- Data revealed a record surge in UK basic wages.

- The UK’s unemployment rate climbed to 4.2% from 4.0%.

- Market estimates suggest a 55% likelihood of the BoE’s benchmark rates reaching 6% in early 2024.

Today’s GBP/USD price analysis is bullish. On Tuesday, the British pound gained ground following data revealing a record surge in UK basic wages. Consequently, this development heightened the Bank of England’s concerns about inflation. The pound marked a 0.12% increase.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Initially, it had risen by as much as 0.28% to $1.2720 after the release of the wage data. Notably, British wages, excluding bonuses, surged by 7.8% compared to the same period the previous year, spanning three months ending in June.

This upturn represented the highest annual growth rate since comparable records were initiated in 2001. Surprisingly, the UK’s unemployment rate climbed to 4.2% from 4.0%. Analysts noted that this wage rise and unemployment could complicate the Bank of England’s decision-making.

Moreover, pay growth appears poised to surpass the rate of consumer price inflation, projected to slow to 6.8% in July. This is according to upcoming data from the ONS on Wednesday. Meanwhile, market estimates suggest a 55% likelihood of the BoE’s benchmark rates reaching 6% in early 2024, up from their current level of 5.25%.

Elsewhere, Governor Andrew Bailey remarked earlier that the pace of pay growth exceeded the central bank’s predictions. However, the BoE also hinted that it was nearing a pause in its series of interest rate increases. Bailey and his colleagues might find solace in some indications of a cooling labor market beyond the pay data.

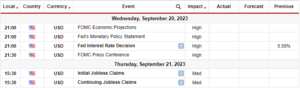

GBP/USD key events today

Investors will now focus on the US, which will release retail sales data. They expect to see a drop in core retail sales and an increase in retail sales in July.

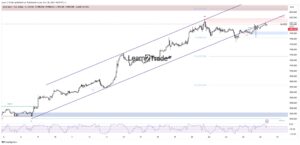

GBP/USD technical price analysis: Bulls push above 30-SMA and 1.2701 resistance.

The pound is pushing above the charts’ 30-SMA and 1.2701 resistance level. Bulls took control at the 1.2625 support level with a strong candle that paused at the 1.2701 resistance. The bulls have now gathered enough momentum to go above this resistance.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Moreover, the RSI has crossed above 50, indicating a stronger bullish momentum. If bulls can close above this resistance zone, the price will likely retest the next resistance level at 1.2803.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-price-analysis-pound-soars-amid-upbeat-basic-wages/

- :has

- :is

- $UP

- 1

- 167

- 2%

- 2001

- 2024

- 30

- 300

- 50

- 7

- a

- About

- above

- According

- Accounts

- After

- also

- Amid

- an

- analysis

- Analysts

- and

- Andrew

- Andrew Bailey

- annual

- AS

- At

- BAILeY

- Bank

- Bank of England

- basic

- Benchmark

- Beyond

- BoE

- bonuses

- boost

- British

- British Pound

- Bullish

- Bulls

- by

- CAN

- central

- CFDs

- check

- Climbed

- Close

- colleagues

- comparable

- compared

- Concerns

- Consequently

- Consider

- consumer

- Container

- control

- Core

- could

- Crossed

- Current

- data

- Decision Making

- detailed

- Development

- Drop

- Earlier

- Early

- England

- England’s

- enough

- estimates

- events

- exceeded

- excluding

- expect

- Find

- Focus

- following

- forex

- from

- gained

- gathered

- GBP/USD

- Go

- Governor

- Ground

- Growth

- had

- Have

- heightened

- High

- highest

- his

- However

- HTTPS

- if

- in

- Increase

- Increases

- indicating

- indications

- inflation

- initially

- initiated

- interest

- INTEREST RATE

- interested

- Invest

- investor

- IT

- ITS

- July

- june

- Key

- labor

- labor market

- learning

- Level

- likelihood

- likely

- lose

- losing

- Making

- marked

- Market

- max-width

- Meanwhile

- might

- Momentum

- money

- months

- more

- much

- nearing

- next

- notably

- noted

- now

- of

- on

- our

- Pace

- pause

- Pay

- period

- plato

- Plato Data Intelligence

- PlatoData

- poised

- pound

- Predictions

- previous

- price

- Price Analysis

- projected

- provider

- Push

- Pushing

- Rate

- Rates

- reaching

- record

- records

- release

- remarked

- represented

- Resistance

- retail

- Retail Sales

- Revealed

- revealing

- Rise

- Risen

- Risk

- robust

- ROW

- rsi

- s

- sales

- same

- see

- Series

- should

- since

- slow

- Soars

- some

- spanning

- strong

- stronger

- suggest

- support

- support level

- surge

- Surged

- surpass

- SVG

- Take

- Technical

- that

- The

- the UK

- their

- they

- this

- three

- to

- today’s

- took

- trade

- Trading

- Tuesday

- Uk

- unemployment

- unemployment rate

- upcoming

- us

- wage

- wages

- was

- Wednesday

- were

- when

- whether

- which

- will

- with

- year

- you

- Your

- zephyrnet