- The RBA’s decision to raise interest rates in June was “finely balanced.”

- The strong jobs report for May solidified the RBA’s hawkish outlook.

- There is a need for Australia’s unemployment rate to increase to mitigate inflation.

Today’s AUD/USD outlook is slightly bearish. The Australian dollar experienced a sharp decline of over 0.8% following the release of minutes of the Reserve Bank of Australia’s recent policy meeting on Tuesday.

-If you are interested in forex day trading then have a read of our guide to getting started-

The minutes revealed that the RBA’s decision to raise interest rates in June was regarded as being “finely balanced.” Still, the Reserve Bank of Australia (RBA) deemed the decision to raise interest rates in June necessary. This was to prevent high inflation from impacting wage and price expectations.

Furthermore, the minutes of the RBA’s June 4 policy meeting, released on Tuesday, revealed that consumer spending was noticeably slowing down. Still, the board believed there were upward risks to inflation.

Moreover, the strong jobs report for May solidified the RBA’s hawkish outlook. Consequently, futures are pricing in a peak for rates around 4.6%, up from 3.85% a few months ago.

With headline inflation remaining high at 7.0% and unemployment reaching near 50-year lows of 3.6%, wage pressures continued to intensify. The board expressed concerns about low productivity and rising wages, noting that the recent national award for low-paid workers had exceeded expectations.

Elsewhere, a senior central banker emphasized the need for Australia’s unemployment rate to increase to mitigate inflation, prevent higher interest rates, and avoid a severe economic downturn. This warning came after data revealed minimal relaxation in an extremely tight labor market.

AUD/USD key events today

Investors will watch out for the building permits report from the US, showing the state of the US housing market. On the other hand, Australia will not be releasing key economic data today.

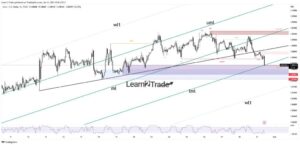

AUD/USD technical outlook: New bearish sentiment faces the 0.6801 support.

Bears have taken control in the 4-hour chart. The price has broken below the 30-SMA support and the RSI below the 50-level. This is an indication that sentiment has shifted to the downside.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Bulls could not surpass the 0.6900 resistance level, allowing bears to take over. However, bears face the 0.6801 support level, which might see the price retest the recently broken SMA. If bears eventually break below 0.6801, the price will likely fall to the next support at 0.6700.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/aud-usd-outlook-aussie-pares-gains-after-rba-minutes/

- :has

- :is

- :not

- $UP

- 1

- 167

- 30

- 300

- 7

- a

- About

- Accounts

- After

- ago

- Allowing

- an

- analysis

- and

- ARE

- around

- AS

- At

- AUD/USD

- aussie

- Australia

- Australian

- Australian dollar

- avoid

- award

- Bank

- banker

- BE

- bearish

- Bears

- being

- believed

- below

- BEST

- board

- Break

- Broken

- Building

- Bulls

- came

- CAN

- central

- CFDs

- Chart

- check

- Concerns

- Consequently

- Consider

- consumer

- Container

- continued

- control

- could

- data

- day

- Day Trading

- decision

- Decline

- deemed

- detailed

- Dollar

- down

- downside

- DOWNTURN

- Economic

- economic downturn

- emphasized

- Ether (ETH)

- events

- eventually

- exceeded

- expectations

- experienced

- expressed

- extremely

- Face

- faces

- Fall

- few

- following

- For

- Forecast

- forex

- from

- Futures

- Gains

- getting

- guide

- had

- hand

- Have

- Hawkish

- headline

- High

- High inflation

- higher

- housing

- housing market

- However

- HTTPS

- if

- impacting

- in

- Increase

- indication

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- Jobs

- jobs report

- june

- Key

- labor

- labor market

- Level

- likely

- looking

- lose

- losing

- Low

- Lows

- Market

- max-width

- May..

- meeting

- might

- minimal

- minutes

- Mitigate

- money

- months

- my

- National

- Near

- necessary

- Need

- New

- next

- noticeably

- noting

- now

- of

- on

- Other

- our

- out

- Outlook

- over

- Peak

- plato

- Plato Data Intelligence

- PlatoData

- policy

- prevent

- price

- Price Analysis

- pricing

- productivity

- provider

- raise

- Rate

- Rates

- RBA

- RBA Minutes

- reaching

- Read

- recent

- recently

- regarded

- relaxation

- release

- released

- releasing

- remaining

- report

- Reserve

- reserve bank

- reserve bank of australia

- Reserve Bank of Australia (RBA)

- Resistance

- retail

- Revealed

- rising

- Risk

- risks

- ROW

- rsi

- s

- see

- senior

- sentiment

- severe

- sharp

- shifted

- should

- showing

- Slowing

- SMA

- Spending

- State

- Still

- strong

- support

- support level

- surpass

- SVG

- Take

- taken

- Technical

- that

- The

- The State

- then

- There.

- this

- to

- today

- today’s

- trade

- Trading

- Tuesday

- unemployment

- unemployment rate

- upward

- us

- US Housing

- US housing market

- wage

- wages

- warning

- was

- Watch

- were

- when

- whether

- which

- will

- with

- workers

- you

- Your

- zephyrnet