- The US inflation scenario is now leaning towards lower levels.

- The dollar index is poised for a weekly loss of approximately 0.73%.

- Data revealed a 2.5% year-on-year increase in Japan’s core consumer prices for November.

Friday’s USD/JPY price analysis was bearish, with the dollar weak and investors on the edge as they eagerly anticipated US inflation data. According to Chris Weston, the head of research at Pepperstone, the US inflation scenario is now unbalanced and leaning towards lower levels.

Moreover, the dollar index is poised for a weekly loss of approximately 0.73%, extending the previous week’s 1.3% decline.

Meanwhile, the yen held steady, unaffected by Friday’s data revealing a 2.5% year-on-year increase in Japan’s core consumer prices for November. It marked the slowest growth over a year. Moreover, this eases pressure on the Bank of Japan to scale back its substantial stimulus. Notably, the core consumer price index decelerated from the 2.9% gain in October.

Furthermore, the Japanese currency appears poised to end the week flat. Earlier in the week, the BoJ maintained its ultra-loose policy settings and provided few indications of when it might shift away from negative interest rates.

Elsewhere, the minutes of the Bank of Japan’s October meeting revealed ongoing divisions among board members regarding the timeline for Japan to meet conditions for an exit. Meanwhile, a Reuters poll conducted in November showed that over 80% of economists expected that the BoJ would conclude its negative rate policy next year.

USD/JPY key events today

- US Core PCE Price Index m/m

- Revised UoM US Consumer Sentiment

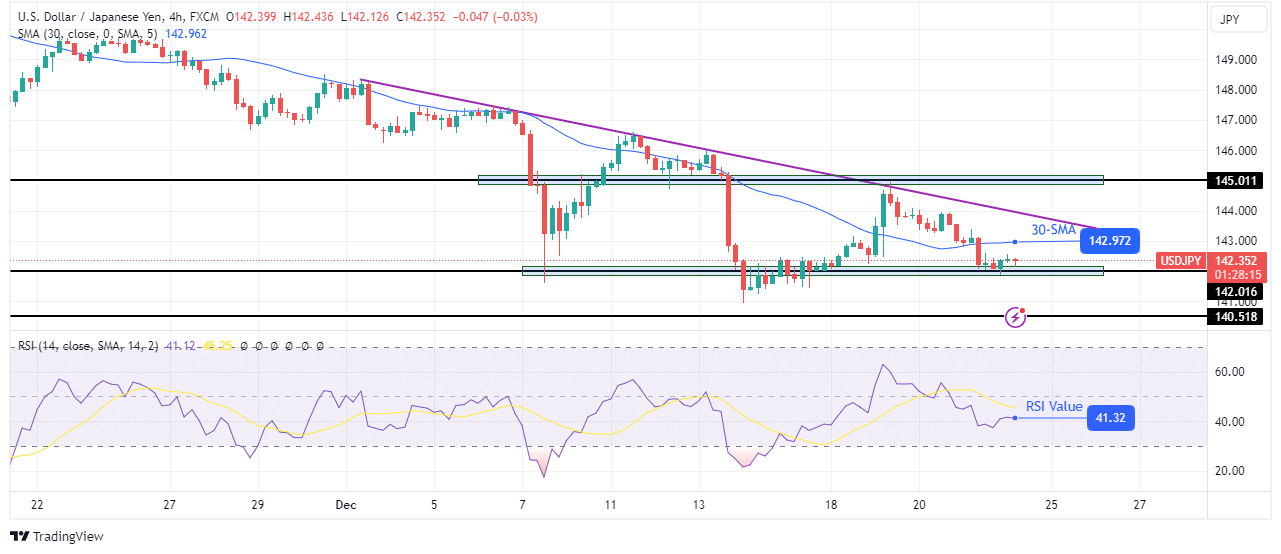

USD/JPY technical price analysis: Price returns to crucial 142.01 support level

On the charts, USD/JPY is back at the 142.01 support level. This comes after a failed attempt to reverse the trend. Initially, buyers threatened to take control when sellers challenged the 142.01 level a second time and failed to break below. However, the price stopped at the resistance trendline and the 145.01 key level.

–Are you interested to learn more about forex tools? Check our detailed guide-

Therefore, sellers reversed the bullish move and pushed the price back below the 30-SMA. Sellers are challenging the 142.01 support level for a third time. If they are strong enough, the price will break below and fall to the 140.51 level and lower. However, if the support is firm, bulls might resurface.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/22/usd-jpy-price-analysis-investors-on-edge-ahead-of-us-inflation/

- :is

- 01

- 1

- 51

- a

- About

- According

- Accounts

- After

- ahead

- among

- an

- analysis

- and

- Anticipated

- appears

- approximately

- ARE

- AS

- At

- attempt

- away

- back

- Bank

- bank of japan

- bearish

- below

- board

- boj

- Break

- Bullish

- Bulls

- buyers

- by

- CAN

- CFDs

- challenged

- challenging

- Charts

- check

- Chris

- comes

- conclude

- conditions

- conducted

- Consider

- consumer

- consumer price index

- control

- Core

- crucial

- Currency

- data

- Decline

- detailed

- Dollar

- dollar index

- eagerly

- Earlier

- Eases

- economists

- Edge

- end

- enough

- events

- Exit

- expected

- extending

- Failed

- Fall

- few

- Firm

- flat

- For

- forex

- from

- Gain

- Growth

- head

- Held

- High

- However

- HTTPS

- if

- in

- Increase

- index

- indications

- inflation

- initially

- interest

- Interest Rates

- interested

- Invest

- investor

- Investors

- IT

- ITS

- Japan

- Japan’s

- Japanese

- Key

- LEARN

- Level

- levels

- lose

- losing

- loss

- lower

- marked

- max-width

- Meet

- meeting

- Members

- might

- minutes

- money

- more

- Moreover

- move

- negative

- negative interest rates

- next

- November

- now

- october

- of

- on

- ongoing

- our

- over

- pce

- pepperstone

- plato

- Plato Data Intelligence

- PlatoData

- poised

- policy

- poll

- pressure

- previous

- price

- Price Analysis

- Prices

- provided

- provider

- pushed

- Rate

- Rates

- regarding

- research

- Resistance

- retail

- returns

- Reuters

- Revealed

- revealing

- reverse

- Risk

- Scale

- scenario

- Second

- Sellers

- settings

- shift

- should

- showed

- steady

- stimulus

- stopped

- strong

- substantial

- support

- support level

- Take

- Technical

- that

- The

- they

- Third

- this

- time

- timeline

- to

- towards

- trade

- Trading

- Trend

- unaffected

- us

- us inflation

- USD/JPY

- was

- week

- weekly

- when

- whether

- will

- with

- would

- year

- Yen

- you

- Your

- zephyrnet