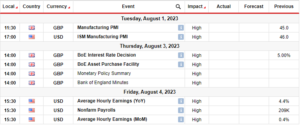

- Reports on US consumer confidence and job openings came in lower than expected.

- Private employment in the US fell while the core PCE figure came in as expected.

- The US unemployment rate jumped, showing signs of an easing labor market.

The AUD/USD weekly forecast is bearish as investors expect the RBA to pause at the next policy meeting.

Ups and downs of AUD/USD

AUD/USD closed the week with gains but far below the week’s highs. The fluctuations came amid mixed economic releases from the US. The week started with reports on consumer confidence and job openings. Both reports came in lower, increasing bets of a Fed pause. This saw the dollar weaken, boosting the Aussie.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

Afterward, investors received employment and inflation data. Private employment in the US fell while the core PCE figure came in as expected. However, on Friday, a mixed report saw the dollar fall before rising. While US employment figures beat forecasts, the unemployment rate jumped, showing signs of an easing labor market.

Next week’s key events for AUD/USD

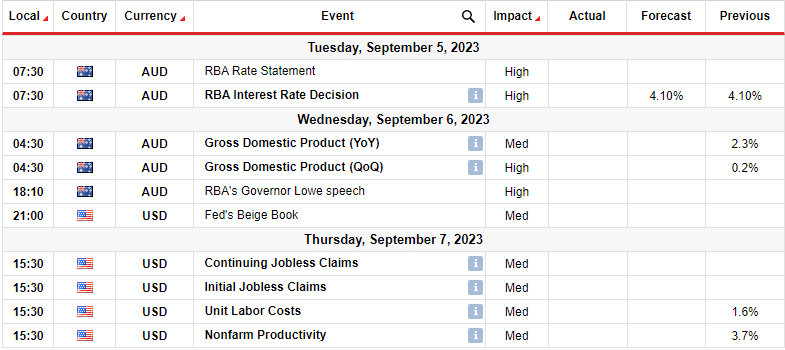

Investors are eagerly awaiting the RBA policy meeting on Tuesday. Apart from this, Australia will release GDP data showing the state of the economy. Meanwhile, the US will release weekly employment data.

Economists say the RBA will maintain its key interest rate on Tuesday. Most economists, however, anticipate a final rate hike in the next quarter.

Due to recent decreases in inflation and a slight uptick in unemployment, economists believe that on September 5, the RBA will retain its official cash rate at 4.10%, aligning with the pricing of interest rate futures.

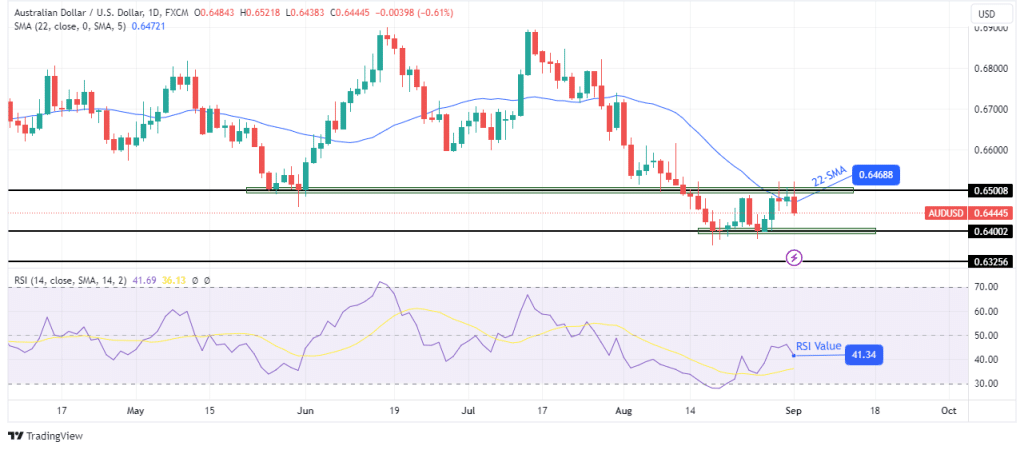

AUD/USD weekly technical forecast: Bearish pressure below 0.6500

On the daily chart, AUD/USD is pushing lower after facing resistance at the 22-SMA and the 0.6500 key level. The bearish bias is strong as the price has kept below the SMA for some time. At the same time, the RSI has traded in the bearish territory below 50.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

The bearish move, however, stopped at the 0.6400 support level, allowing bulls to retrace the move. Since then, the price has consolidated within the 0.6400-0.6500 range. However, with resistance from the 22-SMA, bears might finally be strong enough to break below the 0.6400 support. A break below this support would pave the way for a retest of the 0.6325 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/aud-usd-weekly-forecast-rba-likely-to-hold-in-next-meeting/

- :has

- :is

- 1

- 50

- a

- About

- Accounts

- After

- aligning

- Allowing

- Amid

- an

- and

- anticipate

- apart

- ARE

- AS

- At

- AUD/USD

- aussie

- Australia

- awaiting

- BE

- bearish

- Bears

- before

- believe

- below

- Bets

- bias

- boosting

- both

- Break

- Bulls

- but

- came

- CAN

- Cash

- CFDs

- Chart

- check

- closed

- confidence

- Consider

- consumer

- Core

- daily

- data

- decreases

- detailed

- Dollar

- downs

- eagerly

- easing

- Economic

- economists

- economy

- employment

- enough

- events

- expect

- expected

- facing

- Fall

- far

- Fed

- Figure

- Figures

- final

- Finally

- fluctuations

- For

- Forecast

- forecasts

- forex

- Friday

- from

- Futures

- Gains

- GDP

- High

- Highs

- Hike

- hold

- However

- HTTPS

- in

- increasing

- inflation

- interest

- INTEREST RATE

- interested

- Invest

- investor

- Investors

- ITS

- Job

- kept

- Key

- labor

- labor market

- LEARN

- Level

- likely

- lose

- losing

- lower

- maintain

- Market

- max-width

- Meanwhile

- meeting

- might

- mixed

- money

- more

- most

- move

- next

- now

- of

- official

- on

- openings

- our

- pause

- pave

- pce

- plato

- Plato Data Intelligence

- PlatoData

- policy

- pressure

- price

- pricing

- private

- provider

- Pushing

- Quarter

- range

- Rate

- Rate Hike

- RBA

- received

- recent

- release

- Releases

- report

- Reports

- Resistance

- retail

- retain

- rising

- Risk

- rsi

- same

- saw

- say

- September

- should

- showing

- Signs

- since

- SMA

- some

- started

- State

- stopped

- strong

- support

- support level

- Take

- Technical

- territory

- than

- that

- The

- The State

- then

- this

- time

- to

- trade

- traded

- Trading

- Tuesday

- unemployment

- unemployment rate

- us

- US Unemployment Rate

- Way..

- week

- weekly

- when

- whether

- while

- will

- with

- within

- would

- you

- Your

- zephyrnet