reaction of other auto companies will determine whether the

gains in the BEV mix level will be a blip in the trend or a dynamic

tipping point in the electrification progress of the market. Beyond

the pricing developments, a sustained churn of new and refreshed

BEVs will continue to promote BEV sales as the year progresses.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/us-auto-sales-sustain-muted-progress-in-march.html

- :is

- ][p

- $UP

- 1

- 2021

- 2022

- 2023

- 7

- 8

- 9

- a

- Able

- acceptance

- Additional

- Adjusted

- adjustments

- advances

- Agreement

- aligned

- analyst

- Analysts

- and

- annual

- ARE

- around

- article

- AS

- assumption

- At

- auto

- average

- BE

- before

- began

- Beyond

- Books

- bring

- by

- chain

- Checks

- Chris

- Companies

- conditions

- considering

- consistent

- Consumers

- continue

- continuing

- course

- Current

- Days

- Demand

- Determine

- Development

- developments

- difficult

- Division

- down

- dynamic

- Economic

- Economic Conditions

- Enter

- estimated

- Ether (ETH)

- Even

- expect

- expected

- experiencing

- First

- FLEET

- For

- from

- further

- Gains

- given

- Global

- headwinds

- Hikes

- historically

- However

- HTTPS

- improved

- in

- Incentives

- Incoming

- Increase

- interest

- Interest Rates

- issues

- January

- Level

- levels

- light

- Low

- low levels

- managed

- March

- Market

- million

- mobility

- Momentum

- Month

- months

- more

- Near

- New

- number

- of

- order

- order books

- Other

- Pace

- period

- plato

- Plato Data Intelligence

- PlatoData

- Point

- price

- pricing

- Principal

- Production

- Progress

- projected

- projects

- promote

- providing

- published

- purchasing

- Quarter

- Rate

- Rates

- ratings

- reaction

- Reading

- ready

- recovering

- reflect

- remain

- remains

- Reports

- represent

- retail

- rising

- s

- S&P

- S&P Global

- Said

- sales

- same

- Second

- second quarter

- Selling

- Share

- since

- Slowly

- So

- specter

- Still

- stimulus

- stimulus checks

- stock

- strong

- supply

- supply chain

- Supported

- Tally

- Tesla

- that

- The

- three

- time

- Tipping

- Tipping point

- to

- translate

- Trend

- units

- us

- vehicle

- Vehicles

- volume

- war

- whether

- which

- while

- will

- willing

- with

- would

- year

- zephyrnet