Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 04/11/2022

Close to apply: 11/11/2022

Balloting: 16/11/2022

Listing date: 23/11/2022

Close to apply: 11/11/2022

Balloting: 16/11/2022

Listing date: 23/11/2022

Share Capital

Market cap: RM98.175mil

Total Shares: 577.5mil shares

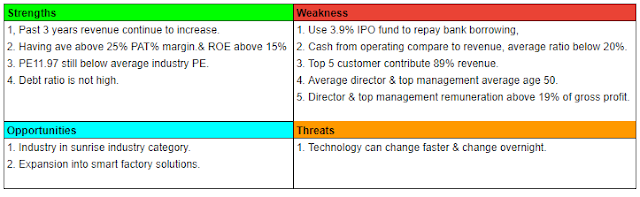

Industry CARG (2015-2021)

Global automated manufacturing solutions industry: 7.9%

Automated manufacturing solutions industry in Malaysia: 17.5%

Competitors PAT%

ECA Integrated Group: 39.9%

Aimflex Berhad:6.2% PE18

BBS Automation Penang Sdn Bhd:78.8%

DNC Automation (M) Sdn Bhd:1.0%

Genetec Technology Berhad:26.0% PE21

Greatech:35.2%, PE38

Pentamaster:17.1%, PE33

Vitrox: PE33

Business (FYE 2022)

Automated manufacturing solution provider.

1.Integrated production systems: 84.6%

2.Standalone automated equipment: 9.9%

3.After sales service to our customers for the provision of technical support services and spare parts: 5.5%

Revenue by Geo

1. Msia: 34.2%

2. Europe: 16.1%

3. Asia: 7.0%

4. North America: 42.7%

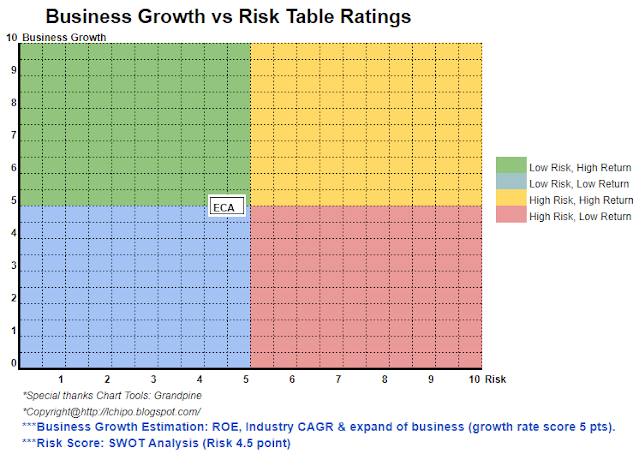

Fundamental

1.Market: Ace Market

2.Price: RM0.17

3.P/E: 11.97 @ RM0.0142

4.ROE(Pro Forma III): 15.4%

5.ROE: 48%(FYE2022), %(FYE2021), 62.8%(FYE2020), 47.3%(FYE2019)

6.NA after IPO: RM0.08

7.Total debt to current asset after IPO: 0.21 (Debt: 10.706mil, Non-Current Asset: 5.950mil, Current asset: 49.075mil)

8.Dividend policy: target 20% PAT dividend policy.

9. Shariah starus: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2022 (FYE 30Jun, 8mths): RM17.816 mil (Eps: 0.0079),PAT: 25.7%

2021 (FYE 31Oct): RM20.511 mil (Eps: 0.0142),PAT: 39.9%

2020 (FYE 31Oct): RM15.367 mil (Eps: 0.0096),PAT: 36.2%

2019 (FYE 31Oct): RM7.671 mil (Eps: 0.0024),PAT: 17.8%

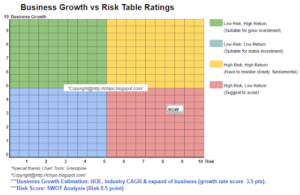

Major customer (2022)

1. Customer B5: 42.4%

2. Customer H: 18.7%

3. Customer C: 10.8%

4. Customer B2: 10.0%

5. Customer A2: 7.1%

***total 89.0%

Major Sharesholders

Mr.Ooi: 24.3%

Mr.Chua: 27.8%

Mr.Kang: 13.6%

Directors & Key Management Remuneration for FYE2023 (from Revenue & other income 2022)

Total director remuneration: RM1.335mil

key management remuneration: RM0.70mil - RM0.850mil

total (max): RM2.185 mil or 19%

Use of funds

1. Acquisition of machineries: 30.2%

2. Repayment of bank borrowings: 3.9%

3. Working capital: 54.9%

5. Listing Expenses: 11%%

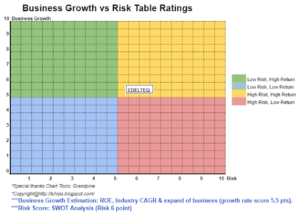

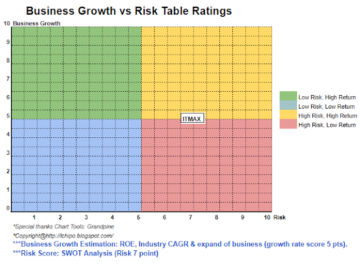

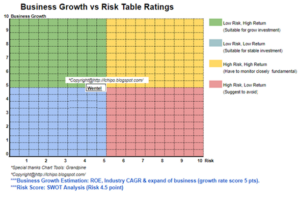

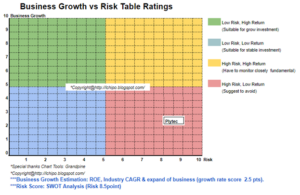

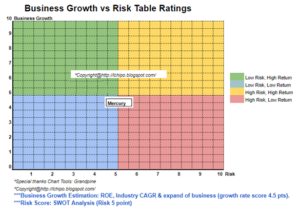

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is a slightly above normal IPO. Investor need to take note on the cash operating cashflow is not strong, & need to be monitor for every QR result.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://lchipo.blogspot.com/2022/11/eca-integrated-solution-berhad.html

- 1

- 10

- 11

- 2%

- 2022

- 39

- 7

- 84

- 9

- a

- above

- acquisition

- After

- All

- america

- and

- Apply

- asia

- asset

- Automated

- Automation

- Bank

- cap

- capital

- Cash

- Center

- change

- clear

- color

- company

- Current

- customer

- Customers

- Date

- Debt

- decision

- Director

- dividend

- Earning

- equipment

- Ether (ETH)

- Europe

- expenses

- financial

- financial performance

- follow

- Forecast

- from

- fundamental

- Group

- homework

- HTTPS

- in

- Income

- industry

- integrated

- investment

- investor

- IPO

- Key

- listing

- Malaysia

- management

- manufacturing

- Market

- max

- Monitor

- Need

- New

- normal

- North

- north america

- operating

- Opinion

- Other

- own

- parts

- perception

- performance

- personal

- plato

- Plato Data Intelligence

- PlatoData

- policy

- price

- Pro

- Production

- provider

- provision

- Quarter

- Reader

- Recommendation

- Red

- release

- remuneration

- repayment

- result

- revenue

- Risk

- sales

- service

- Services

- Shares

- Shariah

- should

- solution

- Solutions

- standalone

- strong

- support

- Systems

- Take

- Target

- Technical

- technical support

- Technology

- The

- their

- to

- Total

- us

- value

- View

- will

- working

- zephyrnet