Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Open to apply: 16/03/2021

Close to apply: 24/03/2021

Listing date: 06/04/2021

Share Capital

Market Cap: RM57.75mil

Total Shares: 165mil shares, Esos 49.5mil (Public apply: 8.25mil, Company Insider/Miti/Private Placement/other: 51.75mil)

Market Cap: RM57.75mil

Total Shares: 165mil shares, Esos 49.5mil (Public apply: 8.25mil, Company Insider/Miti/Private Placement/other: 51.75mil)

Industry

Volcano: 28.82%

Nameplate Competitor (GP margin)

Chiyoda Integrco.(M) Sdn Bhd: 28.52%

Flexi Components Sdn Bhd: 39.91%

Sanwa Screen (M) Sdn Bhd: 42.43%

Plastic injection moulded Competitor (GP Margin)

Saha-Union: 13.5%

Srithai Superware: 8.64%

SNC former: 10.39%

Volcano: 28.82%

Nameplate Competitor (GP margin)

Chiyoda Integrco.(M) Sdn Bhd: 28.52%

Flexi Components Sdn Bhd: 39.91%

Sanwa Screen (M) Sdn Bhd: 42.43%

Plastic injection moulded Competitor (GP Margin)

Saha-Union: 13.5%

Srithai Superware: 8.64%

SNC former: 10.39%

Business

Manufacturing of nameplates, Plastic injection moulded.

M'sia: 4.17%

S'pore: 43.98%

Thailand: 44.11%

others: 7.74%

Fundamental

1.Market: Ace Market

2.Price: RM0.35 (EPS:RM0.205)

3.P/E: PE17 (based on EPS 0.205, we not accept IPO prospecture using EPS 0.0232 to cal PE)

4.ROE(Pro Forma III): 3.78%

5.ROE: 4.19%(2020), 11.18%(2019), 12.38%(2018)

6.Cash & fixed deposit after IPO: RM0.12 per shares

7.NA after IPO: RM0.408

8.Total debt to current asset after IPO: 0.1567 (Debt: 7.032mil, Non-Current Asset: 29.544mil, Current asset: 44.86mil)

9.Dividend policy: PAT 30% dividend policy.

Past Financial Performance (Revenue, Earning Per shares)

2020: RM52.527 mil (EPS:0.0205)

2019: RM55.892 mil (EPS:0.0290)

2018: RM58.649 mil (EPS:0.0412)

Net Profit Margin

2020: 28.82%

2019: 30.65%

2018: 32.35%

After IPO Sharesholding

Datuk Ch'ng Huat Seng: 16.97%

Gan Yew Thiam: 12.73%

Dato' Wong Tze Peng: 14.85%

Yeap Guan Seng: 6.36%

Khoo Boo Wui: 12.73%

Directors & Key Management Remuneration for FYE2021 (from gross profit 2020)

Total director remuneration: RM3.104 mil or 20.5%

key management remuneration: RM0.153mil - 0.3mil or 1.01%-1.98%

total (max): RM3.404mil or 22.48%

Use of fund

Purchase of machineries & equipment: 63.43%

Listing Expenses: 36.57%

Good thing is:

1. Purchase of 6 unit laser cutting machines will increase 33.33% nameplate production.

2. Purchase 5 unit of platic injection moulded will increase 15.56% capacity of production.

2. Have 30% PAT dividend policy.

3. Net profit is above 28% for past 3 years.

The bad things:

1. PE17 is a bit expensive.

2. For past 3 years, ROE is dropping.

3. Revenue did not grow for past 3 years.

4. Director remuneration is too expensive, 20.5% from the gross profit in 2020 pay for director remuneration.

5. Listing expenses 36.57% from IPO fund is too expensive.

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

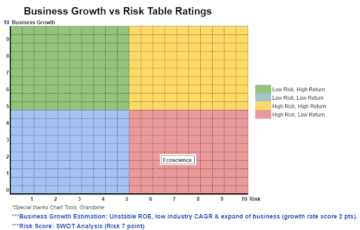

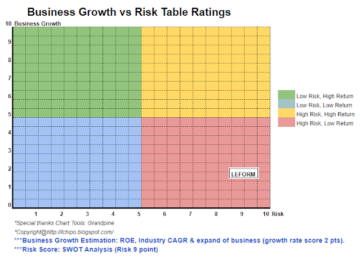

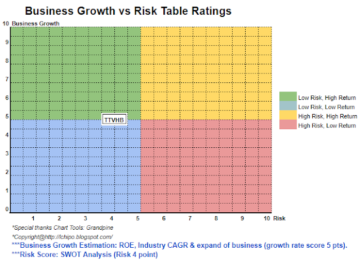

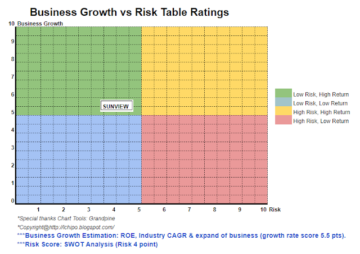

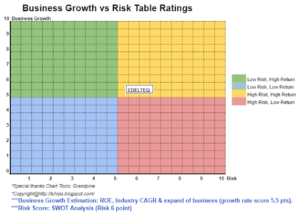

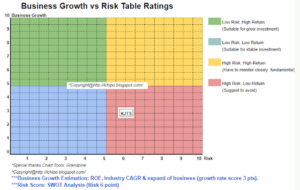

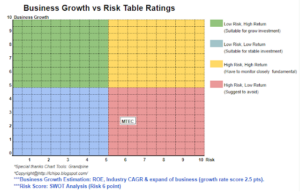

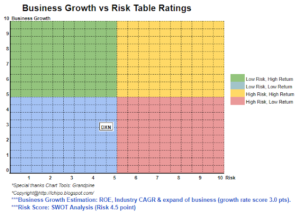

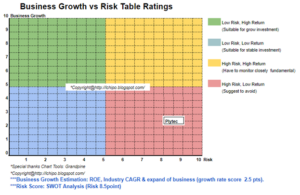

With the additional machineries will increase the capacity of the company. However the company still some risk like over past 3 year revenue did not grow. Please refer below chart to view the company Business expension potential & risk rating.

With the additional machineries will increase the capacity of the company. However the company still some risk like over past 3 year revenue did not grow. Please refer below chart to view the company Business expension potential & risk rating.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

Source: http://lchipo.blogspot.com/2021/03/volcano-berhad.html- Additional

- asset

- Bit

- BP

- business

- Capacity

- Cash

- change

- company

- Current

- Debt

- DID

- Director

- dividend

- equipment

- expenses

- financial

- follow

- fund

- GP

- Grow

- homework

- HTTPS

- Increase

- investment

- IPO

- Key

- laser

- listing

- Machines

- management

- Market

- net

- Opinion

- P&E

- Pay

- performance

- plastic

- policy

- price

- Pro

- Production

- Profit

- public

- purchase

- Reader

- revenue

- Risk

- Screen

- Shares

- us

- value

- View

- year

- years