Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 17/08/2022

Close to apply: 24/08/2022

Balloting: 01/09/2022

Listing date: 20/09/2022

Close to apply: 24/08/2022

Balloting: 01/09/2022

Listing date: 20/09/2022

Share Capital

Market cap: RM mil

Total Shares: 520 mil units

Industry CARG (2016-2021)

Msia Indutry properties rental income CAGR: 11.59% (data from

Competitors distribution yield

Alsreit: 4.74% (PE104.48, below IPO price RM1.00)

Atrium: 6.5% (PE17.39, above IPO price @ IPO RM1.02)

Axreit: 4.89% (PE14.16, above IPO price @ RM1.25)

AME reit: 5.67% (PE19.33, yield estimated @ pg28)

Business (FYE 2022)

Reit Structure: At least 75% total asset must invested in real estate to generate recurrent rental income.

Financial Limitation: Maximum allow up to 50% for financing.

31 Industrial Properties (Freehold)

3 Industrial-Related Properties (Freehold)

Occupancy Rate: 100%

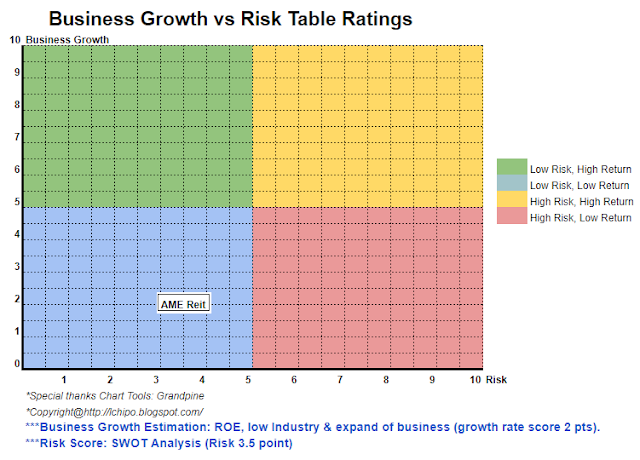

Fundamental

1.Market: Main Market

2.Price: RM1.15 (refund will make if final institutional price lower than RM1.15)

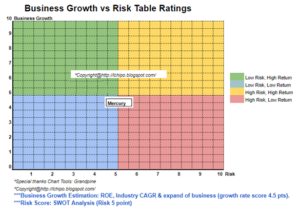

3.P/E: 19.33 @ RM0.0595 (pg28)

4.ROE(Pro Forma III): 5.23%

5.NA after IPO: RM0.99

6.Total debt to current asset after IPO: 0.369 (Debt: 47.5mil, Non-Current Asset: 557mil, Current asset: 17.549mil)

7.Dividend policy: 90% of nett income distribute quartely basic.

8.Syariah Status: Yes (Islamic Reit)

Past Financial Performance (Revenue, Earning Per shares)

2022 (FPE 31Mar): RM35.236 mil (Eps: 0.0518)

2021 (FYE 31Mar): RM28.653 mil (Eps: 0.0377)

2020 (FYE 31Mar): RM26.870 mil (Eps: 0.0392)

Major Sharesholders

Lee Sai Boon: 51.3% (indirect)

Lee Chai: 51.3% (indirect)

Lim Yook Kim: 51.3% (indirect)

Kang Ah Chee: 51.3% (indirect)

Management Fees & Trustee's fees FYE2023 (compare to Rental income)

Management Fees: RM3.573 mil

Trustee's fee: RM0.175 mil

total (max): RM3.748 mil or 9.14%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall the Reit is a bit expensive reit. After listing, might have chance to collect below IPO price.

Overall the Reit is a bit expensive reit. After listing, might have chance to collect below IPO price.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://lchipo.blogspot.com/2022/08/ame-reit.html

- 1

- 11

- 2022

- 39

- 9

- a

- above

- After

- All

- and

- Apply

- asset

- basic

- below

- Bit

- CAGR

- cap

- Center

- Chance

- change

- clear

- collect

- color

- company

- compare

- Current

- data

- Date

- Debt

- decision

- distribute

- distribution

- dividend

- Earning

- estate

- estimated

- Ether (ETH)

- expensive

- fee

- Fees

- final

- financial

- financial performance

- financing

- follow

- Forecast

- fundamental

- generate

- homework

- HTTPS

- in

- Income

- industrial

- Institutional

- invested

- investment

- IPO

- Islamic

- Kim

- limitation

- listing

- Main

- make

- Market

- max

- maximum

- might

- New

- Opinion

- own

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Pro

- properties

- Quarter

- Rate

- Reader

- real

- real estate

- Recommendation

- Red

- refund

- release

- result

- revenue

- Risk

- Shares

- should

- Status

- structure

- Take

- The

- their

- to

- Total

- Trustee

- us

- value

- View

- will

- Yield

- zephyrnet